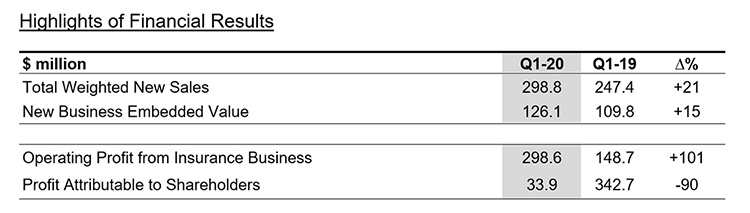

Great Eastern Reports Q1-20 Financial Results

- New Business Embedded Value up 15% to S$126.1 million

- Profit Attributable to Shareholders down 90% to S$33.9 million

Singapore, 6 May 2020 – Great Eastern Holdings Limited (the “Group”) today announced its financial results for the quarter ended 31 March 2020 (“Q1-20”).

Total Weighted New Sales (“TWNS”) and New Business Embedded Value (“NBEV”)

The Group’s TWNS for Q1-20 grew 21% from the same quarter last year. The Group’s operations in Singapore and Malaysia continued its growth momentum, driven by the agency channels in both countries and the bancassurance channel in Singapore. Correspondingly, the Group’s NBEV increased by 15% for the quarter.

Profit Attributable to Shareholders

Q1-20 Operating Profit doubled from the same quarter last year from improved contribution of our core markets and reduction in insurance contract liabilities in both Singapore and Malaysia. These were negated by the lower valuation of investments arising from unfavourable financial market conditions in the first quarter, resulting in the lower Group’s Profit Attributable to Shareholders in Q1-20.

Regulatory Capital

The Capital Adequacy Ratios of the Group’s insurance subsidiaries in both Singapore and Malaysia remain strong and well above their respective minimum regulatory levels.

Commenting on the Group’s financial results, Group Chief Executive Officer Mr Khor Hock Seng said:

“We have delivered strong operating results in the first quarter of 2020. Our Group’s key operating metrics such as Operating Profit, Total Weighted New Sales and New Business Embedded Value have shown good growth in the quarter compared with the same period last year.

The onset of the COVID-19 outbreak has delivered many challenges globally in Q1-20 and will continue for a period of time. While the Group’s profit was impacted by the volatility in the global financial markets during the quarter, our investment portfolio remains sound and our capital position also remains strong. We expect our new business activity to be dampened as a result of weakened demand and restricted face-to-face interactions. The major digital and technology infrastructure initiatives that we have embarked on in the past two years have helped the company to cushion the impact of the COVID-19 situation.

We have been progressively rolling out services on digital platforms, and this enabled us to respond swiftly to offer alternatives to the traditional face-to-face interactions with our customers. We are able to provide greater convenience and have accelerated our adoption of additional digital capabilities to boost the connectivity and ease of engagement between our financial representatives and customers. We remain fully committed to deliver quality customer service under current circumstances. Even as we observe the tighter government measures, we will continue to be accessible and responsive to customers through a number of touchpoints.”

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$90 billion in assets and more than 8 million policyholders, including 5 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei and has a presence in China as well as a representative office in Myanmar.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by Standard and Poor's since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the largest private sector asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #TheLifeCompany #Lifeproof

The “Unaudited Financial Summary for Q1-20” is posted on SGXNet.

Media Contacts

Annette Pau

VP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com

Crystal Chan

AVP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com