Great Eastern reports 1Q-23 Financial Results

Singapore, 5 May 2023 – Great Eastern Holdings Limited (the “Group”) today reported its financial results for the quarter ended 31 March 2023 (“1Q-23”).

Total Weighted New Sales (“TWNS”) and New Business Embedded Value (“NBEV”)

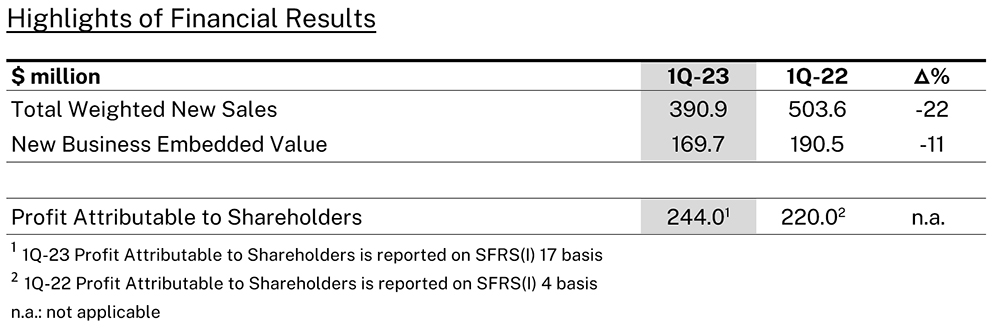

The Group’s TWNS for 1Q-23 declined 22% against the same period last year due to lower sales from single premium plans, offset partially by better performance in the regular premium sales. While the Group’s NBEV for 1Q-23 fell by 11% to S$169.7 million as a result of the lower TWNS, the NBEV margins were higher against 1Q-22 due to the shift in product mix.

Profit Attributable to Shareholders

The Group has adopted SFRS(I) 17 Insurance Contracts on 1 January 2023 and has prepared its 1Q-23 Profit Attributable to Shareholders under this basis. The comparative for prior period (1Q-22) has not been restated and is reported based on SFRS(I) 4 Insurance Contracts. More details on the impact of SFRS(I) 17 and the restated comparative information will be disclosed upon announcement of the 1H-23 interim financial statements.

SFRS(I) 17 replaces SFRS(I) 4 and is effective for annual periods beginning on or after 1 January 2023. This accounting change will impact the timing of profit recognition and initial shareholders’ equity, but will not affect the Group’s business operation.

Profit Attributable to Shareholders for 1Q-23 remained healthy, reflecting the Group’s underlying solid business fundamentals.

Regulatory Capital

The Capital Adequacy Ratios of the Group’s insurance subsidiaries in both Singapore and Malaysia remain strong and well above their respective minimum regulatory levels.

Commenting on the Group’s financial results, Group Chief Executive Officer Mr Khor Hock Seng said:

“Our ability to adapt to change is a key driving factor underpinning our financial results in the long term. In the first quarter, we achieved margin improvements for our life business across all markets compared to the same period last year. Given our distribution capabilities, digital solutions and comprehensive suite of products, we remain confident about the long-term growth of the Group.”

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$100 billion in assets and more than 14.5 million policyholders, including 12 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by S&P Global Ratings since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the largest private sector asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s and AA- by both Fitch and S&P. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #ReachforGreat

For more information, please contact:

Elgin Toh

VP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com

Tan Jo Lynn

AVP, Group Finance

Email: Investor-relations@greateasternlife.com