Great Eastern’s Latest App Feature ‘My Protection Explorer’ Puts Financial Preparedness in Customers’ Hands

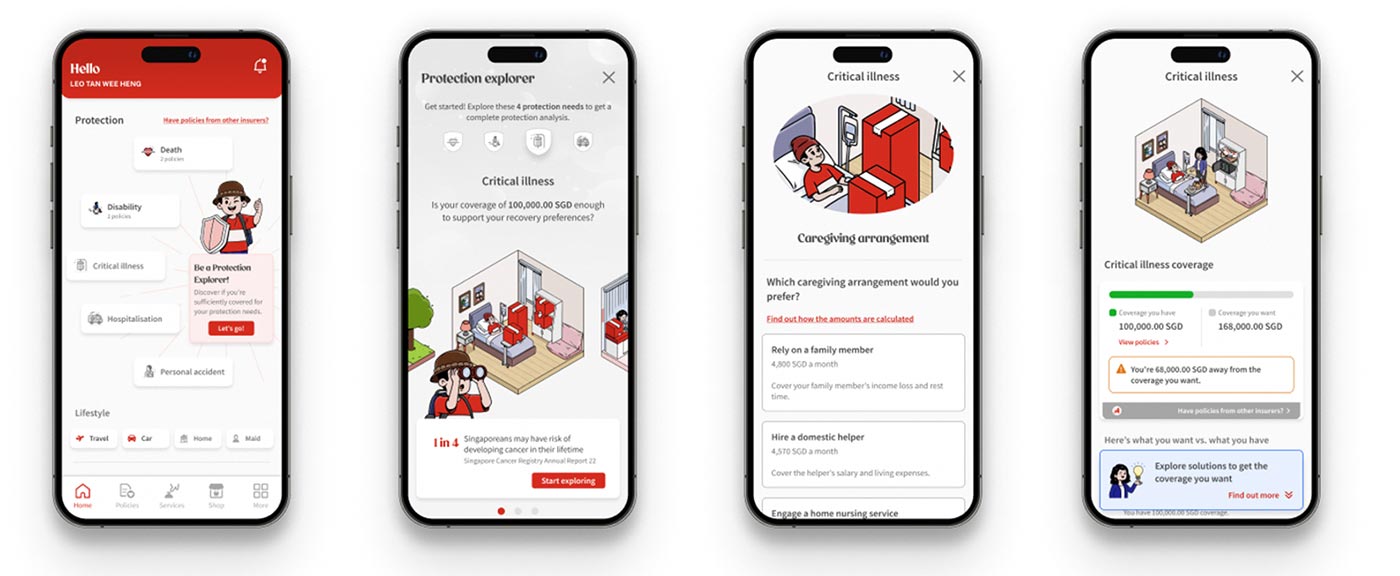

Singapore, 3 September 2025 – Singapore’s longest established insurer Great Eastern today introduced a new app feature ‘My Protection Explorer’, which takes a first-of-its-kind approach to empower its customers in Singapore to assess if they are financially prepared for unforeseen life events.

“Being financially prepared is key to handling unexpected money troubles. It is about preparing not just for immediate needs but also for long-term financial well-being. Life can be unpredictable, and we want to make it easier for our customers to plan ahead and to have the confidence and resources to deal with economic changes,” said Group CEO of Great Eastern Greg Hingston. “Our new feature offers customers a simple, personalised way to self-discover their readiness for life’s uncertainties. By uncovering protection gaps early, customers can make informed decisions to safeguard themselves and their loved ones.”

The user-friendly, self-help tool is the latest innovation reflecting Great Eastern’s enduring commitment to empower individuals and families to live well, plan with confidence and retire better.

Taking a personalised approach to financial preparedness

Born out of intensive research and customer focus groups, ‘My Protection Explorer’ takes a customer-first approach towards financial planning.

With just 26% of Singaporeans seeking professional financial advice, My Protection Explorer offers individuals a convenient tool to evaluate their protection coverage at their own pace. Another customer experience study showed that 78% of consumers in Singapore expect greater personalisation as technology advances. ‘My Protection Explorer’ meets these shifting preferences by combining simplicity, discretion and personalisation to provide a clear picture of financial preparedness.

The tool is designed to help customers understand the financial impact of unforeseen life events, such as hospitalisation, disability or critical illness, based on their own unique financial circumstance. It allows customers to see how well-prepared they are for these unexpected events with their own current policies in their portfolio. Additionally, it matches their desired level of coverage with their financial needs and goals.

Positive feedback from user tests

Customers who have tried the feature in a pilot test said that their perspective on their necessary coverage changed significantly, as the tool prompted them to factor in financial considerations they had not previously accounted for.

Unlike other financial planning tools, ‘My Protection Explorer’ offers a high level of detail needed to help users fully understand their financial needs for various life events, including retirement.

‘My Protection Explorer’ puts control directly in the hands of customers, with a few clicks, customers can see exactly where they stand, identify any protection gaps and receive recommendations to address these gaps within the Great Eastern app itself.

Unlocking multiple benefits for Great Eastern customers

Customers with the Great Eastern App can tap into the following benefits with ‘My Protection Explorer’:

Discover Financial Preparedness for Unforeseen Circumstances

Life is unpredictable, and unforeseen circumstances can arise at any moment. With the ‘My Protection Explorer’ feature, customers can assess their readiness for such events. This tool helps customers understand how well their current policies cover their financial needs and preferences, compared to their ideal coverage. By gaining clarity on their preparedness, customers can make informed decisions to ensure they and their loved ones are adequately protected.

Receive Comprehensive Coverage Insights

The ‘My Protection Explorer’ feature provides users a detailed view of various aspects of protection:

- Hospitalisation: Review how a customer’s current policy supports him/her during hospital stays and medical treatments;

- Critical Illness: Understand the extent of a customer’s coverage for serious health conditions;

- Disability: Check how well a customer is protected financially in case of disability that limits his/her ability to work; and

- Life Protection: Evaluate the security a customer’s policy provides for his/her family's future.

Adapt to Life’s Changing Needs

The ‘My Protection Explorer’ feature offers intuitive, user-friendly navigation for customers to easily access their coverage details anytime, anywhere. It adapts with their changing needs, letting them update preferences as their lives evolve—whether starting a family, buying a home, or planning retirement—making insurance management straightforward for everyone.

Prepare for Informed Conversations

Before engaging in conversation with a financial representative about potential new products or additional coverage, it is useful for customers to have a clear understanding of their current coverage. The ‘My Protection Explorer’ feature equips customers with the necessary information to have meaningful and productive conversations about potential products or riders to enhance their protection. By knowing where they stand, customers can explore opportunities to optimise their coverage and address any gaps.

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$117 billion in assets and more than 15.5 million policyholders, including 11.5 million from government schemes, it provides insurance solutions to customers through multiple distribution channels – a tied agency force, bancassurance, direct digital, digital partnerships and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength ratings of "AA" by Fitch Ratings and "AA-" by S&P Global Ratings, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the leading asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC, the longest established Singapore bank, formed in 1932. It is the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s and AA- by both Fitch and S&P. Recognised for its financial strength and stability, OCBC is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker

#GreatEasternSG #ReachforGreat

For more information, please contact:

Sharan Nanwani

Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com

Krittika Venkatesh / Sim Bao Zi

Edelman Singapore

Email: greateastern@edelman.com