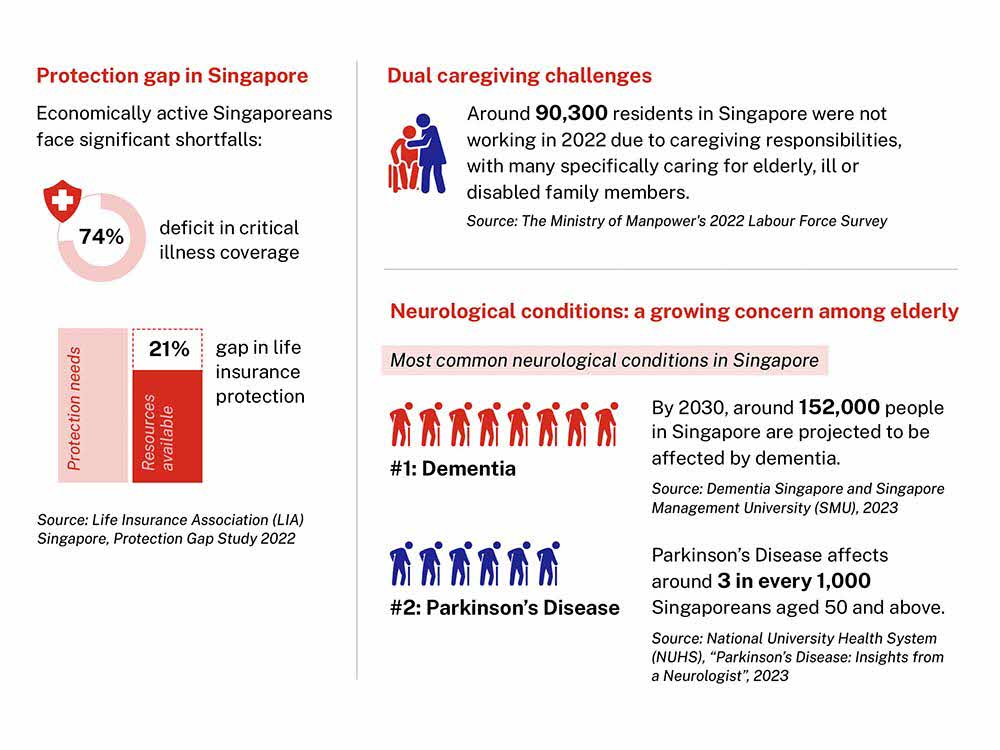

Protection for yourself

Comprehensive protection multiplied for your prime years

Comprehensive protection multiplied for your prime years

Rest easy knowing your coverage is multiplied from day one based on your chosen multiplier factor, providing high protection during your prime years at an affordable premium. Enhance your coverage further with our Critical Illness Multiplier Riders, customisable to cover early, intermediate and /or critical stage critical illnesses, helping you manage treatment expenses and caregiving needs. The Critical Illness Mulitplier Rider (E&I) also includes additional Special Benefits1 covering common conditions such as Diabetic Complications, Glaucoma surgery and Osteoarthritis requiring joint replacement.

Beneficiary access for future decisions

Beneficiary access for future decisions

With our first-ever beneficiary access feature, your nominated beneficiary will be able to access a portion of your policy’s accumulated cash value if you become mentally incapacitated. This helps alleviate potential financial pressure on your loved ones should such a situation arise.

Protection for your parents

Guaranteed coverage for age-related conditions2 without medical assessment

Guaranteed coverage for age-related conditions2 without medical assessment

Ensure your parents receive the care they deserve with the Parent Care Rider. This add-on benefit provides guaranteed coverage for age-related conditions2 such as Alzheimer’s Disease/ Severe Dementia, Idiopathic Parkinson’s Disease and Major Head Trauma, without requiring any medical assessment for your parents at the point of coverage. It offers immediate financial support and reassurance when it matters most.

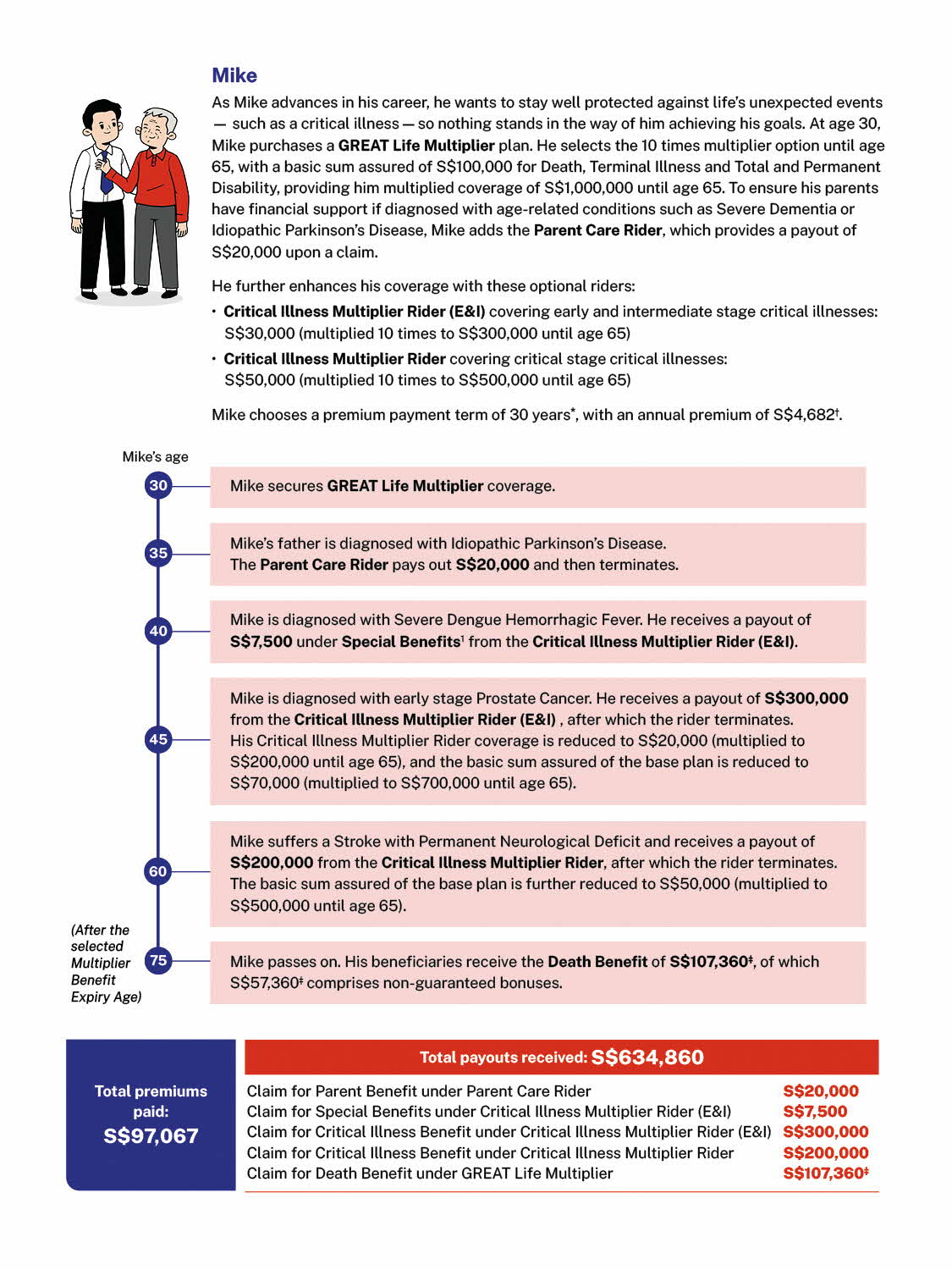

Here's how GREAT Life Multiplier supports you through life’s unexpected turns

Your questions answered

GREAT Life Multiplier is a limited pay whole of life participating plan designed to meet your protection needs. It provides financial protection against death, total and permanent disability (TPD) and terminal illness (TI), with the flexibility to enhance your coverage through a range of optional riders such as for early, intermediate and/or critical stage critical illnesses.

It offers you enhanced protection through a multiplier benefit equivalent to 3, 5, 8, or 10 times the basic sum assured which applies up to your selected multiplier expiry age of 65, 75 or 85 age next birthday. You may choose premium terms of 15, 20, 25 or 30 years.

This base plan allows you to participate in the performance of the participating fund in the form of bonuses that are not guaranteed. The objective of this plan is to provide insurance protection together with stable medium- to long-term returns using a combination of guaranteed benefits and non-guaranteed bonuses.

GREAT Life Multiplier provides financial protection against death, total and permanent disability and terminal illness.

The table below shows an overview of coverage under GREAT Life Multiplier and the optional Critical Illness Multiplier Riders available:

| COVERAGE | BASE PLANS | CHOICE OF UP TO 2 OPTIONAL RIDERS | |

| GREAT Life Multiplier | Critical Illness Multiplier Rider | Critical Illness Multiplier Rider (E&I) | |

| Death, Total and Permanent Disability, Terminal Illness | ✓ | ||

| Critical Stage of Critical Illness | ✓ | ||

| Early and Intermediate Stages of Critical Illness | ✓ | ||

| Additional Benefits: Special Benefit, Juvenile Benefit, Senior Benefit, Benign Tumour Benefit | Only for Angioplasty and Other Invasive Treatment For Coronary Artery | ✓ (excluding Angioplasty and Other Invasive Treatment For Coronary Artery | |

For detailed terms and conditions on the benefits payable, you are advised to read the policy/rider contract.

The premium rates for GREAT Life Multiplier are guaranteed.

The premium rates for Critical Illness Multiplier Rider and Critical Illness Multiplier Rider (E&I) are NOT guaranteed. We may change these rates based on future experience at any time with at least 45 days' notice before the premium due date at which the amended rates will apply. The amended rates will apply according to the age next birthday of the life assured as at the date of commencement of the rider.

GREAT Life Multiplier provides both guaranteed and non-guaranteed benefits. The guaranteed benefits, including bonuses which have already been declared, will be paid regardless of how the participating fund performs. Non-guaranteed benefits are in the form of future bonuses. The future bonuses which have yet to be declared are not guaranteed and are dependent on the performance of the participating fund. There are two main types of bonuses for GREAT Life Multiplier:

- Reversionary bonus; and

- Terminal bonus.

You may attach one or more optional rider(s) to your GREAT Life Multiplier policy to enhance the protection coverage.

Here is the list of optional riders offered for GREAT Life Multiplier:

Riders that offer critical illness benefit:

(a) Critical Illness Multiplier Rider; and/or

(b) Critical Illness Multiplier Rider (E&I) Rider*.

Rider that offers critical illness benefit for the policyholder’s parent(s):

(c) Parent Care Rider

Riders that waive premium payment for specified covered medical conditions:

(d) Premium Waiver Enhanced (CI) Rider;

(e) Payer Benefit Enhanced Rider; or

(f) Payer Benefit Enhanced (CI) Rider.

Riders that offer disability benefit:

(g) LifeSecure Rider; or

(h) PayAssure Rider.

Riders that offer personal accident benefit:

(i) AccidentCare Plus II Rider; or

(ii) Accidental Permanent Disablement Provision

*Please note that Critical Illness Multiplier Rider (E&I) Rider may only be attached to the base plan if Critical Illness Multiplier Rider Rider is also attached.

The riders offered for GREAT Life Multiplier may be subject to change from time to time.

For more details on GREAT Life Multiplier, please refer to the product summary of the relevant plan and riders. Alternatively, you may also speak to your financial representative or call us at 1800 248 2888 (9am to 5.30pm (Mon- Fri).

Understand the details before buying

1 Each Special Benefit, Juvenile Benefit or Senior Benefit provides a payout equivalent to 25% of the rider sum assured, without reducing the basic sum assured of the GREAT Life Multiplier plan and its riders. Up to six claims can be made for different covered conditions.

2 Excluding pre-existing conditions. Other terms and conditions apply. Please refer to the product summary and policy contract for details.

* The limited pay option is applicable to the base plan and critical illness rider(s). It does not apply to the Parent Care Rider, which is a regular premium rider.

† Premium rates shown are rounded to the nearest dollar. Premium rates for the riders are not guaranteed and may be adjusted based on future experience.

‡ The non-guaranteed benefits are illustrated based on the Illustrated Investment Rate of Return (IIRR) of the participating fund at 4.25% p.a.. At an IIRR of 3.00% p.a., the non-guaranteed bonuses would be S$24,260, and the Death Benefit payable would be S$74,260. The actual benefits payable may vary according to the future performance of the participating fund. Illustrated figures are rounded to the nearest dollar.

All ages specified refer to age next birthday.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance or a recommendation to buy an insurance product or service. This document does not take into account the specific investment and protection aims, financial situation or particular needs of any particular person. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

The precise terms and conditions of this insurance plan are specified in the policy contract. If you are interested in the insurance product, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and the Chinese versions, the English version shall prevail.

Information correct as at 1 October 2025.

Let our Financial

Representative serve you

We are happy to help you.