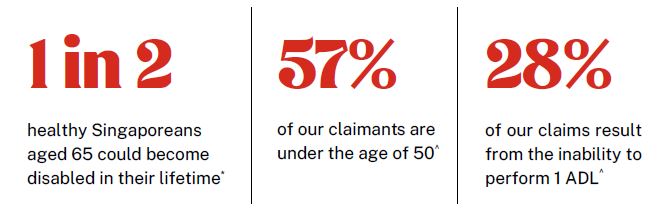

What you need to know about Disability

How GREAT CareShield benefits you

Monthly financial support1 starts from the inability to perform any Activity of Daily Living2

Monthly financial support1 starts from the inability to perform any Activity of Daily Living2

Receive monthly payouts3 and a lump sum Initial Benefit4 of up to S$15,000 to support your daily expenses and long-term care. Your future premiums will also be waived5.

Get up to 90% more in monthly benefits for caregiver’s and children’s expenses

Get up to 90% more in monthly benefits for caregiver’s and children’s expenses

Upon the inability to perform at least 2 ADLs, you will receive an additional 60% of the Monthly Benefit in monthly payouts for caregiving support6 and an additional 30% of the Monthly Benefit in monthly payouts to provide for your child7.

Utilise your MediSave funds8 for enhanced coverage

Utilise your MediSave funds8 for enhanced coverage

No additional cash premium top-ups may be needed as GREAT CareShield can be paid with your MediSave funds.

Let our Financial

Representative serve you

We are happy to help you.