Your choice of 3 plans to match your wealth goals

For better liquidity with lifetime payouts in your choice of currency

- Prestige Life Rewards 5 (SGD)

Receive total monthly payouts of up to 3.35% per annum2 of the single premium paid, from the 3rd policy year. The monthly payouts consist of a guaranteed survival benefit and a non-guaranteed cash bonus.

- Prestige Life Rewards 4 (USD)

Receive total monthly payouts of up to 4.10% per annum3 of the single premium paid, from the 2nd policy year. The monthly payouts consist of a guaranteed survival benefit and a non-guaranteed cash bonus.

For higher accumulated value for your next generation

- Prestige Life Rewards 5A (SGD)

Receive total monthly payouts of up to 3.00% per annum4 of the single premium paid, from the 5th policy year. With a longer accumulation period before the first payout, your plan will have a potentially higher policy value as an inheritance for your loved ones.

Key Benefits

One-time commitment for a lifetime of payouts and a lasting legacy

With a single premium payment, you can grow your wealth and receive monthly payouts for life. When the time is right, you can transfer the policy ownership to your child to continue receiving the monthly payouts and support their future.

Enjoy early payouts in your choice of currency

Choose between these two plans and get rewarded with lifetime payouts from as early as the 2nd policy year:

- Prestige Life Rewards 5 (SGD): Get total monthly payouts of up to 3.35% per annum2 of the single premium paid, starting from the 3rd policy year.

- Prestige Life Rewards 4 (USD): Get total monthly payouts of up to 4.10% per annum3 of the single premium paid, starting from the 2nd policy year.

Your choice for a potentially higher inheritance amount

Enjoy a potentially higher policy value with Prestige Life Rewards 5A (SGD). Start your monthly payouts from the 5th policy year and receive total monthly payouts of up to 3.00% per annum4 of the single premium paid. Plus, enjoy the assurance of a comfortable inheritance to be passed down to your next generation.

Support your changing financial needs

As we prioritise your financial flexibility, we’ve made sure that with whichever plan you have chosen, you can enjoy liquidity via a guaranteed surrender value of 80% of the single premium paid from day one.

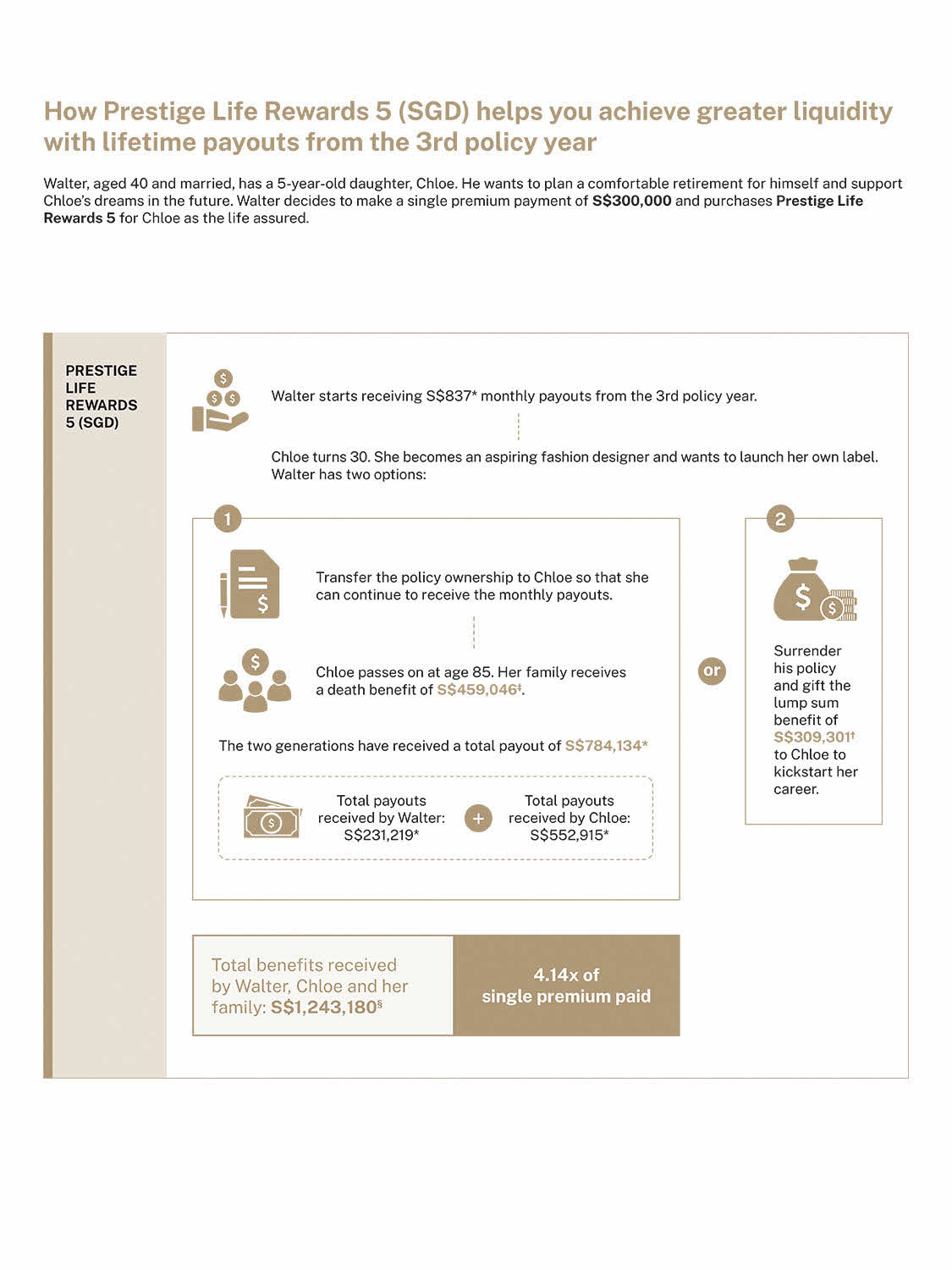

How Prestige Life Rewards 5 (SGD) helps you achieve greater liquidity with lifetime payouts from the 3rd policy year

Your questions answered

The Prestige Life Rewards Series consists of 3 single premium participating whole of life insurance plans. These plans provide lifetime monthly payouts, which comprises of a guaranteed survival benefit (also known as monthly income) and non-guaranteed cash bonuses. These plans also provide financial protection against death and terminal illness and allow you to take part in the performance of the participating fund in the form of non-guaranteed bonuses.

There are 3 plans available under the Prestige Life Rewards Series, namely Prestige Life Rewards 5 (SGD), Prestige Life Rewards 5A (SGD) and Prestige Life Rewards 4 (USD) with different features and benefits to match your wealth goals.

A summary of the product features is shown in the table below:

| Prestige Life Rewards 5 (SGD) | Prestige Life Rewards 5A (SGD) | Prestige Life Rewards 4 (USD) | |||

| Policy Term | Whole of Life | Whole of Life | Whole of Life | ||

| Premium Term | Single Premium | Single Premium | Single Premium | ||

| Currency | SGD | SGD | USD | ||

| Death Benefit | For life assured’s entry age next birthday 1 to 75: 105% of Single Premium + Non-guaranteed Bonus For life assured’s entry age next birthday 76 to 80: 101% of Single Premium + Non-guaranteed Bonus | 105% of Single Premium + Non-guaranteed Bonus | 101% of Single Premium + Non-guaranteed Bonus | ||

| Terminal Illness Benefit | Accelerates from Death Benefit | Accelerates from Death Benefit | Accelerates from Death Benefit | ||

| First Payout Starts | 3rd policy year | 5th policy year | 2nd policy year | ||

| Annual payout expressed as % of Single Premium | Guaranteed | 1.25% p.a. | 1.25% p.a. | 1.60% p.a. | |

| Non-Guaranteed* | Up to 2.10% p.a. | Up to 1.75% p.a. | Up to 2.50% p.a. | ||

| Total | 3.35% p.a. | 3.00% p.a. | 4.10% p.a. | ||

| Enjoy earlier and bigger payouts | |

|

|||

| Enjoy a potentially higher policy value | |||||

* Based on an Illustrated Investment Rate of Return (IIRR) of 4.25% p.a. for Prestige Life Rewards 5 (SGD) and Prestige Life Rewards 5A (SGD); and IIRR of 5.20% p.a. for Prestige Life Rewards 4 (USD). Based on an IIRR of 3.00% p.a. for Prestige Life Rewards 6 (SGD) and Prestige Life Rewards 5A (SGD); and IIRR of 3.95% p.a. for Prestige Life Rewards 4 (USD), the non-guaranteed payout is up to 1.09% p.a. for Prestige Life Rewards 5 (SGD), up to 0.88% p.a. for Prestige Life Rewards 5A (SGD), and up to 1.56% p.a., for Prestige Life Rewards 4 (USD).

The Prestige Life Rewards Series provides financial protection against death and terminal illness.

| Coverage | Prestige Life Rewards 5 (SGD) |

Prestige Life Rewards 5A (SGD) | Prestige Life Rewards 4 (USD) |

| Death Benefit | For life assured’s entry age next birthday 1 to 75: 105% of Single Premium + Non-guaranteed Bonus For life assured’s entry age next birthday 76 to 80: 101% of Single Premium + Non-guaranteed Bonus |

105% of Single Premium + Non-guaranteed Bonus | 101% of Single Premium + Non-guaranteed Bonus |

| Terminal Illness Benefit | Accelerates from Death Benefit | ||

The plan will terminate once any of the benefits above are paid. For other detailed terms and conditions on termination, you are advised to read the policy contract.

We will provide a payout at the end of each policy month until a claim is admitted, or the plan is terminated, whichever is earlier. When the payout starts depends on the plan selected.

| Prestige Life Rewards 5 (SGD) | Prestige Life Rewards 5A (SGD) | Prestige Life Rewards 4 (USD) | |

| First Payout Starts | Start of 3rd policy year | Start of 5th policy year | Start of 2nd policy year |

Each payout comprises of:

- Guaranteed survival benefit, also known as monthly income; and

- 1/12 of the yearly cash bonus that is declared yearly

You may withdraw these payouts or keep them with us to earn non-guaranteed interest. Please note that the non-guaranteed interest is subject to change without prior notice. If there is any debt attached to the policy at the time we are due to pay the payouts, we will first use these payouts to reduce any debt you have with us before the balance amount is paid.

This plan provides both guaranteed and non-guaranteed benefits. The guaranteed benefits, including bonuses which have already been declared, will be paid regardless of how the participating fund performs. Non-guaranteed benefits are in the form of future bonuses.

The future bonuses which have yet to be declared are not guaranteed and are dependent on the performance of the participating fund.

There are two main types of bonuses for this plan:

- cash bonus; and

- terminal bonus

You will receive an annual bonus update that will include the following:

The performance of the participating fund and its future outlook, which you should receive around the second quarter of each year after bonus is declared for your policy; and

An annual statement regarding bonuses for your policy, which you should receive around the second quarter of each year after bonus is declared for your policy.

When there is a change in the rate of bonuses declared, you can ask us for an update of the illustrated values.

If you surrender your policy after the 14-day free-look period, you may lose part or all of the premiums paid. This is because the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

This plan provides guaranteed and non-guaranteed benefits. We will pay the guaranteed benefits no matter how the participating fund performs. Payment of non-guaranteed benefits is dependent on the performance of the participating fund.

As Prestige Life Rewards 4 (USD) is denominated in US Dollar, you should be aware that if the US Dollar is not your home currency, you will be exposed to foreign exchange volatility risks between the time you purchase the policy to the time the policy benefits are payable. You must therefore recognise and accept this foreign exchange exposure.

For more details on Prestige Life Rewards Series, please refer to the product summary of the relevant plan. Alternatively, you may also speak to your financial representative or call us at 1800 248 2888 (9am to 5.30pm (Mon- Fri).

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 Please be aware that if the US Dollar is not your home currency, you will be exposed to foreign exchange volatility risk.

2 Applicable to Prestige Life Rewards 5 (SGD), based on an Illustrated Investment Rate of Return (IIRR) of the participating fund at 4.25% p.a., the guaranteed monthly payout is 1.25% p.a. and the non-guaranteed monthly payout is up to 2.10% p.a.. At an IIRR of 3.00% p.a., the non-guaranteed monthly payout is up to 1.09% p.a. of the single premium paid.

3 Applicable to Prestige Life Rewards 4 (USD), based on an IIRR of the participating fund at 5.20% p.a., the guaranteed monthly payout is 1.60% p.a. and the non-guaranteed monthly payout is up to 2.50% p.a.. At an IIRR of 3.95% p.a., the non-guaranteed monthly payout is up to 1.56% p.a. of the single premium paid.

4 Applicable to Prestige Life Rewards 5A (SGD), based on an IIRR of the participating fund at 4.25% p.a., the guaranteed monthly payout is 1.25% p.a. and the non-guaranteed monthly payout is up to 1.75% p.a.. At an IIRR of 3.00% p.a., the non-guaranteed monthly payout is up to 0.88% p.a. of the single premium paid.

All figures in the above illustration are in Singapore Dollars based on an IIRR of the participating fund at 4.25% p.a. and are subject to rounding.

* The figure comprises guaranteed and non-guaranteed benefits. Based on an IIRR at 3.00% p.a., the monthly payout received by Walter is S$585, the total monthly payouts received by Walter at age 65 is S$161,621, and the total monthly payouts received by Chloe from age 30 to age 85 is S$386,485. The two generations have received a total payout of S$548,106.

† The figure comprises total guaranteed and non-guaranteed surrender value plus remaining declared but unpaid cash bonus. Based on an IIRR at 3.00% p.a., the lump sum benefit received by Walter upon surrender is S$276,322.

‡ The total death benefit received by Chloe’s family includes total guaranteed and non-guaranteed death benefit. Based on an IIRR at 3.00% p.a., the total death benefit received by Chloe’s family is S$390,024.

§ Based on an IIRR at 3.00% p.a., the total benefits received by Walter, Chloe and her family is S$938,130 (3.12x of single premium paid) if Walter transfers his policy ownership to Chloe at age 65.

As the bonus rates used for the benefits illustrated are not guaranteed, the actual benefits payable may vary according to the future experience of the participating fund.

All ages specified refer to age next birthday.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and the Chinese versions, the English version shall prevail.

Information correct as at 1 March 2024.