Navigating the Closure of CPF Special Account

Learn more about how GREAT Invest Advantage can help you achieve your retirement aspirations today.

Too Long, Didn’t Read? In a nutshell…

- With the CPF Special Account (CPF-SA) closure in 2025, funds will be transferred to your CPF Retirement Account (CPF-RA) and CPF Ordinary Account (CPF-OA) at age 55

- Starting investments early and beyond retirement can provide benefits such as growth of savings and achieving retirement goals.

- Great Eastern’s GREAT Invest Advantage allows you to invest CPF funds flexibly and securely while being insured against death and terminal illness.

Imagine: You’re 55 this year, and you receive the news — your CPF-SA is closed. It’s natural to feel a moment of uncertainty, but rest assured, your savings won’t disappear; they’ll simply be reallocated to a different account. However, you might be wondering, what happens to your savings? Where will they go? And how can you make the most of this transition? We’ll cover more about this transfer in the following section, “Understanding the CPF Special Account Closure”.

According to the Life Insurance Association (LIA) Singapore, life insurance sales surged by nearly 20% in 2024 — driven by a remarkable jump of 41% in Investment-Linked Plans (ILPs)1. This surge highlights a growing interest in wealth accumulation, especially through ILPs like Great Eastern's GREAT Invest Advantage. This is important to individuals turning 55 as they approach key financial milestones.

This article will also explore why investing is crucial for maintaining and growing your retirement nest egg. We'll delve into the reasons people invest, the options available, and key considerations before making investment decisions.

Understanding the CPF-SA Closure

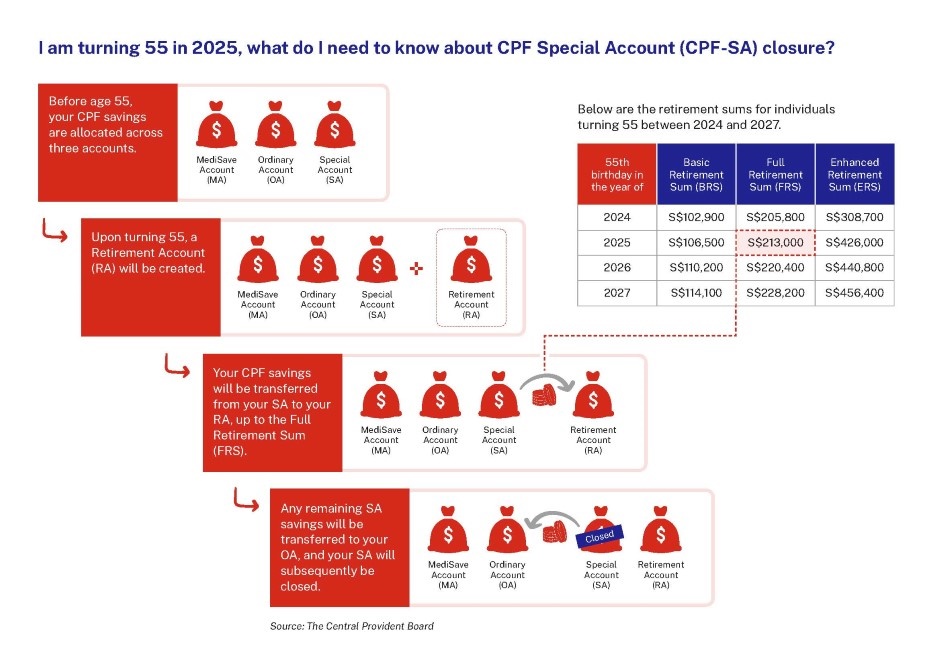

From 2025, the CPF-SA will be closed for members aged 55 and above. This change is to better align CPF interest rates to the nature of CPF savings in each CPF account, i.e. savings that cannot be withdrawn on demand should earn the long-term interest rate, and savings that can be withdrawn on demand should earn the short-term interest rate (refer to the image above for a visual representation).

Here’s how the CPF-SA closure works2:

- Before age 55, CPF savings are allocated across three accounts — MediSave Account (MA), Ordinary Account (OA), and Special Account (SA).

- At age 55, CPF-RA will be created. Funds from the CPF-SA will be transferred to the CPF-RA, up to the members’ cohort Full Retirement Sum (FRS), where they will continue to earn the long-term interest rate. The CPF-RA savings will be used to provide monthly payouts in retirement.

- Any remaining savings will be transferred to the CPF-OA, where they will earn 2.5% interest per annum, and members have the flexibility to withdraw them when needed. The CPF-SA will subsequently be closed.

As these monies can only be streamed out as a LIFE payout from 65, this highlights the need to explore investment options for retirement if you are aiming to maintain a comfortable lifestyle in your twilight years.

According to an article by Channel News Asia6, this change was made to address a flaw within the CPF system. The featured economist explained that, in the past, individuals who had met the Full Retirement Sum were able to withdraw funds from their Special Account and reinvest them elsewhere, which led to higher returns.

This led to an unintended advantage within the system. By closing the Special Account for those aged 55 and over, this anomaly has been resolved to ensure that the system remains fair and consistent.

If members would like to continue earning the higher interest rate of 4% per annum and enjoy higher retirement payouts, they can transfer these OA savings to their RA up to the current year’s Enhanced Retirement Sum (ERS). This transfer is irreversible and can be made anytime.

Why Investment Decisions Do Not Stop At 55

Beyond the shifts caused by the CPF-SA closure, investing plays a vital role in maintaining and growing your retirement savings.

Preserve and Grow Savings

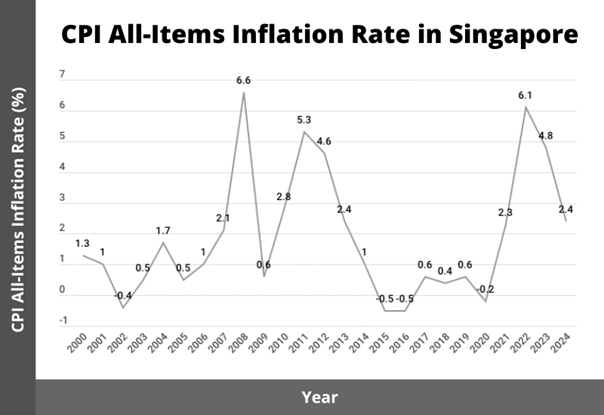

Inflation erodes purchasing power. For example, Singapore's annual inflation rate was 0.40% in 1961 and rose to 4.82% in 20233. While this number trended lower (2.4%) in 20244, it demonstrates the significant impact of fluctuating inflation rates on the cost of living over the long term. To further emphasise the impact of inflation on savings, let’s recall that the CPF-OA earns an interest rate of 2.5%5. The real value of the OA savings decreases in years where the inflation rate exceeds the interest rate, as illustrated by the 2023 figures: 4.82% inflation versus 2.5% OA interest.

Image Source: ‘CPI All-Items Inflation Rate in Singapore’ from https://smartwealth.sg

In this sense, investing provides a way to preserve and grow wealth. In the best case, investing ensures that your savings retain their value or even outpace inflation.

Achieve Financial Goals

Whether it’s for an early retirement, supporting a child’s education, or managing healthcare needs, investing can be a tool to potentially reach these financial goals faster. However, careful planning and risk tolerance are essential as all investments carry certain risks.

Build a Legacy

Of course, some want a better life for their loved ones. Investing with a long-term perspective, through options like investment-linked plans (such as GREAT Invest Advantage), can provide a powerful way to build a substantial financial legacy and support future generations. The combination of potential investment growth and insurance protection can create a significant asset to pass on to beneficiaries.

Key Considerations Before Investing

Before investing, it’s important to consider key factors that will align your investment strategy with your financial goals and risk profile:

- Risk appetite: The level of risk an investor is willing and able to take by considering factors like investment horizon and investment capital they can afford to lose.

- Risk tolerance: The level of risk an individual can afford to take without experiencing undue stress or jeopardising their financial stability.

- Financial goals: Clearly defined objectives that guide your investments, priorities, and timeframe.

- Time Horizon: The length of time you plan to hold your investments. The longer your horizon, the more flexibility you have to ride out market fluctuations and benefit from compounding growth.

- Professional advice: Seeking guidance from qualified financial representatives can make a significant difference in achieving your financial goals.

Investing is a journey, and careful planning is essential to its success. For expert guidance and personalised strategies, contact Great Eastern’s qualified financial representatives. Our team of professionals can help you build a robust investment plan that aligns with your goals and secures your financial future.

Investing with CPF Savings: Understanding the Options

For CPF members who have the knowledge and time to invest and are prepared to take an investment risk, the CPF Investment Scheme (CPFIS) offers a pathway to invest CPF savings in CPFIS-included financial products. CPFIS helps members grow their savings by investing in these products. To be eligible, you must:

- be at least 18 years old.

- not be an undischarged bankrupt.

- have more than S$20,000 in your OA and/or more than S$40,000 in your SA.

- have completed the CPFIS Self-Awareness Questionnaire (SAQ) for new investors.

Investment Options Available Under CPFIS

CPFIS provides a variety of investment options, allowing members to customise their portfolios based on their needs and risk appetite. These options include: unit trusts, ILPs, bonds, exchange-traded funds (ETFs), shares, and fixed deposits.

Among the options, Great Eastern’s GREAT Invest Advantage is part of the ILP offerings accessible via CPFIS, unlocking the growth potential on your investment with flexibility and confidence. Some of its key features and benefits include:

- Multiple funding choices: Invest using cash, Supplementary Retirement Scheme (SRS) or CPFIS, either as a lump-sum investment or a series of recurring contributions.

- Customisable portfolio: Tap into 18 CPFIS-included GreatLink funds such as GreatLink Global Equity Alpha Fund, designed to suit various investment goals and risk profiles.

- Full cash flow control with no lock-in: Free to invest more when the time is right and take out the funds in part or full whenever you want.

- Insurance coverage at no extra cost: Enjoy added assurance with death and terminal illness coverage, offering financial support and security for your loved ones.

Note that the benefit of no premium charge is exclusively applicable to those who invest under CPFIS.

With these features, GREAT Invest Advantage provides a flexible solution for growing your savings and achieving long-term financial goals.

Investing for Your Future with Great Eastern

The CPF-SA closure highlights the need for proactive retirement planning ahead of any possible changes that may affect your CPF funds. Investing wisely before you hit 55 years old is essential to ensure your savings continue to grow to sustain the retirement lifestyle you’ll want. Investment-linked plans like GREAT Invest Advantage provide flexibility and insurance coverage that makes them a valuable consideration for long-term financial planning. Remember to apply the key considerations, including understanding your risk appetite, defining your financial goals, and considering your investing horizon, to make informed decisions.

Take the next step towards securing your financial future. Learn more about how GREAT Invest Advantage can help you achieve your retirement aspirations today.

Footnotes:

1. https://www.straitstimes.com/business/banking/life-insurance-sales-in-singapore-up-nearly-20-to-5-9-billion-in-2024

2. https://www.cpf.gov.sg/member/infohub/educational-resources/closure-of-special-account-for-members-aged-55-and-above-in-early-2025

3. https://www.macrotrends.net/global-metrics/countries/sgp/singapore/inflation-rate-cpi

4. https://smartwealth.sg/average-inflation-rate-singapore/

5. https://www.cpf.gov.sg/service/article/what-are-the-cpf-interest-rates

6. CNA Explains: How will the closure of CPF Special Accounts affect those 55 and older? - CNA

7. https://www.moneysense.gov.sg/investments/investment-risk/

Disclaimers:

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person, and should not be construed as an advice or recommendation to invest in the funds. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. Please refer to Fund Details and Product Highlights Sheet for the specific risks of the fund(s). Past performance is not necessarily indicative of future performance. A Product Summary and a Product Highlights Sheet in relation to the fund(s) may be obtained through The Great Eastern Life Assurance Company Limited or its financial representatives. Potential investors should read the Product Summary and the Product Highlights Sheet before deciding whether to invest in the fund(s). Returns on the units of the fund(s) are not guaranteed. The value of the units in the fund(s) and the income accruing to the units, if any, may fall or rise.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information correct as of 6 June 2025.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.