Great Eastern reports 9M-25 Financial Results

Singapore, 30 October 2025 – Great Eastern Holdings Limited (the “Group”) today reported its financial results for the nine months ended 30 September 2025 (“9M-25”).

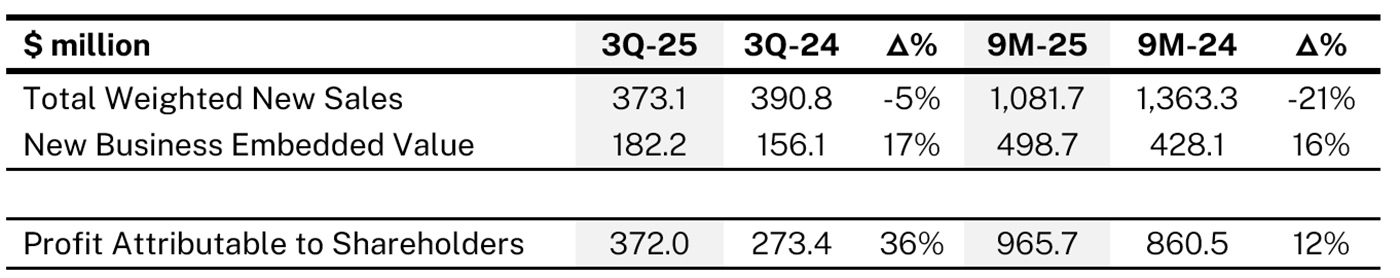

Total Weighted New Sales (“TWNS”) & New Business Embedded Value (“NBEV”)

The Group’s TWNS for 3Q-25 and 9M-25 declined by 5% and 21% respectively when compared against the same period last year, mainly due to lower single premium sales in Singapore following a shift in product mix to align with emerging customer needs for longer-term financial planning priorities. This led to a more favourable product mix and an improvement in overall margins, reflecting a year-on-year growth in the Group’s NBEV of 17% and 16% in both 3Q-25 and 9M-25 respectively.

Profit Attributable to Shareholders

The Group’s Profit Attributable to Shareholders for 3Q-25 and 9M-25 increased by 36% and 12% respectively on a year-on-year basis driven mainly by robust investment results from shareholders’ fund, supported by modest growth in underlying insurance business.

Regulatory Capital

The Capital Adequacy Ratios of the Group’s insurance subsidiaries remain strong and above their respective minimum regulatory levels.

Message from Group Chief Executive Officer

Commenting on the Group’s financial results, Group Chief Executive Officer Mr Greg Hingston said:

“While the business environment remained challenging amid market volatility, and shifting interest rate conditions, the Group continued to deliver growth and solid performance over the quarter.

The Group’s Profit Attributable to Shareholders grew year-on-year, through the disciplined execution of the Group’s strategy and continued focus on driving sustainable long-term growth. Stronger investment performance contributed to the improvement, while the underlying insurance business continued to show steady growth, supported by effective in-force portfolio management.

The Group’s new business sales performance remains robust with year-on-year growth in NBEV, reflecting the Group’s ability to adapt to changing market demand while maintaining growth that supports the long-term profitability of the Group.

The Group celebrated its 117th anniversary where we announced three strategic growth priorities, aimed at enabling people to live well, plan with confidence and retire better. From delivering more tailored customer propositions and engagement to providing advisory and service excellence through best-in-class advisors, digital tools and platforms, as well as creating a culture of agility and innovation for a future-ready workforce, we remain committed to expanding our customer-centric offerings for the community and markets where we operate.

Looking ahead, while we expect the broader market to continue to experience elevated volatility and uncertainty stemming from the global geopolitical environment, we remain steadfast in executing our growth strategy as we work to conclude the year on a solid footing.”

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$117 billion in assets and more than 15.5 million policyholders, including 11.5 million from government schemes, it provides insurance solutions to customers through multiple distribution channels – a tied agency force, bancassurance, direct digital, digital partnerships and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength ratings of "AA" by Fitch Ratings and "AA-" by S&P Global Ratings, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the leading asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC, the longest established Singapore bank, formed in 1932. It is the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s and AA- by both Fitch and S&P. Recognised for its financial strength and stability, OCBC is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #ReachforGreat

For more information, please contact:

Pamela Pung

Head, Group Corporate Communications & CSR

Email: Corpcomms-sg@greateasternlife.com

Low Lai Fong

Head, Business Finance

Email: Investor-relations@greateasternlife.com