Great Eastern Reports FY-22 Financial Results

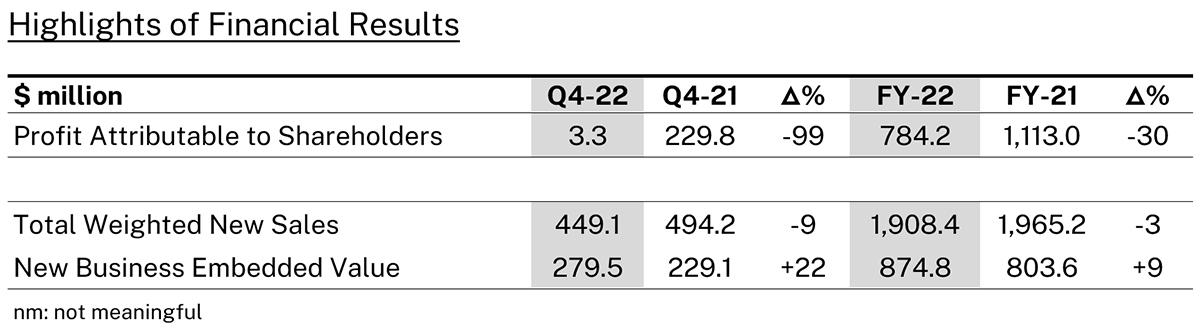

- FY-22 Profit Attributable to Shareholders down 30% to S$784.2

million - FY-22 Total Weighted New Sales down 3% to S$1,908.4 million

- FY-22 New Business Embedded Value up 9% to S$874.8 million

Singapore, 22 February 2023 – Great Eastern Holdings Limited (the “Group”) today reported its financial results for the year ended 31 December 2022 (“FY-22”).

Profit Attributable to Shareholders

Profit Attributable to Shareholders declined for Q4-22 posting S$3.3 million, largely reflecting the negative impact of financial market movements which adversely impacted the valuation of insurance contract liabilities in the Singapore Non-Participating business. For FY-22, while Profit Attributable to Shareholders fell 30% to S$784.2 million largely reflecting the lower valuation of investments given the challenging global investment climate, Operating Profit from Insurance Business registered a healthy growth of 7% for the year.

Total Weighted New Sales (“TWNS”) and New Business Embedded Value (“NBEV”)

The Group’s TWNS for Q4-22 and FY-22 declined 9% and 3% respectively reflecting lower sales from the single premium plans, offset partially by better performance in the regular premium sales. The Group’s NBEV for Q4-22 and FY-22 grew 22% and 9% to S$279.5 million and S$874.8 million respectively as a result of the shift in product mix, leading to higher NBEV margins.

Regulatory Capital

The Capital Adequacy Ratios of the Group’s insurance subsidiaries in both Singapore and Malaysia remain strong and well above their respective minimum regulatory levels.

Dividend

The Directors have recommended, for shareholders’ approval at the Annual General Meeting, the payment of a final one-tier tax exempt dividend of 55 cents per ordinary share. Upon approval, the final dividend will be payable on 8 May 2023. Including the interim one-tier tax exempt dividend of 10 cents per ordinary share paid in August 2022; total dividend for FY-22 would amount to 65 cents per ordinary share.

Commenting on the Group’s financial results, Group Chief Executive Officer Mr Khor Hock Seng said:

“While the Group’s profit was impacted by the volatility in the global financial markets during the year, our investment portfolio remains sound and our capital position also remains strong. The Group’s NBEV and Operating Profit from Insurance Business continued its good growth momentum, underscoring the strength of our core business fundamentals, achieving a year-on-year growth of 9% and 7% for the full year.

Looking ahead, the business climate remains challenging, reflecting geopolitical uncertainty, a difficult investment climate and inflationary pressures. We remain positive on the long-term growth potential of the markets we operate in and will continue to strengthen our business model and build a resilient and sustainable business for the long term.”

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$100 billion in assets and more than 14.5 million policyholders, including 12 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by S&P Global Ratings since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the largest private sector asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s and AA- by both Fitch and S&P. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #ReachforGreat

For more information, please contact:

Keith Chia

Head, Group Brand & Marketing

Email: Corpcomms-sg@greateasternlife.com

Low Lai Fong

Senior Vice President, Group Finance

Email: investor-relations@greateasternlife.com