Does a long and happy retirement sound great to you?

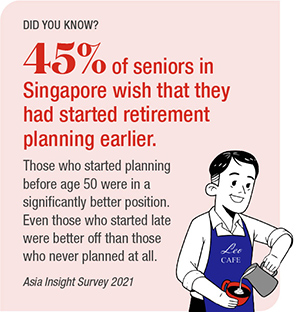

To retire as early as age 55 is certainly a goal many of us share, as it allows you time to pursue all your dreams as you ease into your golden years. This is a good thing. At the same time, people are living longer than ever before. This means your savings may have to stretch that much further so you can enjoy a long retirement without running out of money. This is why it is important to plan well – as early as you can.

Planning for a great retirement

Rising life expectancy is not the only thing to consider when preparing for retirement. Another key factor is inflation, the ever-increasing cost of living.

If you were to save your money under your mattress, it would be worth much less when you retire due to its loss of buying power. So, it is important to put your retirement savings in a suitable place, such as a retirement income or wealth accumulation plan, where it has higher potential in growing your wealth in real terms.

Plus, when you save and invest your money early, you can benefit from the miracle of compounding on your savings. The money you set aside for retirement earns interest and the interest paid on your savings also earns interest for the future. The sooner you begin saving for retirement, the bigger the fund will potentially become.

Here are some tips to retiring well

Is CPF Life enough for me to retire?

Find out if your CPF Life Payouts will be sufficient for your retirement.

7 tips for a great retirement

From making a plan to discovering yourself, we have all the tips you need to get you started with retirement planning, whatever your stage in life.

Retirement Planning for 30s to 40s

When you are in your 30s, start small and grow your savings over time. Take baby steps to your dream retirement.

Retirement Planning for 40s to 50s

Even if you're in your 40s or 50s, it’s never too late to start planning. With proper planning, the combination of savings, investments and CPF can go a long way.