Key benefits

-

Up to 300% payout and up to S$200 daily hospital cash benefit

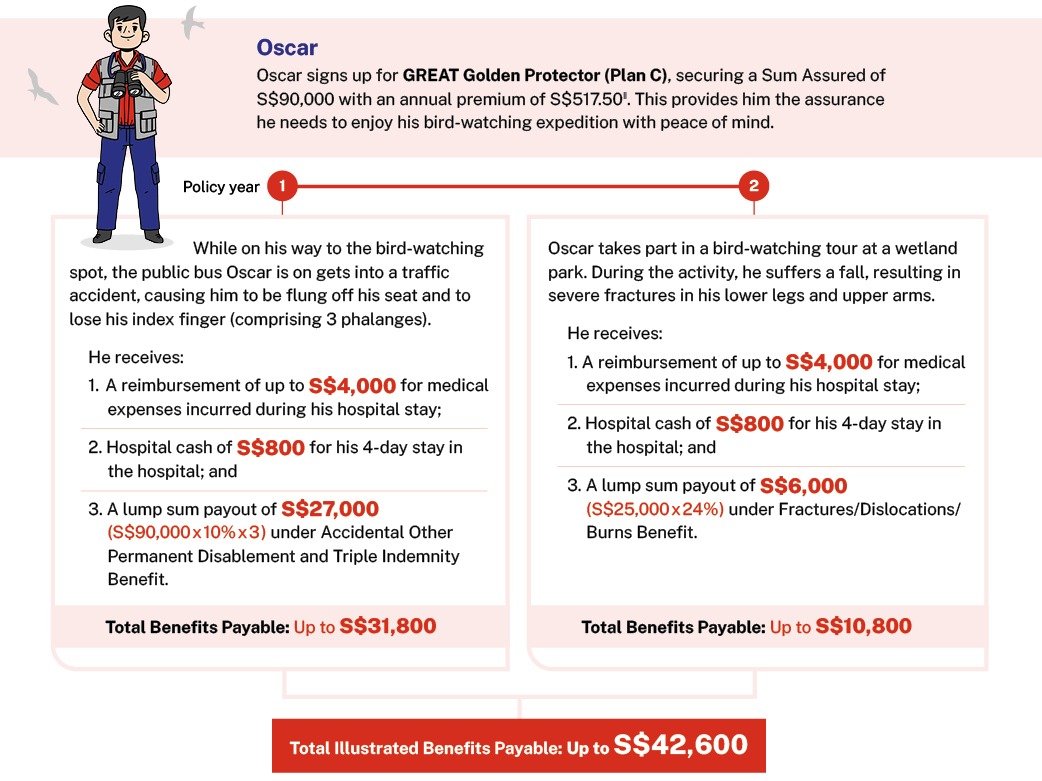

Receive 3 times the payout upon Accidental Death or Permanent Disablement caused by an accident on public transportation or a private car‡. In the event of hospitalisation, you will get a cash benefit of up to S$200 per day, which also covers hospital stays due to Dengue Fever or other Infectious Diseases.

-

Comprehensive post-accident benefits

Get covered up to S$4,000 per accident for treatments in a hospital or clinic and receive additional post-hospitalisation aftercare benefit of up to S$1,200 to support your recovery.

-

Payouts of up to S$25,000 for fractures, dislocations or burns

In the event of an accident, you can get up to S$25,000 for claims due to fractures, dislocations or burns to support your recovery.

-

Get 25% off premiums on 2nd life assured

Enjoy a 25% family discount on premiums throughout the policy term when you add your spouse as the 2nd life assured to your policy. This exclusive offer is available only when you sign up via your financial representative and is not valid for online application. Speak to your financial representative to find out more.

Your questions answered

GREAT Golden Protector is a yearly renewable personal accident plan which is specially designed to pay benefits in the event of an accident which results in Accidental Death, Accidental Major Permanent Disablement, Accidental Other Permanent Disablement or Fractures/Dislocations/Burns. This plan also provides coverage for Accidental Medical Expenses Reimbursement, Hospital Cash Cover, Mobility Aids Reimbursement, Transport Allowance, Loss of Activities of Daily Living and Post-hospitalisation Aftercare Benefit.

This policy is not a MediSave-approved policy and you may not use MediSave to pay the premiums for this policy.

Please refer to the Table of benefits as shown in the brochure for the summary of benefits payable under GREAT Golden Protector.

We will reduce all benefits payable under this policy by 50% when the Life Assured attains the age of 81 years.

Premium rates for GREAT Golden Protector are not guaranteed. These rates may be adjusted based on future experience. We may at our sole discretion change the premium rates by giving at least 30 days’ notice to the policyholder before the renewal date at which these amended rates apply.

There will be no protection under this policy if you surrender your policy early. As the policy has no cash value, you will also lose the premiums you have paid.

This policy is renewable yearly up to the renewal date before the Life Assured turns age 86 next birthday. All endorsements on and variations in this policy which have been authorised by us and any premium loading imposed will also apply to the insurance granted upon renewal unless otherwise agreed in writing by us.

We reserve the right to amend the terms and conditions of this policy provided that (a) the amendment(s) take effect on the renewal date; (b) the amendment(s) apply to all policies of this class of insurance; and (c) we have informed the policyholder of the amendment (s) at least 30 days before the renewal date.

This is a short-term accident and health policy and we are not required to renew this policy. Renewability is not guaranteed and we reserve the right not to renew this policy by giving you 30 days’ written notice.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

* Payout is based on the amount payable under Plan C for a total and permanent disability claim, which is then tripled if injuries are suffered from accidents while as a passenger during a public conveyance, as a rider/pedestrian in a personal mobility device or as a passenger/driver in a private car.

† Daily rate is based on the annual premium of GREAT Golden Protector Plan A, divided by 365 days and rounded off to the nearest cent. Premium rate is inclusive of the prevailing rate of GST. The prevailing rate of GST is subject to change. The premium rates for this policy are not guaranteed and may be adjusted based on future experience.

‡ This includes driving your own car as a licensed driver or a personal mobility device (PMD) accident where you are injured as a rider or pedestrian.

All ages specified refer to age next birthday.

All figures used are for illustrative purposes only and are subject to rounding.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This policy is only for Singapore Citizens and Permanent Residents (PRs). If you are not a Singapore Citizen or PR, you have to meet certain residency requirements before you can apply for a policy or renew it.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy. In case of discrepancy between the English and Chinese versions, the English version shall prevail.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information correct as at 29 January 2026.