Key benefits

-

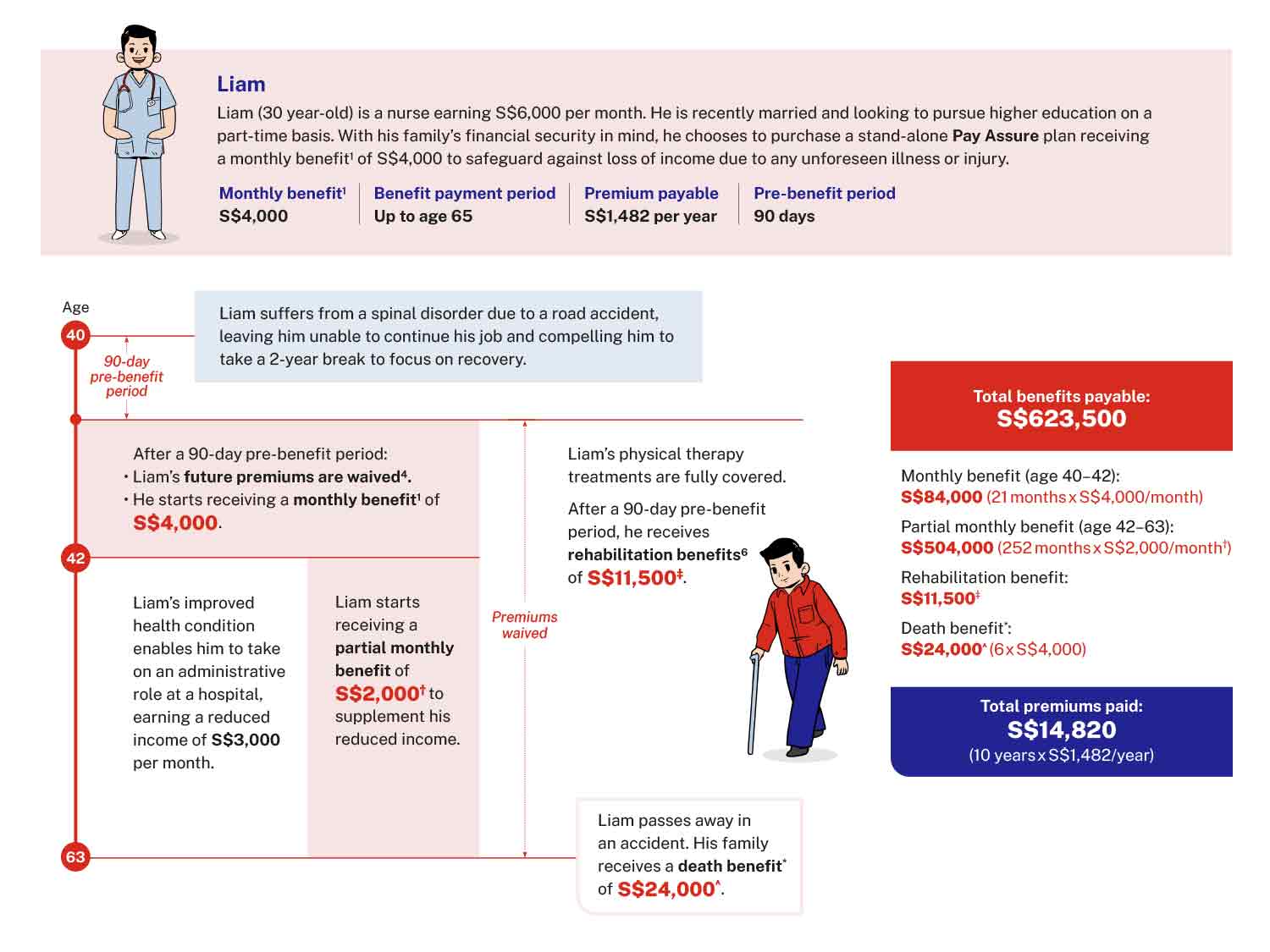

Supplement up to 75% of your income with monthly benefits1

Receive monthly benefits1 of up to 75% of your average monthly income3 when an illness or injury disrupts your ability to work in your current job2. In addition, any premiums payable while you are receiving the monthly benefit shall be waived4 to help ease the financial stress caused by your lost income.

-

Receive partial monthly benefits5upon returning to work

If you are able to work in a reduced capacity, resulting in reduced income, you will receive partial monthly benefits5 to help bridge your income gap.

-

Peace of mind with additional rehabilitation expenses6 support

To better support your recovery, you can be reimbursed for rehabilitation expenses6, up to three times your monthly benefit1 amount.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.

Understand the details before buying

The example above is based on a 30-year-old male non-smoker in occupational class 3, and it is for illustration purposes only.

The premium rates for this plan are not guaranteed and may be adjusted based on future experience of the plan.

† The partial monthly benefit of S$2,000 is calculated as (S$6,000-S$3,000)/S$6,000xS$4,000.

‡ Liam receives a full reimbursement of his rehabilitation expenses of S$11,500, as Pay Assure reimburses rehabilitation expenses up to S$12,000 (three times the monthly benefit selected).

* Applicable to stand-alone plan only.

^ The death benefit payable of S$24,000 is six times the monthly benefit selected.

1 If you are not engaged in any gainful occupation due to disability, upon the expiry of the pre-benefit period (60, 90, or 180 days), you shall receive a monthly benefit for as long as you continue to suffer from disability, up to age 55, 60 or 65 or your death, whichever is earlier.

2 Refers to where you are unable to perform the material duties of the occupation you held immediately prior to the date of disability.

3 Refers to your average monthly income for the 24 months preceding the date of the application if you are an employee; or 36 months prior to date of application if you are self-employed.

4 Any premiums which fall due while you are receiving the monthly benefit shall be waived. However, if the premium is due during the pre-benefit period, you shall pay the premium in full.

5 Partial monthly benefits may be payable if your present earnings are 85% or less than your pre-disability earnings. Other terms and conditions apply, please read the policy contract for full terms and conditions.

6 Rehabilitation expenses may be reimbursed, up to three times the amount of the monthly benefit, provided the expenses are certified by a registered medical practitioner as being necessary for rehabilitation.

All ages specified refer to age next birthday.

All figures used are for illustrative purposes only and are subject to rounding.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As this product has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely.

This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and Chinese versions, the English version shall prevail.

Information correct as at 10 June 2024.