With MediSave-approved plans like GREAT SupremeHealth and GREAT CareShield, you can enhance your health and disability coverage with your MediSave funds.

GREAT CareShield, in particular, offers coverage in the event of unexpected disabilities. With long-term care costs averaging between S$4,000 and S$5,700 per month1, are you adequately protected for such situations?

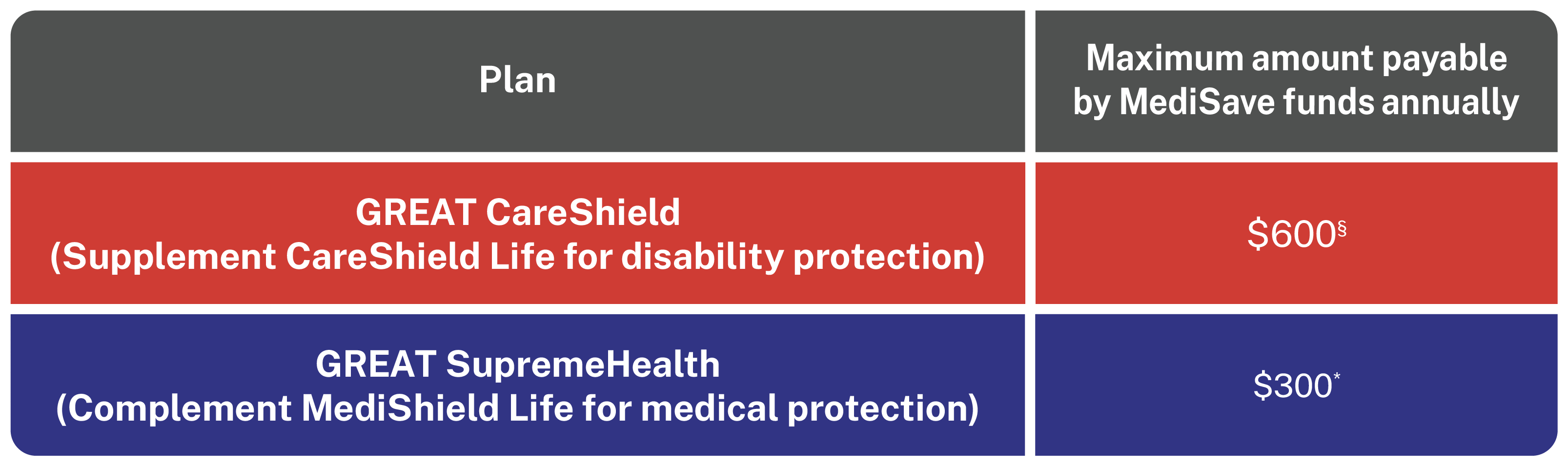

Use your MediSave funds to pay for MediSave-Approved products with us

To illustrate, let's assume you are a 35-year old Singaporean seeking better medical coverage through GREAT SupremeHealth and disability coverage through GREAT CareShield: