Key benefits

-

Guaranteed returns of 3.38% p.a.* and 100% capital guaranteed upon maturity

-

Short term commitment of 36 months

-

Added protection against Death and Total and Permanent Disability1 with no medical assessment needed

Your questions answered

GREAT SP USD is a non-participating single premium endowment plan denominated in US dollars with a 36-month policy term. It provides financial protection against death and total and permanent disability until the end of the policy term. It also pays a maturity benefit at the end of the policy term.

This plan pays a guaranteed survival benefit of 3.38% of the single premium at the end of the 12th, 24th, and 36th policy month.

The objective of the plan is to provide stable returns together with insurance protection.

GREAT SP USD provides you with financial protection against death and total and permanent disability (TPD)1.

We will pay the following if the life assured dies during the term of the policy:

(a) 105% of the single premium; or

(b) the surrender value of the policy,

whichever is higher, less any indebtedness under the policy.

We will pay the death benefit in one lump sum, if the life assured suffers from TPD1 during the term of the policy.

1 For TPD that takes the form of total and irrecoverable loss of the: (a) sight in both eyes; (b) use of two limbs at or above the wrist or ankle; or (c) sight in one eye and the use of one limb at or above the wrist or ankle, the life assured will be covered for the whole of the policy term. For other forms of TPD, it must occur before the policy anniversary on which the life assured is 65 age next birthday. You are advised to refer to the product summary for more details.

We will pay a guaranteed survival benefit of 3.38% of the single premium on the survival of the life assured at the end of the 12th, 24th, and 36th policy month.

We will pay a maturity benefit of an amount equal to 100% of the single premium when the policy matures, if the life assured is still surviving at the end of the policy term.

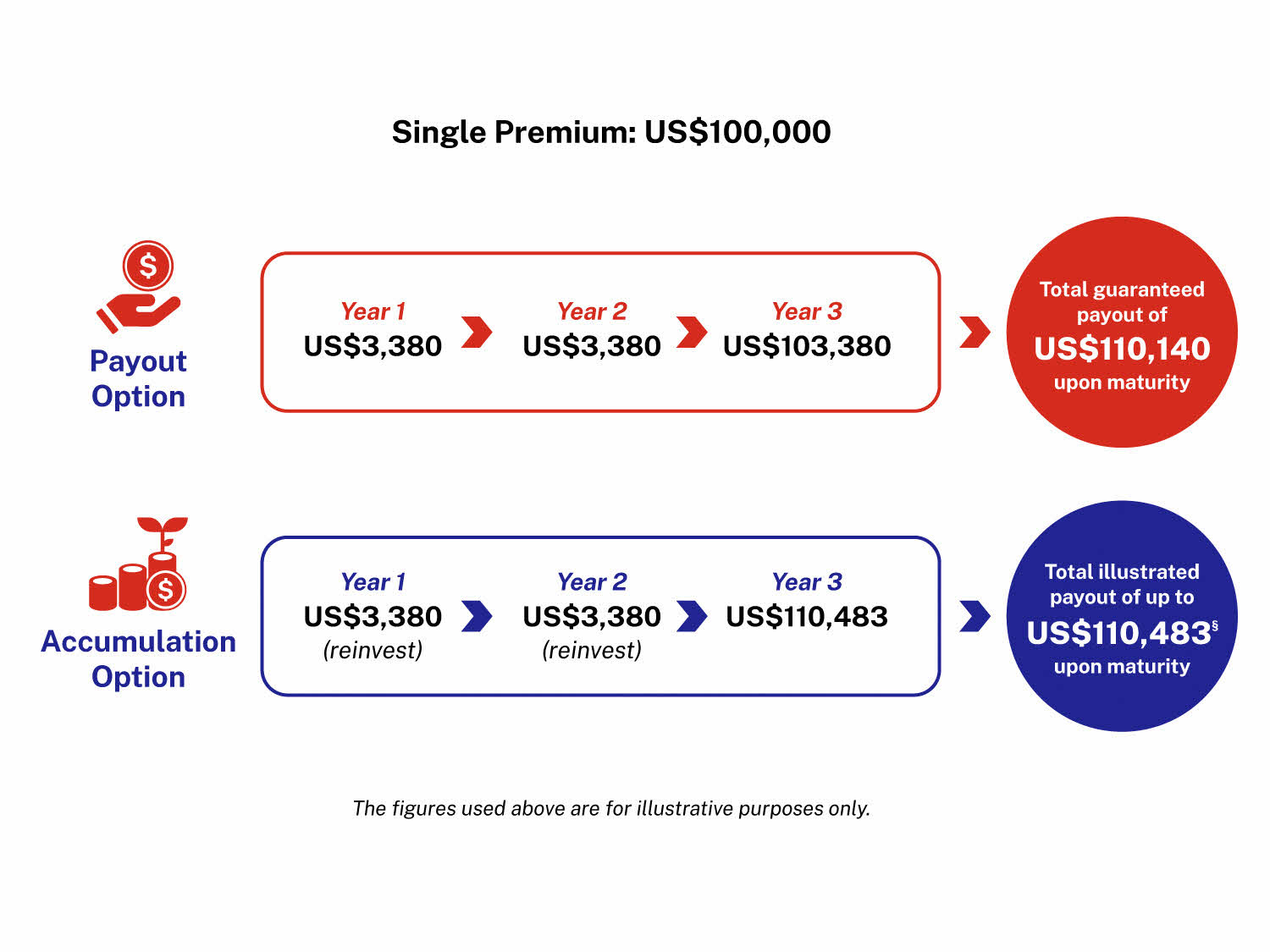

For example, if your GREAT SP USD policy’s single premium is US$100,000, you will receive US$3,380 three times over the term of the policy which will be at the end of the 12th, 24th, and 36th policy month. You will also receive US$100,000 at the end of the policy term. At the end of 36 months, the total guaranteed payout that you will receive will be US$110,140.

Yes. You have the choice to receive your survival benefit paid out to you, or to accumulate your survival benefit with us to earn non-guaranteed interest until the end of your policy term. Please note that the rate of the non-guaranteed interest is subject to change without prior notice.

GREAT SP USD’s maximum entry age of the life assured is 75 age next birthday.

We have included fees and charges when working out the premium and you will not be separately charged for these. However, if any payments to be made under the policy, such as premiums, benefits, claims, refunds, or surrender values, will incur any fees or charges associated with making such payments, including but not limited to, bank or remittance fees and charges, you will be required to bear all such fees and charges.

If you surrender your policy after the 14-day free-look period, you may lose part of the premiums paid. This is because the surrender value, if any, that is payable to you may be less than the total premiums paid.

The surrender value you will receive is reflected in your policy illustration.

As GREAT SP USD is denominated in US dollars, you should be aware that if the US dollar is not your home currency, you will be exposed to foreign exchange volatility risks between the time you purchase the policy to the time the policy benefits are payable. You must therefore recognise and accept this foreign exchange exposure.

For more details on GREAT SP USD, please refer to the product summary of the plan. Alternatively, you may also speak to your financial representative or call us at 1800 248 2888 (weekdays 9.00am to 5.30pm).

The acceptable payment methods are via telegraphic transfer or cheque in US dollars.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

* Guaranteed survival benefit equivalent to 3.38% of the single premium will be payable on the survival of the life assured at the end of the 12th, 24th, and 36th policy month.

† As this plan is denominated in US dollars, if the US dollar is not your home currency, you will be exposed to foreign exchange volatility risks.

‡ The minimum single premium amount will depend on the entry age of the life assured.

§ This figure is subject to rounding and is based on the prevailing accumulation interest rate of 3.35% per annum. Based on an accumulation interest rate of 1.85% per annum, the total illustrated payout at maturity is US$110,328. These rates are not guaranteed and can be changed anytime.

1 If the life assured dies or suffers from Total and Permanent Disability (TPD), the company will pay 105% of the single premium or the surrender value of the policy, whichever is higher, less any indebtedness under the policy. For TPD that takes the form of total and irrecoverable loss of the: (a) sight in both eyes; (b) use of two limbs at or above the wrist or ankle; or (c) sight in one eye and the use of one limb at or above the wrist or ankle, the life assured will be covered for the whole of the policy term. For other forms of TPD, it must occur before the policy anniversary on which the life assured is age 65. You are advised to refer to the product summary for more details.

All ages specified refer to age next birthday.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

This plan is available for a limited time only. Availability is on a first-come-first-serve basis with premiums fully paid to The Great Eastern Life Assurance Company Limited. The Great Eastern Life Assurance Company Limited reserves the right to reject an application and refund the single premium.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and the Chinese versions, the English version shall prevail.

Information correct as at 11 September 2025.