How GREAT Life Multiplier Protects Grandparents & Grandchildren

Secure your family's future with whole life insurance for protection across generations

For those of us who are part of Singapore’s “sandwich generation”, we know it’s not just a catchy label, but a dose of our daily reality. We are raising children while caring for ageing parents who may need more medical and financial support as the years go by.

That means juggling school fees, enrichment classes and the everyday costs of raising a child, alongside helping to cover medical bills, long-term care and ensuring our parents can enjoy a comfortable retirement. And somewhere in between, we still need to plan for our own future — building our savings, preparing for retirement and pursuing personal goals. Balancing all these responsibilities is a lot to manage, both emotionally and financially.

Why Insurance Matters More Than Ever

When we are caring for both young children and elderly parents, unexpected health issues can throw our finances into disarray. For kids, common illnesses like hand-foot-and-mouth disease (HFMD) or dengue can mean hospital stays, and parents needing to take time off work to care for them.

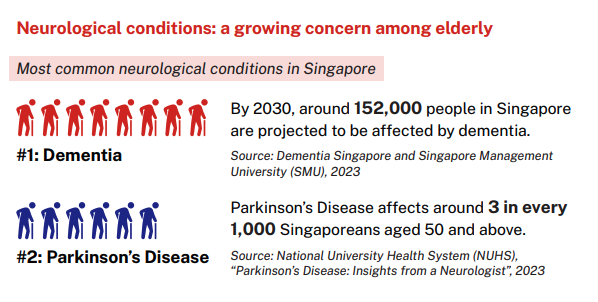

For our elderly parents, the risks are even higher.

Conditions such as Alzheimer’s disease/Severe dementia, idiopathic Parkinson’s disease or major head trauma from a fall can require long-term care, specialised treatment and possibly a full-time caregiver. These costs can escalate quickly, especially if someone in the family needs to stop working to be the main caregiver.

This is where insurance can play a vital role in protecting our family.

Insurance provides a safety net we can’t afford to overlook. When illness strikes, it ensures we are not forced to choose between our family’s health and our financial stability.

However, for the sandwich generation, simply protecting ourselves alone isn’t necessarily enough. We also carry the responsibility of safeguarding the well-being of the multiple generations who depend on us.

Introducing the GREAT Life Multiplier whole life plan

One such insurance policy that is designed specifically to cover our families across generations is the GREAT Life Multiplier. This comprehensive, whole-life participating plan with its riders can protect both our young children and elderly parents.

For example, we can purchase the GREAT Life Multiplier for our child to allow them to enjoy lifelong protection against death, terminal illness and total and permanent disability. On top of this core coverage, we can choose to enhance the plan with an optional rider for critical illnesses, providing our child with vital financial support in the event of a critical illness like major cancer, heart attack or stroke.

What makes the GREAT Life Multiplier stand out is the flexibility it gives through its multiplier feature. We can select a coverage multiplier to boost the coverage up to 10 times the basic sum assured based on our needs and budget. This means we can start our children with a higher level of protection during their earlier years and reduce their coverage by reducing the basic sum assured once they are older.

One key difference between the GREAT Life Multiplier and other traditional whole life insurance policies is that it also provides coverage for our parents through an add-on rider.

For many of us in the sandwich generation, our parents’ health is, rightfully, a constant concern. According to the Great Eastern Long-Term Care Study, at least 70% also worry about the physical and emotional toll that long term disabilities can have on their family. At the same time, 80% are also not confident of being financially ready for long-term care costs arising from disability.

However, as our parents age, securing new insurance coverage becomes increasingly difficult, and options are often limited to personal accident plans with narrow benefits.

With GREAT Life Multiplier, our elderly parents aren’t left out either. With the Parent Care Rider, we can extend protection to them for age-related critical illness conditions1, such as Alzheimer’s disease/Severe dementia, idiopathic Parkinson’s disease and major head trauma, with coverage of up to $50,000 per parent for each rider2.

More importantly, this coverage doesn’t require any health checks at the point of application.

This means we can give our parents added financial protection in their later years, easing the potential burden on the family if such conditions arise.

For added peace of mind, we can also include the Payer Benefit Enhanced (CI) Rider. This means if we’re diagnosed with a late-stage critical illness, all future premiums are waived, ensuring our family’s protection continues without the financial strain of ongoing payments.

Protecting The Family Across Generations Through the GREAT Life Multiplier

For those of us in the sandwich generation, financial planning isn’t just about protecting ourselves but also about making sure the people we love, both young and old, are cared for no matter what happens.

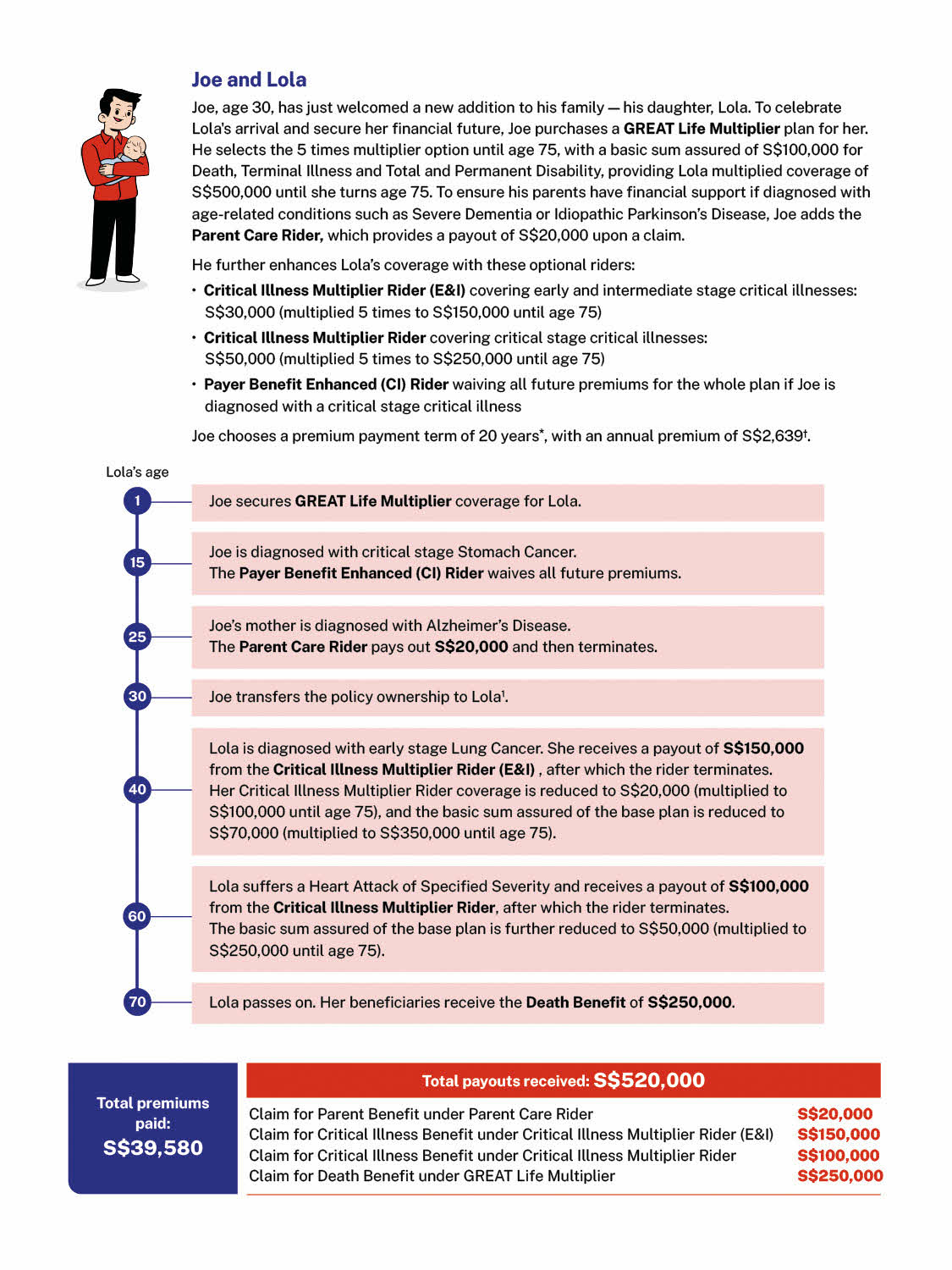

Here’s an illustration of how the GREAT Life Multiplier can potentially work to protect our family.

From the day we protect our child with coverage, we gain peace of mind knowing that whatever health challenges may arise, the GREAT Life Multiplier will continue to safeguard our family for years to come.

By starting our planning early, we can enjoy lower premiums and be prepared for whatever challenges come our way, whether it’s a child falling ill or a parent facing a health condition. This way, our family’s financial stability stays protected, no matter what happens.

Ultimately, the best time to prepare for tomorrow is today. And the right insurance plan can give us the peace of mind to focus on living, knowing that protection is already in place.

Speak to a Great Eastern’s Financial Representative to learn how GREAT Life Multiplier can help protect your family across multiple generations. Choose to use your SG60 Gift Credits to save 10% off and enjoy 15% off first-year premiums when you sign up before 31 Dec 2025! Find out more here.

Disclosure: This article is written by Timothy Ho, a writer and is in collaboration with Dollars and Sense.

Disclaimer:

Terms and conditions apply.

1 Excluding pre-existing conditions. Other terms and conditions apply. Please refer to the product summary and policy contract for details.

2 Up to $100,000 per parent when there are more than 1 policy bought with attaching Parent Care rider.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

You may wish to seek advice from a financial adviser before buying the product. If you choose not to seek advice from a financial adviser, you should consider whether the product is suitable for you.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information correct as at 25 September 2025.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.