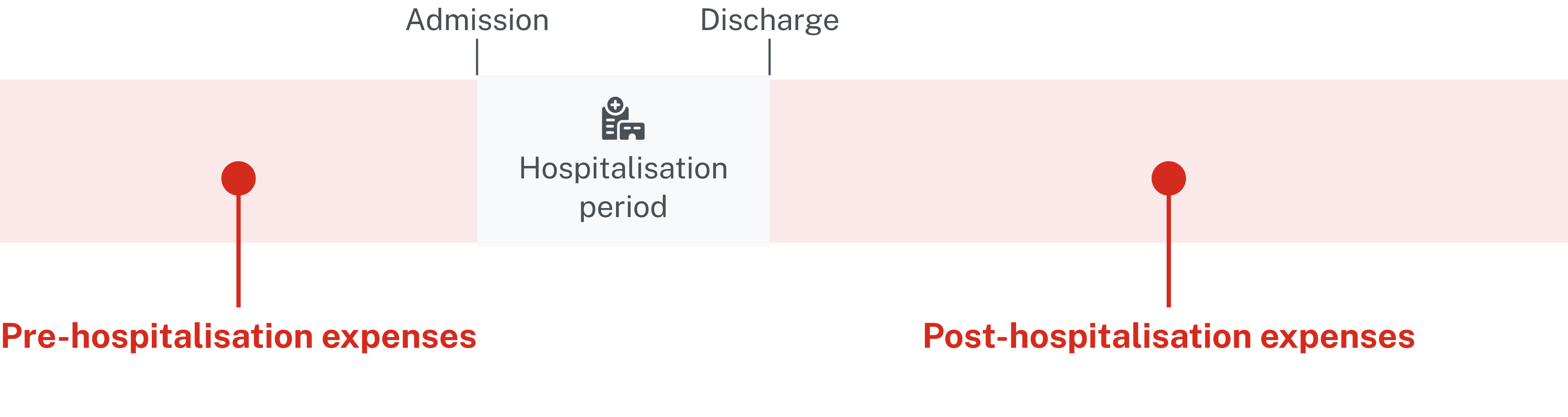

We understand that unexpected medical expenses can be stressful. Your policy provides coverage for expenses incurred before and after hospitalisation, offering comprehensive support throughout your medical journey.

Your hospitalisation journey

Pre or post hospitalisation claims are part of your coverage that reimburses you for related medical expenses incurred before and after a hospital stay within the eligible coverage period.

What is covered:

Pre hospitalisation expenses

- Costs incurred before your hospitalisation or surgery, and

- Includes services prescribed by a general practitioner or specialist as part of an outpatient consultation related to the condition that led to your hospitalisation or surgery, e.g. medical examinations, doctor consultations, laboratory tests, treatments including medication, therapies, etc.

Post hospitalisation expenses

- Costs incurred after your hospitalisation or surgery, and

- Are services prescribed by a general practitioner or specialist as part of an outpatient consultation related to the condition that led to your hospitalisation or surgery, e.g. medical examinations, doctor consultations, laboratory tests, physiotherapy^, treatments including medication, therapies, etc.

^Treatment must be recommended in writing by the treating doctor and performed by qualified physiotherapist.

After you receive an SMS from us that your main hospitalisation claim has been approved, you can begin to submit bills for pre and post hospitalisation expenses whenever you receive them.

Your coverage period and limits vary depending on your policy type. Contact our claims hotline at +65 6856 8548 on weekdays from 9.00am to 5.30pm or Financial Representative for specific details.

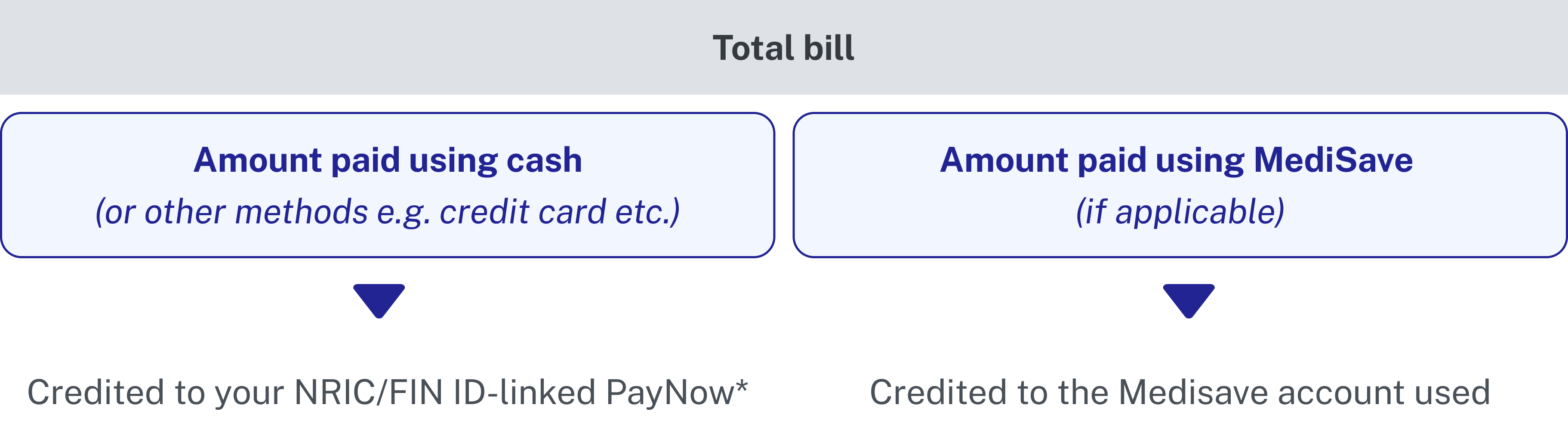

Your claims submission guide

We aim to to keep you informed and supported throughout the claims process. Here is a quick overview of what to expect:

Gather your documents

Here is what you need to submit your claim:

1. Final copies of your hospital and medical bills

2. MediSave Payment and Claims statement (if you paid using your/your loved one’s MediSave)

Retrieve it from the CPF website under the ‘Latest healthcare payments and claims’ section.

Tips for submitting documents

- Digital copies preferred: Retrieve the PDF copy if your clinic provided one or download your bills from the HealthHub app if you visited a restructured hospital.

- Clear photos get processed faster: Check out our guide for tips on taking photos of your medical bills and some examples for reference.

Submit via the following channels

- Great Eastern App

- Online Form