Key benefits

-

Basic lifetime coverage

Receive lifetime protection against Death, Terminal illness1 and Total and Permanent Disability2 and accumulate cash value over time.

-

Affordable premiums for essential coverage

Choose to pay premiums up to age 70 or 85.

-

Option to add-on critical illness coverage

Enhance your coverage against 30 critical illnesses with optional DIRECT - GREAT Critical Care 70/ 85 rider3 .

How to apply

You can submit an application online via ‘Buy Now’ or visit our Customer Service Counters at Great Eastern Centre (address below):

1 Pickering Street

Great Eastern Centre

Singapore 048659

Weekday (except PH): 9:00am to 5:00pm

Sample policy wording for DIRECT - GREAT Life II 70 with DIRECT - GREAT Critical Care 70 |

Sample policy wording for Direct – GREAT Life II 85 with DIRECT – GREAT Critical Care 85 |

1. To compare similar products in Singapore, please visit the Web Aggregator by clicking the link below:

2. Please take note of the following points before decide to purchase this plan:

(a) The DPI is not a savings account or deposit;

(b) You may not get back the premiums paid (partially or in full) if you terminate or surrender the policy early;

(c) Some benefits of the DPI are not guaranteed;

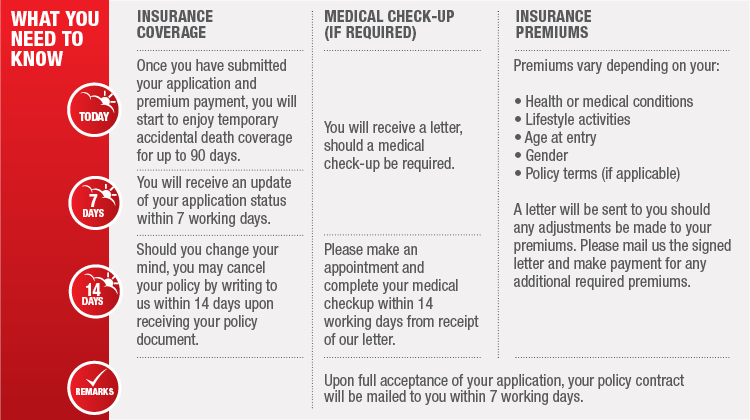

(d) There is a 14-day free-look period;

(e) You may request the financial adviser to explain the product features;

(f) You may wish to separately seek advice on the suitability of the life policy; and

(g) In the event that you choose not to seek advice on the suitability of the life policy, you should consider if the life policy is suitable for your financial circumstances and needs.

3. If you fulfil any two of the following criteria:

(i) 62 years of age or older

(ii) not proficient in spoken or written English

(iii) attained GCE ‘O’ level or ‘N’ level certification, or equivalent academic qualifications;

then you are strongly encouraged to bring along a Trusted Individual to our Customer Service counter to assist in your insurance application.

The Trusted Individual should be:

(i) be at least 18 years of age;

(ii) have Attained GCE ‘O’ level or ‘N’ level certification, or equivalent academic qualifications;

(iii) be proficient in spoken or written English; and

(iv) have your trust

Get this plan

You can submit an application by clicking on ‘Buy Now’ or for more information, please contact our friendly Customer Service Officers.

Contact us

1800 248 2888

Your questions answered

1. What is payable in the event of a claim?

Benefits are payable under DIRECT – GREAT Life II policies:

| Possible events of Claim | Benefit Payable - Only 1 claim will be paid |

What happens to the policy after claim is made? |

| Death | 100% of Sum Assured plus attached bonus if any. | The policy will terminate once the claim is paid. |

| Terminal Illness (TI) | ||

| Total & Permanent Disability (TPD) must occur before the policy anniversary when the Life Assured reaches 65 years of age. |

Benefits are payable under DIRECT – GREAT Life II 70 and DIRECT – GREAT Life II 85 policies when attached with their respective Critical Illness riders: GREAT Critical Care 70 and GREAT Critical Care 85.

| Possible events of Claim | Benefit Payable - Only 1 claim will be paid< |

What happens to the policy after claim is made? |

| Death | 100% of Sum Assured plus attached bonus if any. | The policy will terminate once the claim is paid. |

| Terminal Illness (TI) | ||

| Total & Permanent Disability (TPD) must occur before the policy anniversary when the Life Assured reaches 65 years of age. | ||

| Critical Illness (CI), excluding Angioplasty | ||

| Angioplasty which is one of the CIs | 10% of Sum Assured or S$25k Sum Assured plus attached bonus if any, whichever is lower. Note: No benefit for Angioplasty shall be payable for any subsequent treatment under this policy or any other policies and riders that provide coverage for Angioplasty. |

The policy will remain in force with the reduced Sum Assured with corresponding revised premium. |

2. In which situations are Death, Terminal Illness (TI), and Total & Permanent Disability (TPD) benefits not paid out?

| Benefit payable | Situations whereby benefit is not paid out |

Death Benefit |

|

TI Benefit |

|

TPD Benefit |

|

3. What is the minimum and maximum sum assured available for customers under DIRECT plans?

| Minimum Sum Assured | Maximum Sum Assured | |

| Policies under DIRECT plans

|

$50k, on single policy level. | $400k per life per insurer, and it applies to all policies issued under DIRECT plans. |

| DIRECT – GREAT Term DIRECT – GREAT 5Yr Term |

$50k, on single policy level. | $400k per life per insurer, and it applies to all policies issued under DIRECT plans. |

| DIRECT – GREAT Life II 70/85 | $50k, on single policy level. | $200k per life per insurer, and it applies to all whole life policies issued under DIRECT plans. |

Notes and Disclaimers

- Sum Assured denotes the coverage amount under the policy.

- All ages specified refer to age next birthday.

- The above is for general information only. For precise terms and conditions of this insurance plan, please refer to the policy contract.

1. What are the riders available for DIRECT – Great Life II?

Each main plan, namely DIRECT – Great Life II 70 and DIRECT – Great Life II 85, offers an optional Critical Illness (CI) rider that customer can attach for CI coverage. The CI rider’s sum assured must be the same as the main plan.

If a CI claim is made, the main plan pays out the sum assured and the policy ends. Below is a summary of the main plans with their corresponding CI rider:

Main Plan |

Corresponding CI Rider |

DIRECT – GREAT Life II 70 |

DIRECT – Great Critical Care 70 |

DIRECT – GREAT Life II 85 |

DIRECT – Great Critical Care 85 |

2. What are the CIs covered under the CI rider?

The covered CIs are of the late stage and the 30 CIs are:

1 |

Alzheimer's Disease/ Severe Dementia* |

16 |

Irreversible Loss of Speech* |

2 |

Angioplasty and Other Invasive Treatment for Coronary Artery* |

17 |

Major Burn* |

3 |

Benign Brain Tumour* |

18 |

Major Cancer* |

4 |

Blindness (Irreversible Loss of Sight) * |

19 |

Major Head Trauma* |

5 |

Coma* |

20 |

Major Organ / Bone Marrow Transplantation* |

6 |

Coronary Artery By-Pass Surgery* |

21 |

Motor Neurone Disease* |

7 |

Deafness (Irreversible Loss of Hearing) * |

22 |

Multiple Sclerosis* |

8 |

End Stage Kidney Failure* |

23 |

Muscular Dystrophy* |

9 |

End Stage Liver Failure* |

24 |

Open-Heart Heart Valve Surgery* |

10 |

End Stage Lung Disease* |

25 |

Paralysis (Irreversible Loss of Use of Limbs)* |

11 |

Fulminant Hepatitis* |

26 |

Primary Pulmonary Hypertension* |

12 |

Heart Attack of Specified Severity* |

27 |

Severe Bacterial Meningitis* |

13 |

HIV due to Blood Transfusion and Occupationally Acquired HIV* |

28 |

Severe Encephalitis* |

14 |

Idiopathic Parkinson’s Disease* |

29 |

Stroke with Permanent Neurological Deficit* |

15 |

Irreversible Aplastic Anaemia* |

30 |

Surgery to Aorta* |

* The Life Insurance Association Singapore (LIA) has standard definitions for 37 late-stage Critical Illnesses (Version 2024). These Critical Illnesses fall under Version 2024. You may refer to www.lia.org.sg for the standard definitions (Version 2024). For Critical Illnesses that do not fall under Version 2024, the definitions are determined by the insurance company.

3. In which situations are the CI benefits not paid out?

Benefit payable |

Situations whereby benefit is not paid out |

CI benefit |

|

4. Is it possible to make changes to the CI rider after my policy is in force?

The rider term and the sum assured of the CI rider must match that of the main plan.

- Once a policy is in force, you are unable to change the term of the plan & rider.

- If you want to increase the sum assured of the rider, you need to increase the sum assured of the main plan and it can only be done within 1st policy year.

- If you want to reduce the sum assured of the rider, you need to reduce the sum assured of the main plan, fulfilling the condition that the remaining sum assured must not be lesser than $50k.

You can cancel the CI rider at any time and keep the main plan.

Notes and Disclaimers

- Sum Assured denotes the coverage amount under the policy.

- All ages specified refer to age next birthday.

- The above is for general information only. For precise terms and conditions of this insurance plan, please refer to the policy contract.

1. What are the minimum and maximum sum assured?

The minimum sum assured is S$50,000 (for all plans) and the maximum sum assured is S$400,000*.

*The maximum sum assured is applied on a per life assured, per insurer basis and is subject to underwriting by the company. The maximum sum assured is aggregated for all Direct Purchase Insurance (DPI) plans (including Term and Whole Life plans) at $400,000. In addition, on a per life assured, per insurer basis, the maximum sum assured for DPI Whole Life plans is $200,000.

For example:

- If on a per life assured, per insurer basis, a person purchases a DPI Whole Life plan which sum assured is $200,000, the person may purchase a DPI Term plan which sum assured is not more than $200,000;

- If on a per life assured, per insurer basis, a person purchases DPI Whole Life plans which aggregate sum assured is $100,000, the person may purchase DPI Term plan which aggregate sum assured is not more than $300,000;

- If on a per life assured, per insurer basis, a person purchases DPI Term plan which aggregate sum assured is $400,000, the person will not be able to purchase any DPI Whole Life;

- If on a per life assured, per insurer basis, a person purchases a DPI Whole Life plan which sum assured is $200,000, the person may only purchase a DPI Term plan which sum assured is not more than $200,000 and will not be able to purchase any other DPI Whole Life plan.

2. Does Great Eastern have a panel of doctors?

Yes, the Company has a panel of doctors. The list would be provided should medical check-up is required.

3. Do I have to pay for the medical check-up?

You do not have to pay for the medical check-up which is requested by the company. However, should you decide to free-look the policy, the cost of the medical check-up will be deducted before refund of premiums.

4. What if I change my mind about the new policy, i.e. how to freelook my policy?

This Policy may be cancelled by written request to the Company within 14 days after the Policyholder has received the policy document in which case premiums paid less medical fees (if applicable) incurred in assessing the risk under this Policy will be refunded.

If this policy document is sent by post, it is deemed to have been delivered and received in the ordinary course of the post 7 days after the date of posting.

Please refer to “Your Servicing Guide” attached for more information.

1. How do you inform me when premium is due?

You will not receive premium notices if you are paying by monthly mode. For all other modes of payment, premium notices will be mailed to you.

2. What are the different payment methods available?

Please refer to “Your Servicing Guide” or our website for more details on payment methods available for your policy.

3. What is the GIRO deduction date?

Once your GIRO application is approved by your designated bank, you will receive a confirmation letter to advise you on the pre-assigned GIRO deduction date for your policy(ies).

4. Will I receive any receipt after I pay my renewal premium?

An official receipt will be mailed to the policyholder upon receipt of the payment of renewal premium. No receipt will be issued for payment via GIRO or credit card.

5. How do I change my payment frequency?

Yes, you may download the Application for Change Form from our website and complete “Section 1: Change of Payment Frequency” and post it to us.

6. What are the risks if I do not pay the premiums on time?

| Type of Plans | What will happen to my policy? |

|---|---|

| Term Plans | If premiums are not paid on time, your policy will lapse (after 30 days grace period). However, reinstatement of the policy is allowed within 6 months from the lapse date and usual reinstatement conditions apply. |

| Whole Life Plans | If premiums are not paid on time, your Policy may lapse (after 30 days grace period) depending on the net surrender value. If the Policy has sufficient net surrender value, an automatic premium loan (APL) will be granted. If the Policy lapses due to insufficient net surrender value, reinstatement of the Policy is allowed within 3 years from the lapse date and usual reinstatement conditions apply. |

7. What is the penalty for early termination of policy?

If you cancel your Policy within the free-look period i.e. 14 days from receiving your policy document, you will get a refund of your premiums paid less any medical fees. If you surrender your Policy after the free-look period, you may lose part or all of the premiums paid as the surrender value payable, if any, may be less than the total premiums paid.

Purchasing a new policy may require underwriting and may result in higher premiums and/or benefit exclusions due to your age and health status at the point of re-application.

1. How do I submit a claim?

You may download and print the claim forms from our Great Eastern website at www.greateasternlife.com

- Click on “Quick Links” and select “Submit a Claim”. Choose the relevant form you need from the list, and print it.

- Fill in the required forms and ask your doctor to complete the doctor’s statement.

- Submit all the required forms and supporting documents to us for assessment.

2. How do I check my claims status?

You may check on the status of your submitted claim through any of these options:

- Log on to eConnect for online information about your policies.

- Email us at LifePAClaims-SG@greateasternlife.com. You may check on the status of your submitted claim through any of these options

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 Terminal Illness refers to a conclusive diagnosis of an illness that is expected to result in the death of the Life Assured within 12 months of the diagnosis. The terminal illness must be diagnosed by a registered medical practitioner and must be supported by evidence acceptable to the Company. Please refer to the policy contract for a full list of exclusions.

2 Total and Permanent Disability (TPD) refers to:

(a) The Life Assured, due to accident or sickness, is disabled to such an extent as to be rendered totally unable to engage in any occupation, business or activity for income, remuneration or profit; and the disability must continue uninterrupted for at least 6 consecutive months from the time when the disability started; and the disability must, in the view of a medical examiner appointed by the Company, be deemed permanent with no possibility of improvement in the foreseeable future; or

(b) The Life Assured, due to accident or sickness, suffers total and irrecoverable loss of use of: (i) the entire sight in both eyes; or (ii) any two limbs at or above the wrist or ankle; or (iii) the entire sight in one eye and any one limb at or above the wrist or ankle.

Subject to a maximum TPD Benefit of $5,000,000 on all policies and riders issued by the Company on the same Life Assured. The TPD benefit is only applicable if TPD occurs before the policy anniversary on which the Life Assured is age 65 next birthday.

3 DIRECT - GREAT Critical Care 70/ 85 rider. On diagnosis of one of the 30 critical illnesses (except for Angioplasty & Other Invasive Treatment for Coronary Artery), the basic sum assured together with bonuses (if any) from the basic policy will be accelerated and paid in one lump sum. This rider will then be terminated. The amount of accelerated basic sum assured equals to the sum assured of this rider.

Subject to a maximum CI Benefit of $3,000,000 on all policies and riders issued by the Company on the same Life Assured.

For Angioplasty & Other Invasive Treatment for Coronary Artery (“Angioplasty”), the basic sum assured equal to 10% of the rider sum assured (up to a maximum of $25,000 per Life Assured) together with bonuses (if any) applicable to 10% of the rider sum assured, will be payable if the Life Assured undergoes a treatment. After a claim is paid, the balance of the rider sum assured and balance of the basic sum assured with reduced premiums will continue. No benefit for Angioplasty will be payable for subsequent treatments under this and any other policies and riders covering Angioplasty.

No benefit under this rider will be payable for Heart Attack of Specified Severity, Major Cancer, Coronary Artery By-pass Surgery or Angioplasty & Other Invasive Treatment for Coronary Artery if the diagnosis is made within 90 days from the date of issue of this rider, or from the date of any reinstatement.

Sum assured is capped at $400,000 for all direct purchase insurance plans, with a limit of $200,000 on direct purchase insurance whole life plans.

There are two non-participating riders available:

- You can attach DIRECT – GREAT Critical Care 70 to your whole life plan DIRECT – GREAT Life II 70. You can pay premiums up to age 70 next birthday and enjoy lifetime protection against 30 critical illnesses.

- You can attach DIRECT – GREAT Critical Care 85 to your whole life plan DIRECT – GREAT Life II 85. You can pay premiums up to age 85 next birthday and enjoy lifetime protection against 30 critical illnesses.

Premiums vary according to age at entry, gender and lifestyle choices, such as smoking. The premium charged is not guaranteed and may be revised in future at the Company’s discretion.

All ages specified refer to age next birthday.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

As DIRECT - GREAT Life II is a Direct Purchase Insurance plan, you can sign up for it directly without seeking any advice from any financial advisory representative.

These policies are protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and Chinese versions of this information, the English version shall prevail.

Information correct as at 1 October 2025.