Key benefits

-

Receive regular income stream to suit your retirement needs

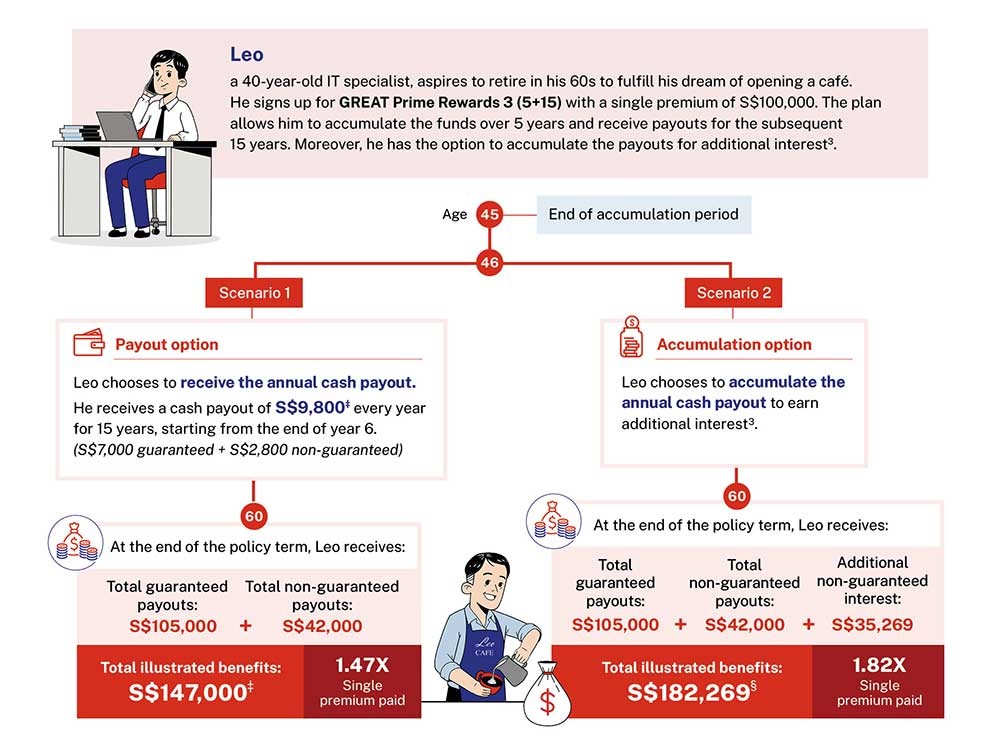

Have the flexibility to choose the duration of your annual payouts for a period of 10, 15, 17 or 20 years and receive total payouts of up to 1.47X* of the single premium.

-

Boost your annual payouts by up to 1.82X†

Make your choice to accumulate the annual payouts at an attractive interest rate3 and receive up to 1.82X† of the single premium to boost your retirement fund. You'll have the option to withdraw your annual payouts anytime.

-

Your capital is guaranteed1

Expect 100% capital guarantee1 from the end of the 5th policy year.

-

Maximise retirement planning with SRS

Enjoy potential tax savings on your SRS contributions, while optimising your wealth. What’s more, you will receive insurance coverage for extra peace of mind.

Your questions answered

GREAT Prime Rewards 3 is a participating single premium endowment insurance plan with 4 plan variations of accumulation periods and payout periods.

The accumulation period commences immediately from the policy commencement date. Upon expiration of the accumulation period, you will receive yearly payouts for the duration of the payout period at the end of each policy year.

| Plan Name | Policy term | Accumulation period | Payout period | Yearly payouts due at the end of policy year |

| GREAT Prime Rewards 3 (5+10) | 15 years | 5 years | 10 years | 6th to 15th year |

| GREAT Prime Rewards 3 (0+20) | 20 years | 0 years | 20 years | 1st to 20th year |

GREAT Prime Rewards 3 (3+17) |

20 years | 3 years | 17 years | 4th to 20th year |

GREAT Prime Rewards 3 (5+15) |

20 years | 5 years | 15 years | 6th to 20th year |

It also allows you to take part in the performance of the participating fund in the form of bonuses that are not guaranteed. There are two main types of bonuses for this plan – cash bonus and terminal bonus.

GREAT Prime Rewards 3 provides you with financial protection against death, total and permanent disability (TPD)*, and terminal illness.

If the life assured suffers from death or terminal illness during the policy term, or TPD during the applicable period, we will pay a lump sum benefit of 110% of the single premium paid less survival benefits already paid OR the guaranteed surrender value, whichever is higher, plus terminal bonus (if any). We will first use any amount payable under the policy to deduct any debt before the balance amount is paid. The policy will terminate after we make this payment.

There are certain situations when we will not pay the benefits under this policy. Please refer to the Product Summary for more details.

* For Total and Permanent Disability (TPD) that takes the form of total and irrecoverable loss of the: (a) sight in both eyes; (b) use of two limbs at or above the wrist or ankle; or (c) sight in one eye and the use of one limb at or above the wrist or ankle, the life assured will be covered for the whole of the policy term. For other forms of TPD, it must occur before the policy anniversary on which the life assured is age 65 next birthday. You are advised to refer to the Product Summary for more details.

At the end of the accumulation period, you will receive a payout at the end of each policy year during the payout period for your plan if the life assured survives to the end of that policy year.

Alternatively, you may also choose to keep the payouts with us to earn non-guaranteed interest. Please note that the non-guaranteed interest is subject to change without prior notice.

Each payout comprises:

• guaranteed survival benefit, and

• non-guaranteed cash bonus that is declared yearly (if any)

You are advised to refer to the Product Summary for more details.

You will also receive the terminal bonus in one lump sum when you surrender your policy or when there is a claim admitted under the policy that terminates the policy, whichever event first occurs.

We usually review the terminal bonus yearly.

You will receive an annual bonus update that will include the following:

• the performance of the participating fund and its future outlook, which you should receive around the second quarter of each year after bonus is declared for your policy; and

• an annual statement regarding bonuses for your policy, which you should receive around the second quarter of each year after bonus is declared for your policy. For policies with cash bonus, you should receive the relevant statement within one month from your policy anniversary only when the cash bonus is due.

When there is a change in the rate of bonuses declared, you can ask us for an update of the illustrated values.

If you surrender your policy after the 14-day free-look period, you may lose part or all of the premiums paid. This is because the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

We have included fees and charges when working out the premium and you will not be separately charged for these. Please refer to the Product Summary for details of the fees and charges.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 Capital guarantee is on the condition that no policy alterations are made.

2 For Total and Permanent Disability (TPD) that takes the form of total and irrecoverable loss of the: (a) sight in both eyes; (b) use of two limbs at or above the wrist or ankle; or (c) sight in one eye and the use of one limb at or above the wrist or ankle, the life assured will be covered for the whole of the policy term. For other forms of TPD, it must occur before the policy anniversary on which the life assured is age 65 next birthday. You are advised to refer to the product summary for more details.

3 The prevailing accumulation interest rate is 3.00% p.a. based on an Illustrated Investment Rate of Return (IIRR) of 4.25% p.a. and 1.50% p.a. based on an IIRR of 3.00% p.a.. This rate is not guaranteed and can be changed from time to time.

* Based on an IIRR of 4.25% p.a. and only applicable to GREAT Prime Rewards 3 (5+15) with single premium of S$100,000 or more, under the payout option. Based on an IIRR of 3.00% p.a., the total payouts when the policy matures is up to 1.27X of the single premium paid, under the payout option. The actual benefits payable may vary according to the future performance of the participating fund.

† Based on an IIRR of 4.25% p.a. and only applicable to GREAT Prime Rewards 3 (5+15) with single premium of S$100,000 or more, under the accumulation option. Based on an IIRR of 3.00% p.a., the total payout when the policy matures is up to 1.41X of the single premium paid, under the accumulation option. The actual benefits payable may vary according to the future performance of the participating fund.

All figures in the above illustration are based on an IIRR of the participating fund at 4.25% p.a. and are subject to rounding. All ages specified refer to age next birthday.

‡ Based on an IIRR of 3.00% p.a., the total cash payout is S$8,500 every year of which S$1,500 is non-guaranteed. The total payouts that Leo receives over the course of the policy is S$127,500, which is 1.27X of the single premium paid. The total of the non-guaranteed payouts is S$22,500. The actual benefits payable may vary according to the future experience of the participating fund.

§ Based on an IIRR of 3.00% p.a., the total payout that Leo receives when the policy matures is S$141,797, which is 1.41X of the single premium paid. The non-guaranteed payout is S$22,500 and the additional non-guaranteed interest is S$14,297. The actual benefits payable may vary according to the future experience of the participating fund.

All figures used are for illustrative purposes only and are subject to rounding.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and Chinese versions, the English version shall prevail.

Information correct as at 22 September 2023.