Picking the right Integrated Shield Plan

Make an informed choice to select an Integrated Shield Plan (IP) that is financially sustainable, and covers your specialist and hospital preferences. Compare the IP options available as well.

Reassessing your IP coverage proactively helps you avoid unexpected financial strain and ensures that you are fully covered. Keeping premiums affordable for IP policyholders in the long run is also in line with Ministry of Health Singapore’s (MOH) objectives. We are committed to providing value-based coverage at affordable rates and will be reviewing our IP offerings to provide supplementary plans that align with MOH’s requirements by 1 April 2026.

Reach out to your Financial Representative if you would like someone to review your plan or walk through the options. Alternatively, call our Customer Service Officers at 1800 248 2888 or email us at wecare-sg@greateasternlife.com for support and clarification.

Understanding your Integrated Shield plan options

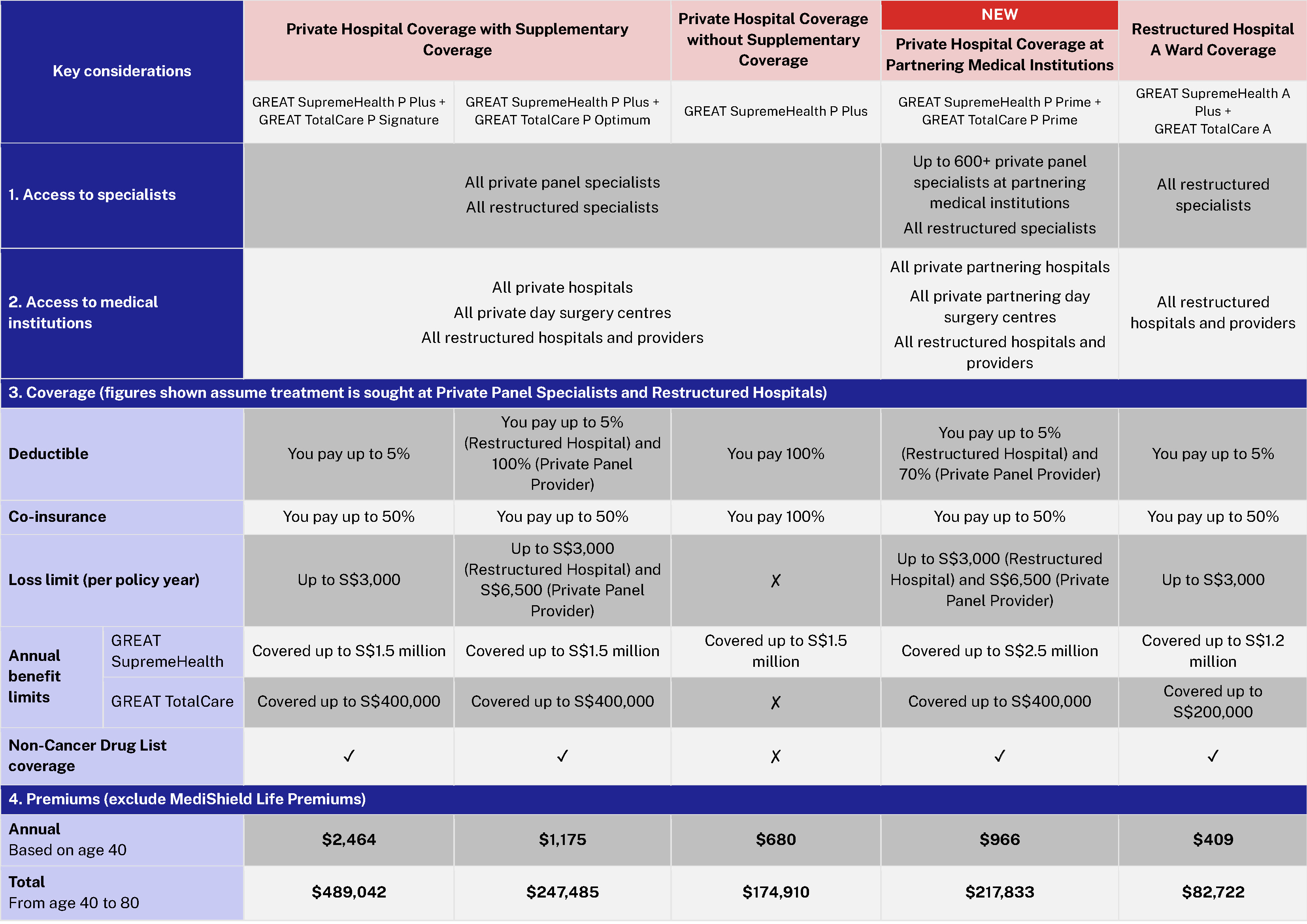

The table provides an overview of some of the IP solutions that you can consider converting to.

Viewing on mobile? Download the full comparison table or switch to desktop for easier viewing.

Notes:

- Refer to the list of partnering medical institutions and panel specialists for more details.

- Illustrated premiums include 9% GST and actual figures will vary according to attained age. Future premium is non-guaranteed and may be subject to change.

- GREAT TotalCare (GTC) P Signature premiums exclude Claims-Adjusted Pricing discount or loading, where the renewal premium is adjusted based on claim history

- Premiums are based on new and renewing GREAT SupremeHealth (GSH) and GTC policies from 1 November 2025. For more details, refer to the benefit schedule and premium rates.

Refer to the list below for definitions of important terms.

Definitions of important terms

Deductible: An amount you pay out of your own pocket for your bill before we pay any benefit under GREAT SupremeHealth. The percentage you pay depends on the IP solution you have.

Co- insurance: A percentage of the remaining bill you pay after paying the deductible under GREAT SupremeHealth. The percentage you pay depends on the IP solution you have.

Loss limit: A benefit offered with supplementary coverage that caps the total amount you need to pay for the deductible, co-payment and co-insurance in a policy year.

Annual benefit limit: A total amount of benefits we will pay during the policy year.

Cancer Drug List: A list of clinically-proven cancer drug treatments on the Ministry of Health, Singapore's website claimable under MediShield Life.

- With GREAT TotalCare, we cover selected outpatient cancer drug treatments that are not on the Cancer Drug List.

You can find out the details of your current IP through the Great Eastern App or in the renewal letter.

Evaluating your ability to sustain insurance costs over time

We encourage you to review your plans annually to ensure that they continue to meet your actual healthcare needs and financial priorities.

The Central Provident Fund Board's Health Insurance Planner allows you to compare health insurance plans across insurers and evaluate if you can afford your preferred coverage over the long term.

Continuing with current Integrated Shield Plan

There will be premium and/or benefit revisions to GREAT SupremeHealth and GREAT TotalCare plans. These revisions will take effect for policy renewals from 1 November 2025.