Enhanced Dependants’ Protection Scheme (DPS) provides higher insurance coverage and more benefits for close to 2 million DPS members

SINGAPORE, 8 April 2021 – Starting this month, the newly-enhanced Dependants’ Protection Scheme (DPS) under the Central Provident Fund Board (CPF Board), provided by home-grown insurer Great Eastern for the next five years, will offer close to 2 million DPS members increased insurance coverage at attractive premiums.

DPS is a term life insurance scheme that provides insured members with coverage in the event of death, terminal illness or total permanent disability.

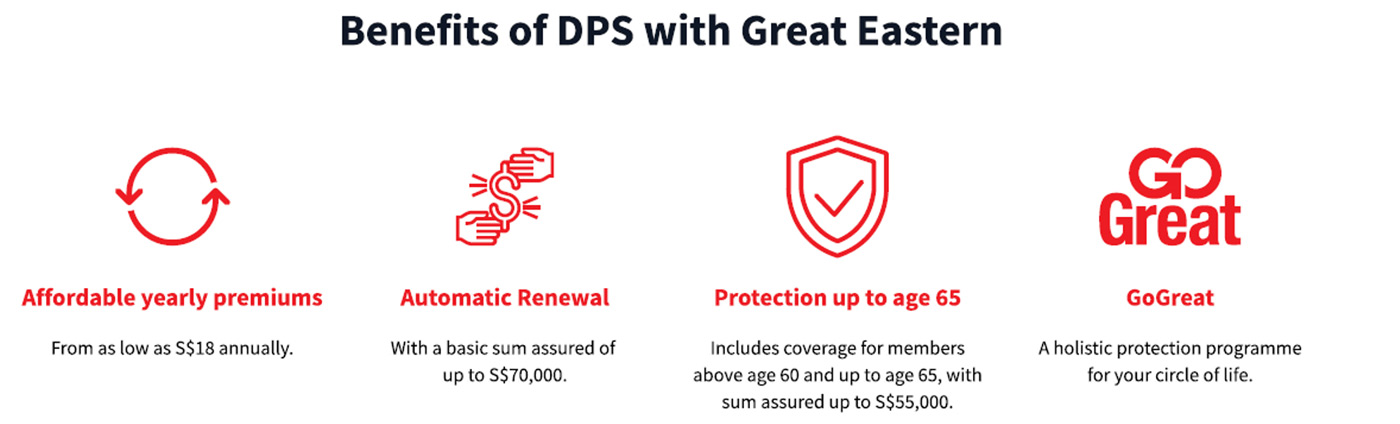

The maximum age of coverage has also been increased to protect customers till age 65, up from the previous age of 60 years. Those below age 60, will now enjoy a higher sum assured of S$70,000, which is 1.5 times more from the previous S$46,000 coverage. For DPS members aged 60 to 65, they will be covered for a sum assured of $55,000.

Khor Hock Seng, Group Chief Executive Officer, Great Eastern said: “We are delighted to be appointed by the CPF Board to provide the enhanced DPS scheme with higher insurance coverage and wider coverage in terms of age to members at attractive premiums, which will help address the protection needs of Singaporeans.

As we now play a leading role in providing basic protection for the working population, we hope to help raise their level of financial awareness. We look forward to delivering our suite of financial tools, information and other value-added solutions to DPS members to help them make informed decisions and take charge of their protection journey against life’s uncertainties.”

Additional Benefits to DPS Members

DPS members will enjoy exclusive insurance solutions and benefits through Great Eastern’s GoGreat Programme. Through this, the insurer aims to raise members’ awareness on the importance of being protected through three pillars: Solutions (to actively Lifeproof themselves against life’s uncertainties through insurance to close their protection gaps), Privileges (get protected and celebrate life with exciting rewards) and Tools (to help them identify gaps, make informed decisions and take charge of their protection journey).

Ryan Cheong, Managing Director, Digital for Business, said: “As a customer-centric insurer, we address our customers’ protection needs at different life stages. As members in the GoGreat Programme, they will also enjoy ongoing privileges and rewards through our UPGREAT app.”

DPS members can look forward to a wide array of benefits via the GoGreat Programme as more features are progressively rolled out. They will enjoy exclusive access to a full suite of financial tools such as an innovative financial storyboard to map their life planning needs at every life stage, privileges such as annual birthday rewards, and access to health and wellness programmes with incentives to stay fit and healthy.

DPS members can also conveniently access their policy information anytime, anywhere, through the Great Eastern App available on both the Apple AppStore for iOS users and Google Play Store for Android users.

For more information/queries on DPS, they can visit the Great Eastern website, our dedicated hotline on 6839-4565 or email Customer Service on dps-sg@greateasternlife.com.

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$90 billion in assets and more than 10 million policyholders, including 6 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei and has a presence in China as well as a representative office in Myanmar.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by Standard and Poor's since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the largest private sector asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #TheLifeCompany #Lifeproof

For more information, please contact:

Annette Pau

VP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com

Abigail Han

AVP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com