Great Eastern reports 1H-25 Financial Results

Singapore, 28 July 2025 – Great Eastern Holdings Limited (the “Group”) today reported its financial results for the half-year ended 30 June 2025 (“1H-25”).

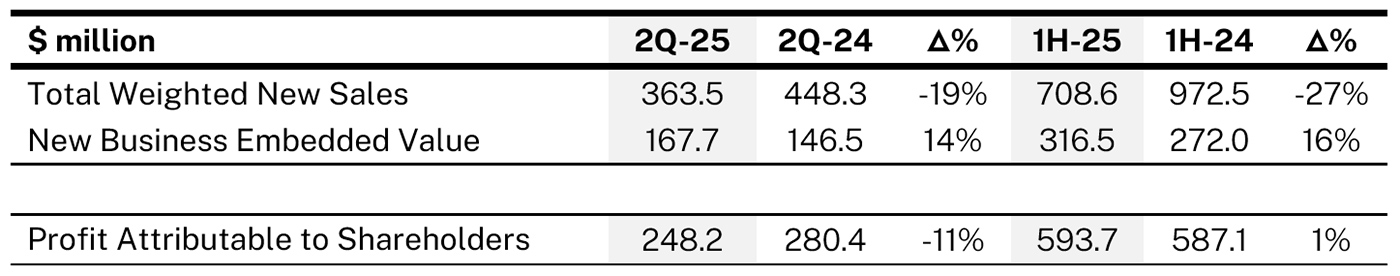

- New Business Embedded Value grew by 16% to S$ 316.5 million

- Profit Attributable to Shareholders grew by 1% to S$ 593.7 million

Total Weighted New Sales (“TWNS”) and New Business Embedded Value (“NBEV”)

The Group’s TWNS for 2Q-25 and 1H-25 declined by 19% and 27% respectively when compared against the same period last year, mainly due to lower single premium sales in Singapore following a shift in product mix to align with emerging customer needs for longer-term financial planning priorities.

Despite lower TWNS, the Group’s NBEV for 2Q-25 and 1H-25 grew by 14% and 16% respectively as overall margins improved following the shift towards more favourable product mix.

Profit Attributable to Shareholders

The Group’s Profit Attributable to Shareholders for 2Q-25 declined by 11% on a year-on-year basis mainly due to lower profit from insurance business for the quarter. 1H-25 recorded a modest growth driven by robust investment results from shareholders’ fund, supported by growth in underlying insurance business.

Regulatory Capital

The Capital Adequacy Ratios of the Group’s insurance subsidiaries remain strong and above their respective minimum regulatory levels.

Bonus Issue and Dividend

At the Company’s Extraordinary General Meeting (“EGM”) on 8 July 2025, the resolutions to facilitate the Company’s resumption of trading were passed. Accordingly, the Bonus Issue will proceed. As announced by the Company on 10 July 2025, the Bonus Issue of up to 473,319,069 Bonus Ordinary Shares and/or Class C Non-Voting Shares are expected to be issued on or around 19 August 2025.

As the bonus shares are expected to be allotted and issued before the record date of the interim dividend which will be on 28 August 2025, the interim one-tier tax exempt dividend of 25 cents per share for the financial year ending 31 December 2025 (“FY25 Interim Dividend”) declared by the Board of Directors will apply to all shares on a post-Bonus Issue basis including the Bonus Ordinary Shares and Class C Non-Voting Shares. This is equivalent to an interim one-tier tax exempt dividend of 50 cents per Ordinary Share on a pre-Bonus Issue basis.

Therefore, assuming there are no changes to shareholders’ shareholdings other than the Bonus Ordinary Shares and Class C Non-Voting Shares allotted and issued pursuant to the Bonus Issue, shareholders will receive the same quantum of FY25 Interim Dividend on a post-Bonus Issue basis as they would have received in respect of the interim dividend for FY 2025 on a pre-Bonus Issue basis.

This represents an increase of 11% from the previous dividend payout on a pre-Bonus Issue basis. Since August 2023, the Company has adopted a progressive dividend payment method where each twice-yearly payment will be of an amount that targets a full year payout to shareholders that is based on the sustainable profit level of the Group, and dividends will be progressive in line with the profit trend. The Company’s dividend per share for the last two financial years has increased by 15% and 20% respectively.

Message from Group Chief Executive Officer, Greg Hingston

Commenting on the Group’s financial results, Group Chief Executive Officer Mr Greg Hingston said:

“The Group saw modest growth in the first half of 2025 despite volatile market conditions, supported by the strength of our underlying business fundamentals and continued focus on disciplined management. The continued increase in the Group’s NBEV is a testament to our commitment to serve different customer segments by introducing enhanced products and propositions to meet their evolving needs.

Reflecting this, we recently launched two first-in-market solutions to support our customers’ protection and wealth needs in Singapore. GREAT Life Multiplier is a multi-generational comprehensive whole-life plan designed for the sandwich generation - middle-aged adults who are simultaneously caring for their aging parents and their own children, while GREAT Index Income is a capital guaranteed, single premium endowment plan with yearly payouts linked to an index, intended for mass affluent customers who are looking for SGD-denominated investment instruments.

In Malaysia, to broaden and enhance health protection for customers, we launched our third medical rider this year and are partnering a trusted network of clinics and hospitals to deliver high-quality, cost-effective treatment and care seamlessly throughout the patient journey.

Besides insurance solutions, Great Eastern has also launched two programmes to delight customers and their children. For those with children aged 12 and below, the Group has started The Great Explorer Programme to provide exclusive bonding experiences to build family resilience and engagement. The Group also introduced online game - The Great FinChamp - in Singapore for primary school children to understand basic financial concepts including budgeting and insurance through play, with plans to localise for Malaysia and Indonesia markets.

At the Company’s EGM on 8 July 2025, the resolutions to facilitate the Company’s resumption of trading were passed. Since this important decision has been made, it is time for us to move forward, and we want to put all our focus on growing our business and striving for better performance.

The Group saw modest growth for its Profit Attributable to Shareholders in the first half of 2025 despite challenging global investment climate, supported by the strength of our underlying business fundamentals and continued focus on disciplined management. In line with this performance, we are pleased to announce an increase in dividend for the period, reflecting the company’s ongoing commitment to delivering progressive and sustainable returns to its shareholders.

The Group remains committed to accelerating its long-term growth strategy. As part of this, the Group is investing in future-focused initiatives to strengthen its capabilities, expand market and customer reach, and enhance operational resilience. These investments are aimed at unlocking new growth opportunities, supporting innovation and building a solid foundation for sustained value creation in the years to come.”

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$100 billion in assets and more than 15.5 million policyholders, including 11.5 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength ratings of "AA" by Fitch Ratings and "AA-" by S&P Global Ratings, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the leading asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC, the longest established Singapore bank, formed in 1932. It is the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s and AA- by both Fitch and S&P. Recognised for its financial strength and stability, OCBC is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #ReachforGreat

For more information, please contact:

Pamela Pung

Head, Group Corporate Communications & CSR

Email: Corpcomms-sg@greateasternlife.com

Low Lai Fong

Head, Business Finance

Email: Investor-relations@greateasternlife.com