Key benefits

-

Up to 3 times payout upon Accidental Death and Permanent Disablement

Receive up to 3 times the payout upon Accidental Death or Permanent Disablement if an accident occurs on public transportation or a private car†, riding on a personal mobility device or even as a pedestrian involved in a personal mobility device-related accident.

-

Receive daily hospital cash benefit

Get a daily hospital cash benefit of up to S$150 per day upon hospitalisation for any of the specified Infectious Diseases including Avian Influenza, Dengue Fever, or other sickness1 like food poisoning and Hand, Foot and Mouth Disease (HFMD).

-

Reimbursement of up to S$9,000 for Accidental Medical Expenses

Be covered for medical treatment and specialist care at the hospital of your choice, including medical expenses due to accidents and sickness1.

Your questions answered

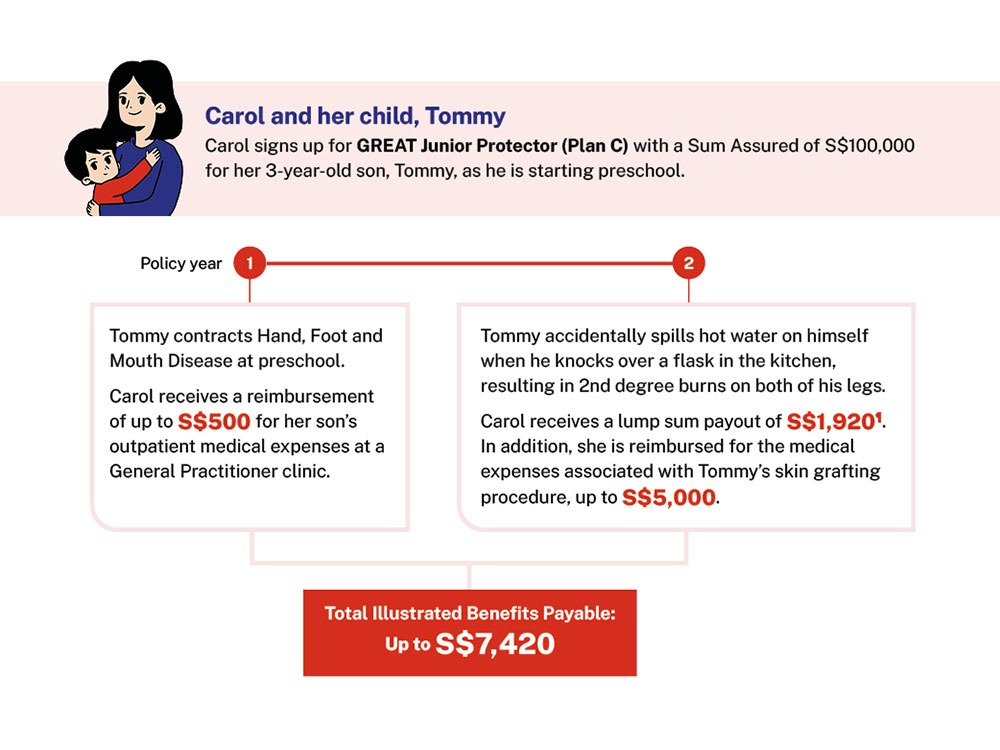

GREAT Junior Protector is a yearly renewable personal accident plan which is specially designed to pay benefits on the child, in the event of an accident which results in Accidental Death, Accidental Major Permanent Disablement, Accidental Other Permanent Disablement or Fractures/Dislocations/Burns. This plan also provides coverage for Accidental Medical Expenses Reimbursement, Hospital Cash Cover, Mobility Aids Reimbursement, Transport Allowance, Reconstructive Surgery and Education Assurance Fund.

This policy is not a MediSave-approved policy and you may not use MediSave to pay the premiums for this policy.

Please refer to the Table of benefits as shown in the brochure for the summary of benefits payable under GREAT Junior Protector.

We will reduce all benefits payable under this policy by 50% if the Life Assured and/or policyholder suffers a claim event while engaging in:

(a) sports coaching;

(b) motor cycling; or

(c) military or police service of a peace-time nature, namely normal training, rangework and military exercises including National Service under Section 10 of the Enlistment Act 1970 of the Republic of Singapore (“Enlistment Act”) (other than peace-time reservist duty under Section 14 of the Enlistment Act whereby full benefits shall be payable).

Furthermore, if it is proven that the Life Assured suffered the claim event while engaging in any of these activities and in so doing, broke or disregarded the usual precautions and safety guidelines accepted for that activity, we may adjust any benefits otherwise payable under this policy or reject the claim for such benefit.

The premium rates for GREAT Junior Protector are not guaranteed. These rates may be adjusted based on future experience. We may at our sole discretion change the premium rates by giving at least 30 days’ notice to the policyholder before the renewal date at which these amended rates apply.

There will be no protection under this policy if you surrender your policy early. As the policy has no cash value, you will also lose the premiums that you have paid.

This policy is renewable yearly up to the renewal date before the Life Assured turns age 76 next birthday. All endorsements on and variations in this policy which have been authorised by us and any premium loading imposed will also apply to the insurance granted upon renewal unless otherwise agreed in writing by us.

We reserve the right to amend the terms and conditions of this policy provided that (a) the amendment(s) take effect on the renewal date; (b) the amendment(s) apply to all policies of this class of insurance; and (c) we have informed the policyholder of the amendment (s) at least 30 days before the renewal date.

This is a short-term accident and health policy and we are not required to renew this policy. Renewability is not guaranteed and we reserve the right not to renew this policy by giving you 30 days’ written notice.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 Sickness refers to Dengue Fever, food poisoning, Hand, Food and Mouth Disease, and Zika Virus.

* Daily rate is based on the annual premium of GREAT Junior Protector Plan A, divided by 365 days and rounded off to the nearest cent. Premium rate is inclusive of the prevailing rate of GST. The prevailing rate of GST is subject to change. The premium rates for this policy are not guaranteed and may be adjusted based on future experience.

† This includes driving your own car as a licensed driver or a personal mobility device (PMD) accident where you are injured as a rider or pedestrian.

¶ Based on 2nd or 3rd degree burns on 18% of body surface, the payout Carol receives is S$8,000 x 24% = S$1,920.

All ages specified refer to age next birthday.

All figures used are for illustrative purposes only and are subject to rounding.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This policy is only for Singapore Citizens and Permanent Residents (PRs). If you are not a Singapore Citizen or PR, you have to meet certain residency requirements before you can apply for a policy or renew it.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

It is usually detrimental to replace an existing accident and health plan with a new one. A penalty may be imposed for early plan termination and the new plan may cost more, or have less benefits at the same cost.

You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy. In case of discrepancy between the English and Chinese versions, the English version shall prevail.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information correct as at 1 January 2024.