Up your coverage with hospital cash insurance

Find out how a hospital cash insurance plan helps manage the unexpected expenses

Despite our best efforts to maintain good health, the unpredictability of life makes it difficult to entirely evade being hospitalised.

In Singapore, the most common reasons for being hospitalised§ include getting into an accident, cancer, heart disease, pneumonia and stroke, amongst other ailments. Not only are these ailments very serious, but people are contracting these serious illnesses at a younger age. The age-specific incidence rates of cancer in Singapore have increased amongst those under the age of 40 at a much faster rate compared to older groups#. This means that more and more people require cancer drug treatment at a younger age.

How can I prepare for the inevitable?

Being hospitalised can be a huge financial burden. We should therefore ensure that we have sufficient coverage so that we will be prepared for such unforeseen events. For many of us, our first line of defence when it comes to health insurance is MediShield Life and Integrated Shield Plans. These two plans work together to reduce out-of-pocket hospitalisation costs.

MediShield Life is a basic health insurance plan designed to offer coverage for hospitalisation to all Singapore Citizens and Permanent Residents against large hospital bills, regardless of age and pre-existing conditions. This includes lifetime coverage and caters to the most essential hospitalisation expenses, including inpatient and selected outpatient treatments with subsidised bills applicable to Class B2/C wards in public hospitals. Individuals who prefer higher coverage for hospitalisation expenses can purchase the Integrated Shield Plan.

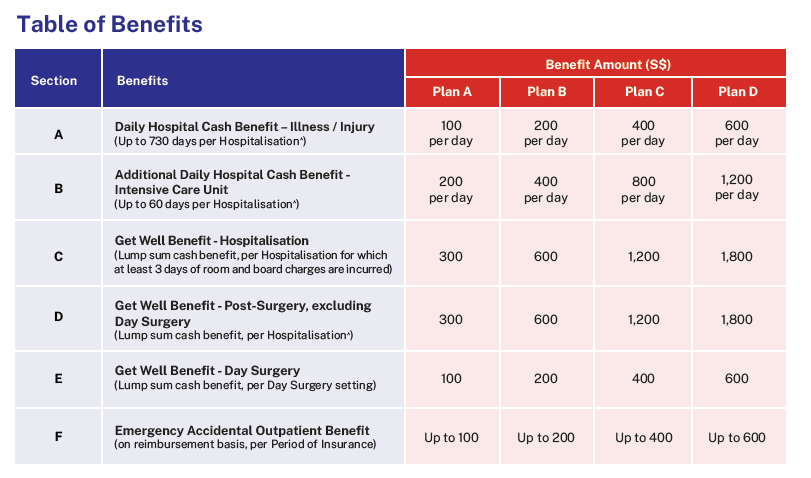

Great Eastern’s GREAT Hospital Cash plan offers four plan types for you to choose the level of coverage that best suits your needs and budget.

The benefits of the GREAT Hospital Cash plan are simple and straightforward. You will receive cash payout of up to S$600 per day when you are hospitalised2 and a lump sum Get Well Benefit of up to S$1,800*. In addition, get reimbursed with up to S$600 when you seek outpatient medical treatment† due to injury at the Accident and Emergency department (A&E) or 24-hour urgent care centre in a hospital.

In the unfortunate event that you need to be admitted to the Intensive Care Unit (ICU), you will get a daily hospital cash benefit of up to S$1,200‡ a day. If you require surgery during hospitalisation, a lump sum cash benefit of up to S$1,800^ will be paid.

All the benefits under the GREAT Hospital Cash plan are summarised below:

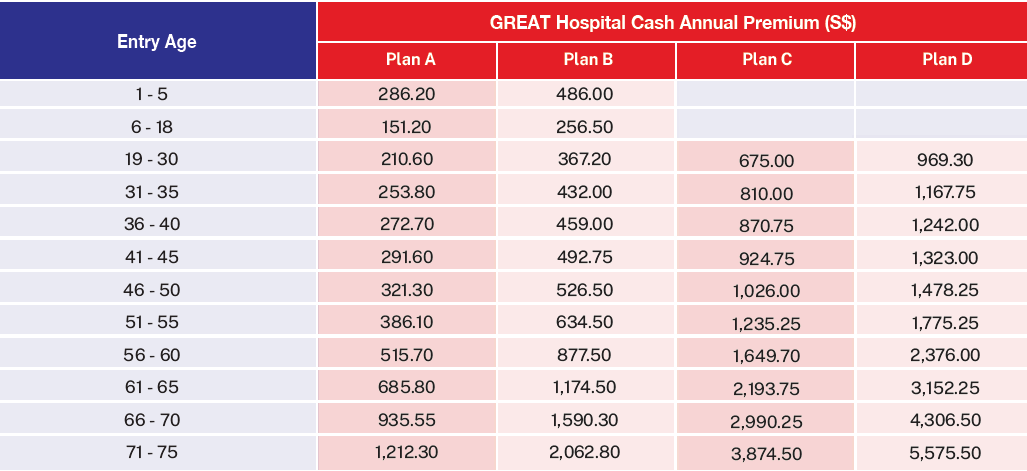

The GREAT Hospital Cash plan is fairly affordable. Starting at S$256.15 per year for those between 31 and 35 years old, it gives you holistic hospitalisation coverage for less than S$1 a day on average. A 5% renewal discount is also available upon renewal of your GREAT Hospital Cash plan regardless of claims status from the second year onwards.

Choose your plan type to suit your budget and needs:

Note: Premiums shown are inclusive of prevailing GST. The prevailing rate of GST is subject to change. Premium rates are not guaranteed and may be adjusted based on future experience.

If you are already a GREAT SupremeHealth policyholder, you can receive a 20% discount on your GREAT Hospital Cash plan premiums. Parents who are considering GREAT Hospital Cash plan coverage for their child will also be delighted to know that a 10% discount on first year premium will be given to their child’s GREAT Hospital Cash plan provided that the parents are insured under GREAT Hospital Cash and that their child is 18 years old or below.

Conclusion

As we navigate the unpredictable landscape of health challenges, the need for comprehensive coverage is paramount. While hospitalisation plans like MediShield Life and Integrated Shield Plans are a crucial foundation, a hospital cash insurance plan that provides cash payout when you are hospitalised fills the gap for various non-medical expenses associated with hospital stays. Planning ahead with a hospital cash insurance plan provides an additional financial safety net and lets individuals and their families focus on recovery without the stress of unforeseen expenses.

Enjoy a hassle-free online application with just 3 simple questions. Find out more about the GREAT Hospital Cash plan here today.

This article first appeared on ValueChampion (part of AMTD PolicyPal).

Source

§ HealthHub: Admissions: Top 10 Reasons for Being Admitted to Hospital (https://www.healthhub.sg/a-z/health-statistics/top-10-conditions-of-hospitalisation)

# Channel News Asia: The Big Read: For young adults with cancer, battling an ‘old person’s disease’ is a lonely journey (https://www.channelnewsasia.com/singapore/young-adults-battling-cancer-lonely-journey-big-read-3775741)

Notes and disclaimers

Terms and conditions apply.

1 Up to 730 days per Hospitalisation.

2 Hospitalisation refers to confinement of the Life Assured in a Hospital or at home under Virtual Hospital Ward admission by a Restructured Hospital, which must be considered Medically Necessary and: (a) for 12 consecutive hours or longer; or (b) for which a room and board charge is made in connection with such confinement.

* Per hospitalisation of at least three days.

† Treatment must be given within 72 hours of the occurrence of the accident.

‡ Daily Hospital Cash Benefit - Intensive Care Unit (ICU) will be payable for each day that the life assured undergoes hospitalisation in an ICU due to an illness or injury, up to a maximum period of 60 days for each hospitalisation. For such hospitalisation in an ICU beyond 60 days, we will treat such hospitalisation as that in a normal ward.

^ Excluding day surgery, and subject to terms and conditions.

All ages specified refer to age next birthday.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person.

This is only product information provided by us. You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy.

Protected up to specified limits by SDIC.

Information correct as at 31 January 2024.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.