Key benefits

For parents who plan ahead

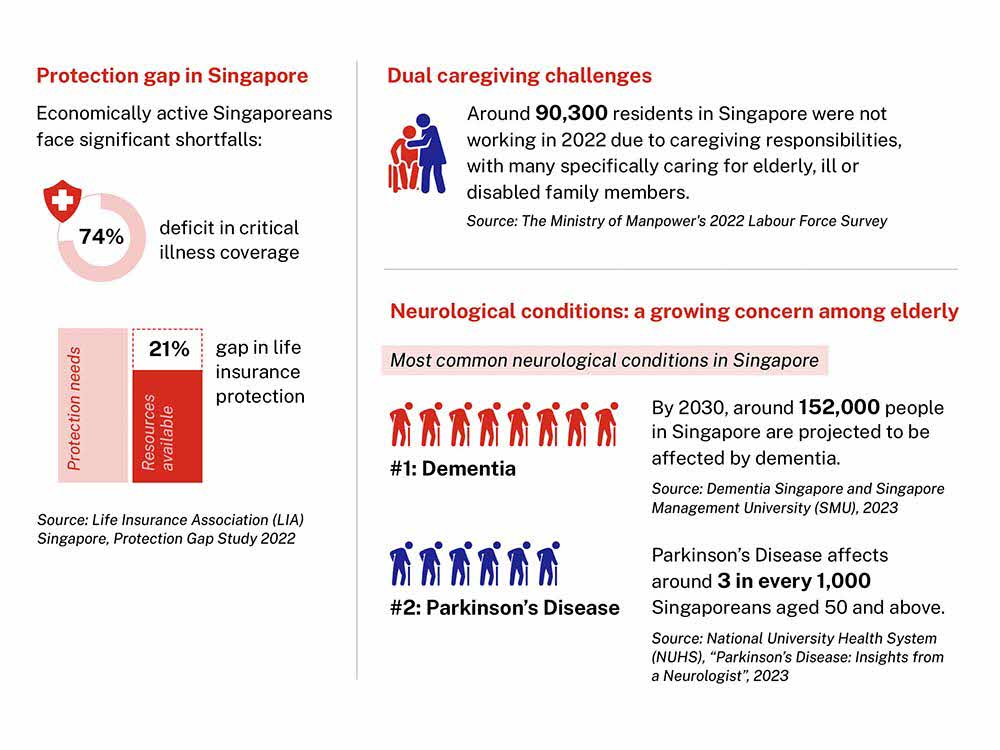

Your greatest wish is a bright, secure future for your child. Give them a head start with GREAT Life Multiplier to safeguard their lifelong financial well-being while also protecting your parents. By planning ahead today, you can ease potential financial burdens tomorrow and make sure your family has the support they need.

Protection for your child

A lifelong gift of up to 10 times multiplied coverage

A lifelong gift of up to 10 times multiplied coverage

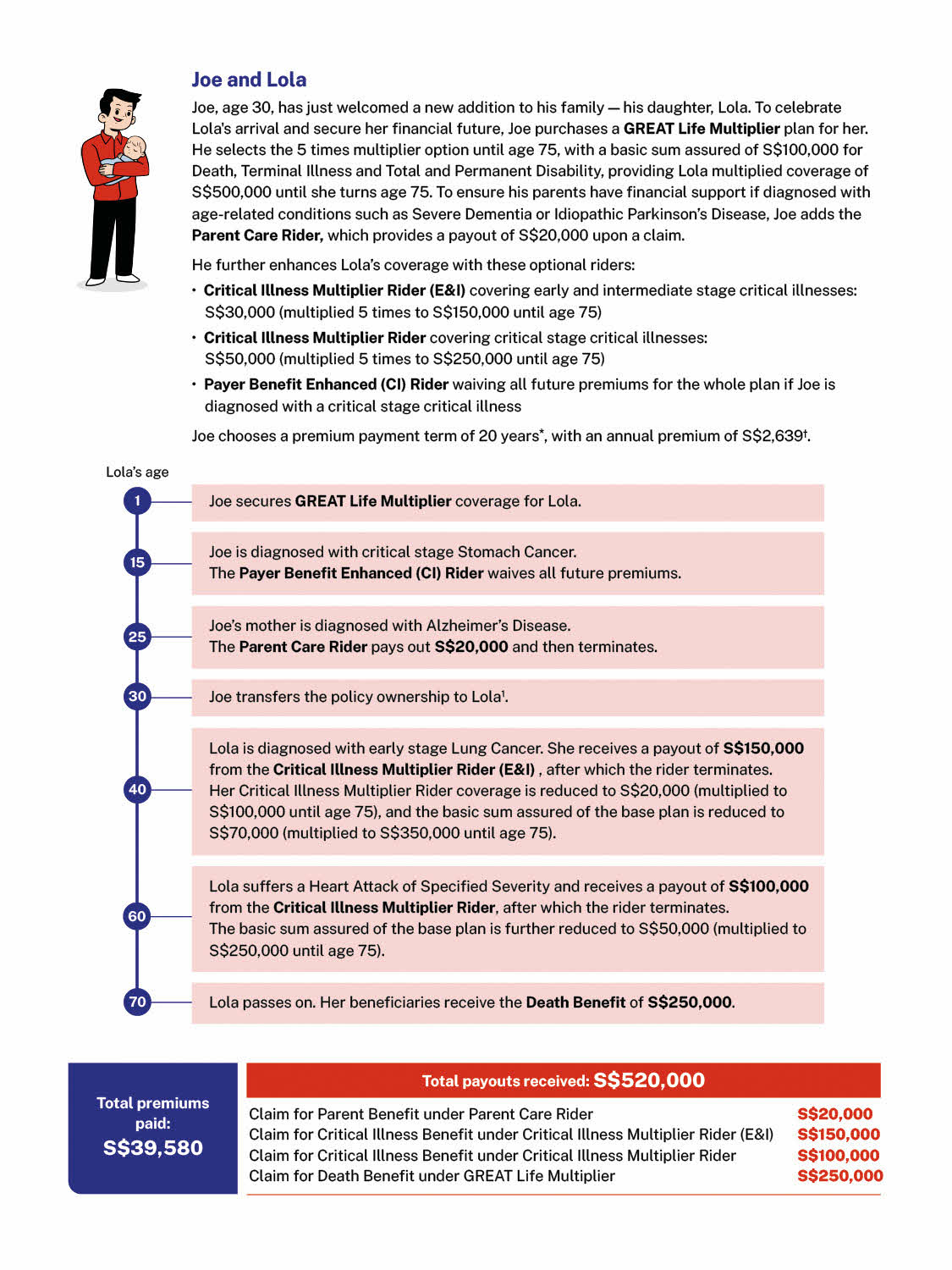

Choose to multiply your child’s coverage by 3, 5, 8 or even 10 times until age 65, 75 or 85, providing robust, lifelong protection at premiums tailored to your budget. When your child turns 18, you can transfer policy ownership to them1, giving them lasting financial security and flexible access to the accumulated cash value whenever they need it.

Protection for your parents

Guaranteed coverage for age-related conditions2 without medical assessment

Guaranteed coverage for age-related conditions2 without medical assessment

Ensure your parents receive the care they deserve with the Parent Care Rider. This add-on benefit provides guaranteed coverage for age-related conditions2 such as Alzheimer’s Disease/ Severe Dementia, Idiopathic Parkinson’s Disease and Major Head Trauma, without requiring any medical assessment for your parents at the point of coverage. It offers immediate financial support and reassurance when it matters most.

Protection for yourself

Various premium options ensuring uninterrupted protection

Various premium options ensuring uninterrupted protection

Choose from various premium payment terms of 15, 20, 25 or 30 years for the base plan and critical illness riders to match your budget. Further strengthen your protection with the Payer Benefit Enhanced (CI) Rider, which waives all future premiums if you're diagnosed with a critical stage critical illness. This ensures the coverage continues as planned for both your child and your parents, without worrying about future premiums.

Here's how GREAT Life Multiplier protects your family across three generations

For young professionals and mid-career adults ready to take charge

You want to confidently manage your growing financial responsibilities as your career progresses. Whether you're just starting out or already well-established professionally, having comprehensive lifelong protection tailored to your current lifestyle and future needs is crucial. This includes caring for yourself while also preparing for future

caregiving responsibilities for your aging parents.

Your questions answered

GREAT Life Multiplier is a limited pay whole of life participating plan designed to meet your protection needs. It provides financial protection against death, total and permanent disability (TPD) and terminal illness (TI), with the flexibility to enhance your coverage through a range of optional riders such as for early, intermediate and/or critical stage critical illnesses.

It offers you enhanced protection through a multiplier benefit equivalent to 3, 5, 8, or 10 times the basic sum assured which applies up to your selected multiplier expiry age of 65, 75 or 85 age next birthday. You may choose premium terms of 15, 20, 25 or 30 years.

This base plan allows you to participate in the performance of the participating fund in the form of bonuses that are not guaranteed. The objective of this plan is to provide insurance protection together with stable medium- to long-term returns using a combination of guaranteed benefits and non-guaranteed bonuses.

GREAT Life Multiplier provides financial protection against death, total and permanent disability and terminal illness.

The table below shows an overview of coverage under GREAT Life Multiplier and the optional Critical Illness Multiplier Riders available:

| COVERAGE | BASE PLANS | CHOICE OF UP TO 2 OPTIONAL RIDERS | |

| GREAT Life Multiplier | Critical Illness Multiplier Rider | Critical Illness Multiplier Rider (E&I) | |

| Death, Total and Permanent Disability, Terminal Illness | ✓ | ||

| Critical Stage of Critical Illness | ✓ | ||

| Early and Intermediate Stages of Critical Illness | ✓ | ||

| Additional Benefits: Special Benefit, Juvenile Benefit, Senior Benefit, Benign Tumour Benefit | Only for Angioplasty and Other Invasive Treatment For Coronary Artery | ✓ (excluding Angioplasty and Other Invasive Treatment For Coronary Artery | |

For detailed terms and conditions on the benefits payable, you are advised to read the policy/rider contract.

The premium rates for GREAT Life Multiplier are guaranteed.

The premium rates for Critical Illness Multiplier Rider and Critical Illness Multiplier Rider (E&I) are NOT guaranteed. We may change these rates based on future experience at any time with at least 45 days' notice before the premium due date at which the amended rates will apply. The amended rates will apply according to the age next birthday of the life assured as at the date of commencement of the rider.

GREAT Life Multiplier provides both guaranteed and non-guaranteed benefits. The guaranteed benefits, including bonuses which have already been declared, will be paid regardless of how the participating fund performs. Non-guaranteed benefits are in the form of future bonuses. The future bonuses which have yet to be declared are not guaranteed and are dependent on the performance of the participating fund. There are two main types of bonuses for GREAT Life Multiplier:

- Reversionary bonus; and

- Terminal bonus.

You may attach one or more optional rider(s) to your GREAT Life Multiplier policy to enhance the protection coverage.

Here is the list of optional riders offered for GREAT Life Multiplier:

Riders that offer critical illness benefit:

(a) Critical Illness Multiplier Rider; and/or

(b) Critical Illness Multiplier Rider (E&I) Rider*.

Rider that offers critical illness benefit for the policyholder’s parent(s):

(c) Parent Care Rider

Riders that waive premium payment for specified covered medical conditions:

(d) Premium Waiver Enhanced (CI) Rider;

(e) Payer Benefit Enhanced Rider; or

(f) Payer Benefit Enhanced (CI) Rider.

Riders that offer disability benefit:

(g) LifeSecure Rider; or

(h) PayAssure Rider.

Riders that offer personal accident benefit:

(i) AccidentCare Plus II Rider; or

(ii) Accidental Permanent Disablement Provision

*Please note that Critical Illness Multiplier Rider (E&I) Rider may only be attached to the base plan if Critical Illness Multiplier Rider Rider is also attached.

The riders offered for GREAT Life Multiplier may be subject to change from time to time.

For more details on GREAT Life Multiplier, please refer to the product summary of the relevant plan and riders. Alternatively, you may also speak to your financial representative or call us at 1800 248 2888 (9am to 5.30pm (Mon- Fri).

Understand the details before buying

1 Subject to the policyholder not having made any nomination under the Beneficiary Access clause.

2 Excluding pre-existing conditions. Other terms and conditions apply. Please refer to the product summary and policy contract for details.

* The limited pay option is applicable to the base plan and critical illness rider(s). It does not apply to the Parent Care Rider, which is a regular premium rider.

† Premium rates shown are rounded to the nearest dollar. Premium rates for the riders are not guaranteed and may be adjusted based on future experience.

All ages specified refer to age next birthday.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance or a recommendation to buy an insurance product or service. This document does not take into account the specific investment and protection aims, financial situation or particular needs of any particular person. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

The precise terms and conditions of this insurance plan are specified in the policy contract. If you are interested in the insurance product, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and the Chinese versions, the English version shall prevail.

Information correct as at 1 October 2025.

Let our Financial

Representative serve you

We are happy to help you.