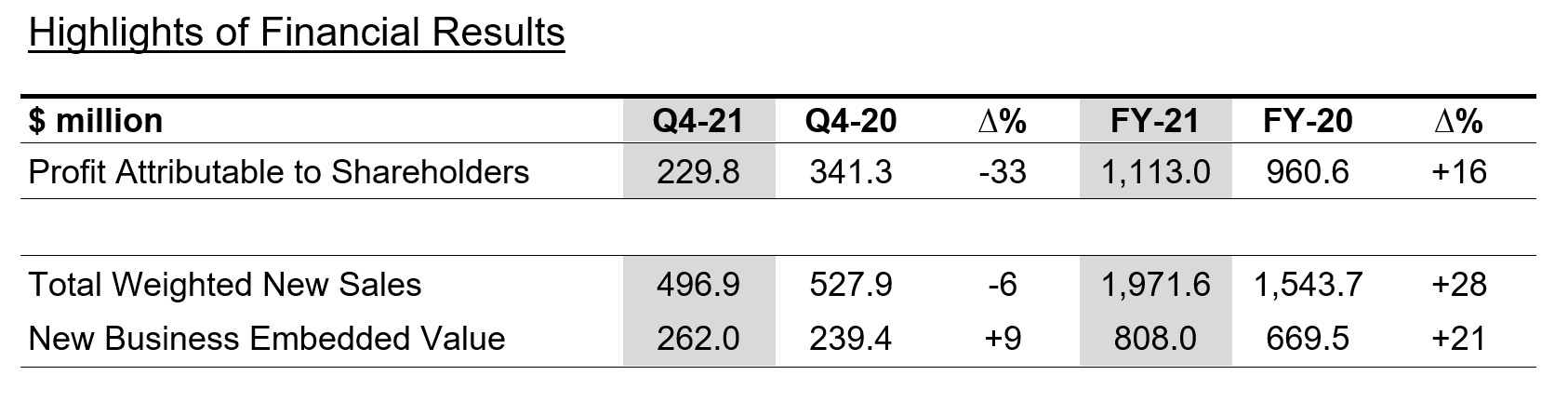

Great Eastern Reports FY-21 Financial Results

- FY-21 Profit Attributable to Shareholders up 16% to S$1,113.0 million

- FY-21 Total Weighted New Sales up 28% to S$1,971.6 million

- FY-21 New Business Embedded Value up 21% to S$808.0 million

Singapore, 22 February 2022 – Great Eastern Holdings Limited (the “Group”) today reported its financial results for the year ended 31 December 2021 (“FY-21”).

Profit Attributable to Shareholders

The Group’s Profit Attributable to Shareholders registered a 16% increase to S$1,113.0 million for FY-21, due to more favourable financial market conditions compared to a year ago and higher operating profit from insurance business. For the quarter, Profit Attributable to Shareholders declined 33% mainly as a result of a one-off positive tax impact recognised in Q4-20.

Total Weighted New Sales (“TWNS”) and New Business Embedded Value (“NBEV”)

The Group’s TWNS for the year recorded an increase of 28% driven by the strong contribution from all markets, while the quarter declined 6% compared to the year ago. The Group’s NBEV for the quarter registered a 9% increase to S$262.0 million, ending the year 21% higher at S$808.0 million.

Regulatory Capital

The Capital Adequacy Ratios of the Group’s insurance subsidiaries in both Singapore and Malaysia remain strong and well above their respective minimum regulatory levels.

Dividend

The Directors have recommended, for shareholders’ approval at the Annual General Meeting, the payment of a final one-tier tax exempt dividend of 55 cents per ordinary share. Upon approval, the final dividend will be payable on 05 May 2022. Including the interim one-tier tax exempt dividend of 10 cents per ordinary share paid in August 2021; total dividend for FY-21 would amount to 65 cents per ordinary share.

Commenting on the Group’s financial results, Group Chief Executive Officer Mr Khor Hock Seng said:

“We delivered a strong set of results for the year. Profit Attributable to Shareholders grew 16% against last year, crossing the S$1.0 billion mark to S$1,113.0 million. TWNS for the year achieved a 28% increase to S$1,971.6 million, inching forward towards the S$2.0 billion mark and NBEV achieved a 21% increase to S$808.0 million.

This achievement is the result of our unyielding commitment to transform our business against a backdrop of uncertainty brought about by unprecedented times. We have done well to strengthen our distribution network, arming our core channels of Agency/Financial Adviser and Bancassurance with digital tools to build resiliency into the business. Further, through the consistent execution of our recruitment strategy, we have strengthened our financial representative footprint across the region.

We have continued to make meaningful strides in our sustainability journey, implementing a slew of initiatives to achieve our two key objectives, which are to improve people’s lives and transition to a low-carbon economy.

As we look ahead, we will continue to be challenged by the ever-evolving pandemic and geo-political uncertainties. The Group’s resilient performance underscores the strength of our core business fundamentals and we will further build on these fundamentals to achieve a sustainable business for the long term.”

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$100 billion in assets and more than 10 million policyholders, including 7.5 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei and has a presence in China as well as a representative office in Myanmar.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by Standard and Poor's since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the largest private sector asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #TheLifeCompany #Lifeproof

For more information, please contact:

Annette Pau

VP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com

Low Lai Fong

Senior Vice President, Group Finance

Email: investor-relations@greateasternlife.com