CPF SA shielding hack loophole

CPF Special Account (SA) shielding hack loophole was for members 55 & above: what this means & what are the alternatives?

For Singaporeans and Permanent Residents (PRs), CPF savings serve as the foundation for retirement income. These savings are primarily held in three main accounts: the CPF Ordinary Account (OA), the CPF Special Account (SA), and MediSave Account.

When CPF members turn 55, a new account—the CPF Retirement Account (RA)—is automatically created and SA will then be closed. The savings in your SA will be transferred to your Retirement Account (RA) to set aside for the Full Retirement Sum (FRS) first. If the SA balance is insufficient to meet the FRS, the shortfall will be covered by transferring savings from the OA. The RA savings will continue to earn the long-term interest rate of at least 4% per annum and from age 65, may be used to provide monthly lifelong payouts through CPF LIFE.

How The SA “Shielding Hack” (Used To) Work

In previous years, some savvy CPF members have discovered a way to maximise the higher interest rate of the SA, which offers a base interest of 4% p.a. currently compared to the OA’s 2.5% per annum. They realised it would be more advantageous to allow their OA savings which was receiving lower returns to be used for topping up their RA to the FRS.

This strategy, known as the SA “shielding hack,” involved temporarily "investing" their CPF- SA savings through the CPF Investment Scheme (CPFIS) just before turning 55. When the RA is created at age 55, with little or no savings left in the SA (as they had been “invested”), the system uses OA savings to meet the FRS requirement. Once the RA is fully funded by OA, members could then sell their SA investments, and the proceeds would flow back into the SA.

This allowed CPF members who deploy this hack to continue earning the higher interest rate of 4% per annum as provided by the SA while using OA savings for the RA top-up.

Closure Of SA For Those Aged 55 & Above – what can you do about it?

With the official announcement of the closure of SA on 19 January 2025, 1.4 million of CPF members (aged 55 and older) had their SA closed. Hence, the “shielding hack” will no longer be possible as CPF members will not be able to keep excess savings in SA to to earn the prevailing 4% p.a. interest.

With the SA closure, even if you invest your SA savings to prevent them from being transferred to your RA and subsequently divest those investments after your retirement sum has been set, the savings can no longer return to your SA. Instead, any CPFIS SA investment proceeds will be deposited into your OA, where they will earn the base interest rate of 2.5% per annum.

So, what does this mean for CPF members? What options are available, and what can we do to optimise our CPF savings?

Let the funds stay in OA

Assuming you have already reached your Full Retirement Sum (FRS), any remaining savings in your SA will be transferred to your OA. The OA savings remain accessible for investment or withdrawal, giving you greater control over the savings.

Of course, you can let your savings remain in OA which will earn you a guaranteed return of 2.5% per annum. The trade-off, however, is that you lose out on an additional 1.5% per annum in interest compared to the 4.0% per annum previously earned in the SA.

Maximise your CPF savings

For those who wish to maximise their CPF savings, here are the options which you can explore:

Boosting monthly payouts by transferring OA savings to RA up to the current year’s Enhanced Retirement Sum

If you wish to earn higher interest and receive higher retirement payouts, you may transfer your SA savings that were channelled to the OA due to the closure of SA, to the RA up to the current year’s Enhanced Retirement Sum (ERS). The RA interest rate is the same as the SA. Find out more about how you can make the transfer at cpf.gov.sg/rstu.

From 1 January 2025, the ERS was raised to four times of the Basic Retirement Sum to allow members to save more in the RA and receive higher payouts, if they want. With the change, the ERS in 2025 would be $426,000, up from $308,700 in 2024. Hence, if you are aged 55 and above in 2025, you can save up to $426,000 in the RA.

Help your loved ones with their retirement by transferring your CPF savings to them to top up their CPF accounts

You can consider transferring to your loved ones – that is, your grandparents, grandparents-in-law, parents, parents-in-law, spouse or siblings – to help them get higher monthly payouts in retirement.

Please note that CPF transfers are irreversible and the savings are set aside to boost your monthly payouts in retirement. Thus, the amount transferred cannot be withdrawn for any other purpose such as housing, investment, or immediate needs after age 55.

Withdraw your savings and invest

For instance, after your SA savings are transferred to your OA, you have the option to withdraw the savings in cash and invest them independently. This approach allows us to explore a wide range of investment options according to your risk appetite, from low-risk Singapore Government Securities to higher-risk assets such as individual stocks.

Invest under CPF Investment Scheme (CPFIS)

For those who prefer to maintain the flexibility of investing for potential growth or yet keeping the choice to fall back on OA’s 2.5% per annum return, investing with CPFIS using your OA savings is one of the best strategies. For example, some investment-linked policies (ILPs) offered by insurers like Great Eastern provide flexibility and ease of entry, with no premium charges. This means that your CPF savings are fully invested from the outset, with no lock-in period, offering you the freedom to manage your funds as you wish.

One such plan you can consider is GREAT Invest Advantage. You can opt for a one-time single premium contribution of at least S$5,000 for a diversified portfolio with higher growth potential. Alternatively, you can also have the choice of a recurrent single premium (RSP) plan, starting from as little as S$100 a month, to steadily accumulate wealth and reduce market timing risks. Both options also allow top-ups of at least S$1,000, at no additional charge through CPFIS, subject to terms and conditions.

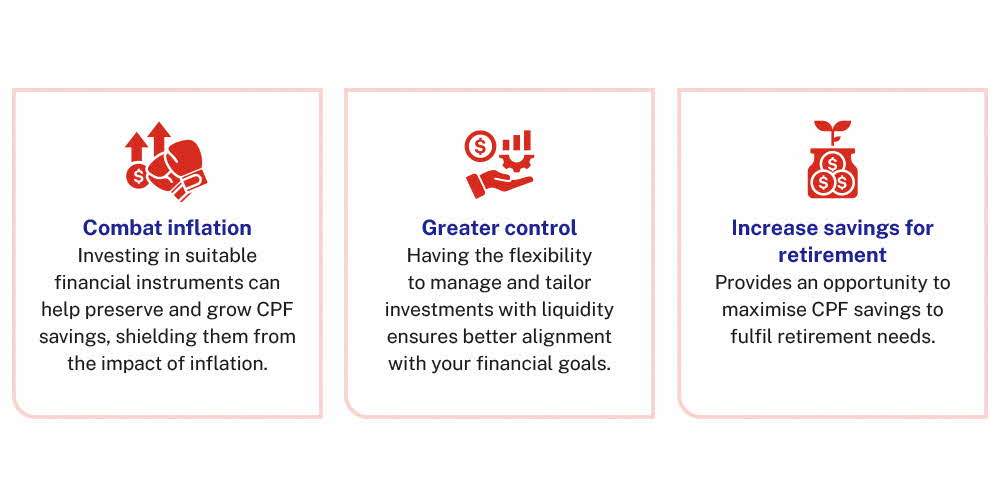

Here are some benefits of investing your CPF savings

Note: There are no guaranteed returns for investment-linked plans.

Source: Great Eastern

Consider investing in GREAT Invest Advantage through CPFIS and customise your portfolio with Great Eastern’s diversified range of CPFIS-included GreatLink funds.

GREAT Invest Advantage is an investment-linked plan that offers the flexibility to invest using your CPF savings under CPF Investment Scheme (CPFIS), cash or Supplementary Retirement Scheme (SRS) funds, with a one-time premium or recurrent single premium.

If you are considering to invest through CPFIS, there are 18 CPFIS-included GreatLink funds available across different asset classes for your selection under GREAT Invest Advantage. Based on their last 5 years’ annualised returns, some funds can potentially provide a return that is higher than the annual interest rate that you can earn from your OA. Here is an overview of 3 GreatLink funds with notable investment performance over the last 5 years.

.jpg)

Source: The Great Eastern Life Assurance Company Limited

Note: Performance figures are calculated on a bid-bid basis, with all dividends and distributions reinvested, taking into account all charges which would have been payable upon such reinvestment. The fees and charges payable through deduction of premium or cancellation of units are excluded in the calculation of fund returns. Past returns, and any other economic or market predictions, projections or forecasts targeted by the funds are not necessarily indicative of future or likely performance of the funds.

The information presented is for informational use only. Investment in these funds involve a high degree of risk and is only appropriate for a person able and willing to take such a risk. Please refer to the Product Summary and Great Eastern website for the full list of GreatLink funds available under GREAT Invest Advantage.

What’s more, investing through GREAT Invest Advantage comes with added benefits, such as death and terminal illness coverage1 at no additional cost. This means that, in the unfortunate event of death or terminal illness, your beneficiaries will receive the death benefit1 regardless of market fluctuations.

As a word of caution, investment could provide higher potential returns but these opportunities do come with investment risk.

Regardless of how you choose to deploy your CPF savings when SA is closed when you reach 55, it is essential to carefully consider your options. Whether you decide to top up your RA to secure a higher CPF LIFE payout, leave the savings in your OA and earn the base interest rate of 2.5% per annum, invest in CPFIS-included funds under an investment-linked plan for potentially higher returns, or withdraw the savings in cash for other uses, each option comes with its own benefits and trade-offs.

Taking the time to evaluate our financial goals, risk appetite and retirement needs will enable us to make informed decisions on how to allocate our savings effectively after the closure of SA. This ensures that our CPF savings and coupled with other alternative savings and investments continue to work hard for us in the most suitable way, even beyond the age of 55.

GREAT Invest Advantage is an investment-linked plan that offers the flexibility to invest using your CPF savings under CPF Investment Scheme (CPFIS), cash or Supplementary Retirement Scheme (SRS) funds.

Footnote:

1 Upon death or terminal illness being diagnosed, we will pay either (a) 110% of the total premiums paid including premium top-ups, less 110% of the total amount of partial surrenders; or (b) the account value of the policy, whichever is higher, less any outstanding debt.

Disclaimers:

All figures used are for illustrative purposes only and are subject to rounding. This advertisement has not been reviewed by the Monetary Authority of Singapore. The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person, and should not be construed as an advice or recommendation to invest in the funds. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. Please refer to Fund Details and Product Highlights Sheet for the specific risks of the fund(s). Past performance is not necessarily indicative of future performance. A Product Summary and a Product Highlights Sheet in relation to the fund(s) may be obtained through The Great Eastern Life Assurance Company Limited or its financial representatives. Potential investors should read the Product Summary and the Product Highlights Sheet before deciding whether to invest in the fund(s). Returns on the units of the fund(s) are not guaranteed. The value of the units in the fund(s) and the income accruing to the units, if any, may fall or rise. Protected up to specified limits by SDIC.

Information correct as at 3 June 2025.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.