Beat the Market Alone or Partner with Experts: Which Truly Builds Wealth?

Stop guessing, start growing

Most of us would have heard: the savvy investor who times the market perfectly, sieves out multi-baggers and compounds his/her returns manifold. While these narratives are inspiring, it's important to recognise how rare they are. The reality is that investing is a fine balancing act. On one hand, we want our money to grow and our wealth to compound; on the other, we are wary of risks such as market volatility.

We can choose to do this alone, or we can ride on the shoulders of giants. For most of us, wealth isn’t built on flashy wins but on steady and disciplined strategies that stand the test of time. That’s where professional fund management provides the winning hand.

DIY Active Investing

With countless self-styled investment gurus dispensing investment advice on social media these days, it feels like anyone can become an overnight investing genius. The Do-It-Yourself (DIY) route is indeed tempting with these benefits to reap:

• Full control over all your investment decisions including asset classes and asset allocation

• Lower upfront fees compared to paid professional advice

But what is the catch? To consistently beat the market to build wealth, a DIY active investor invests not just capital but also time. Constant monitoring, rebalancing of portfolios and keeping up with current financial news are the bare minimum requirements but these are time-consuming activities. Yet, this side of the equation is hardly portrayed on social media.

With so much financial information available, it can even overwhelm the amateur investor into paralysis. Further, most people simply don’t have the time or resources to do this consistently while managing their everyday responsibilities.

Even if we do dedicate the time, market volatility can lead to emotional decision-making. DIY investors often end up chasing trends or engaging in panic selling during downturns, which can undo years of progress.

Actually, investing doesn’t have to be time-consuming, stressful and complicated. A better option might be to leave it to experts to handle the complexities of your investment portfolio while you focus on your life and life goals. This leaves the guesswork out as disciplined strategies and informed decision-making take their place.

Why Professional Fund Management Matters

Who are these experts? These are professional fund managers possessing deep technical skills who are adeptly trained to perform exactly these tasks, day in and day out. They typically manage billions in assets worldwide, with deep expertise across a myriad of asset classes such as equities, fixed income, alternatives etc. Here are just some of the advantages that fund managers have over DIY investors:

• Extensive resources, access to proprietary research, analysis and market insights

• Data-driven decision making powered by artificial intelligence

• Robust governance structures and risk control frameworks

• Global investment mandate and large investment scale

The results of these advantages are innovative strategies, well-diversified portfolios, adaptation to evolving market conditions and effective risk management that safeguards investor capital.

Here’s how Great Eastern, through its product offerings, can help you gain a steady hand and clear perspective afforded in abundance by partnering with its selected professional fund managers.

Active Management through GreatLink Dynamic Portfolios

Great Eastern has introduced the GreatLink Dynamic Portfolios with dynamic asset allocation strategy by J.P. Morgan Asset Management. The allocation for each asset class within the portfolios is actively managed based on deep market insights and expert outlooks to stay ahead of market trends. Long-term risk-adjusted returns are also optimised with strategies that are adapted to changing global conditions.

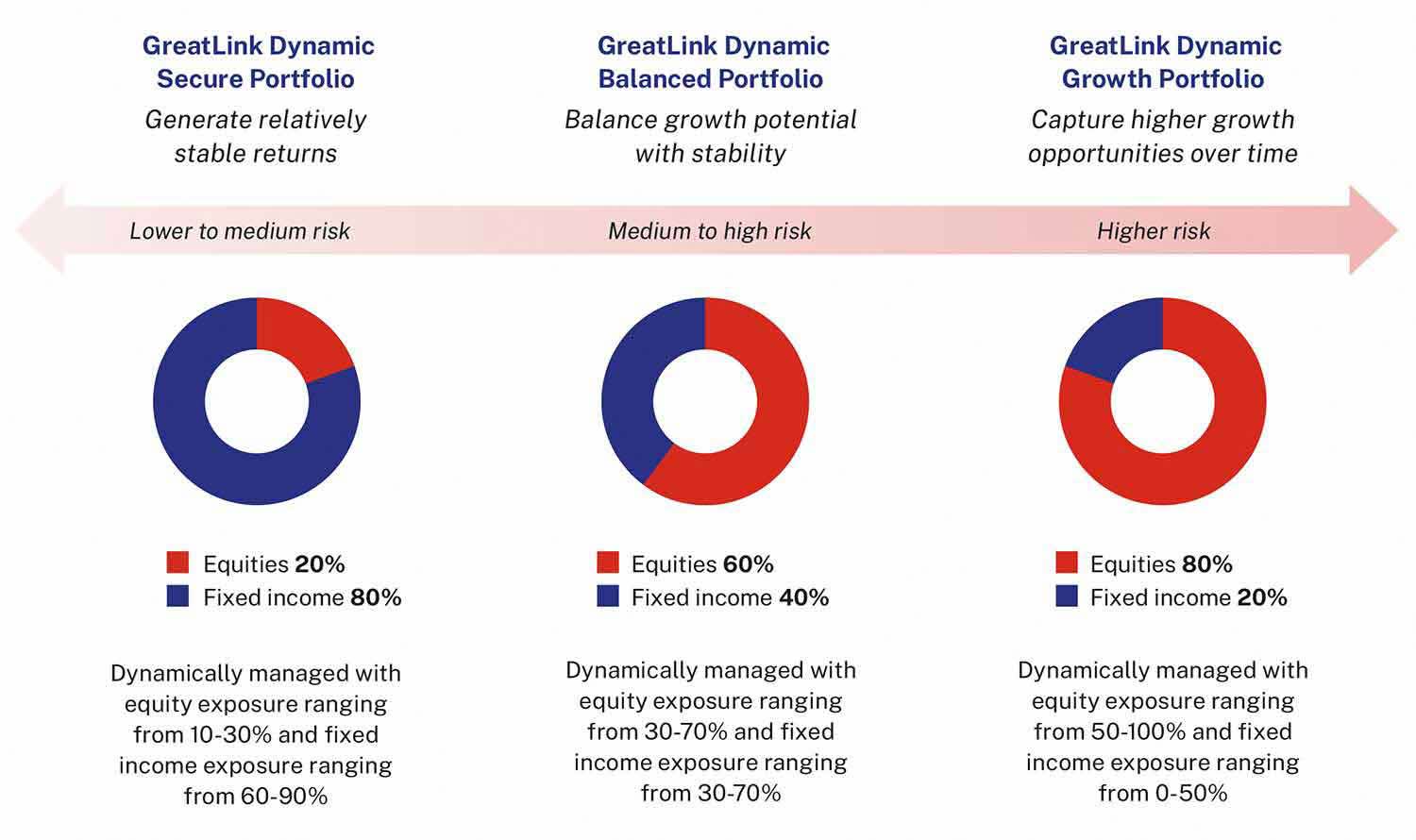

Our holistic solutions are designed for medium-to-long-term capital appreciation. Investors can choose from 3 specially curated portfolios – Secure, Balanced and Growth that vary according to projected risks and returns based on different asset allocations.

Based on consumer risk appetite, investors have the flexibility to switch between 3 dynamic portfolios whenever their needs change.

These portfolios are managed by Lion Global Investors Limited and leverage the strength of J.P. Morgan Asset Management’s asset allocation capabilities to navigate investment uncertainties while achieving the investment objectives.

J.P. Morgan Asset Management is one of the largest and most reputable asset managers in the world. With over 50 years of managing multi-asset solutions, their deep bench of investment talent and expertise brings the power of perspective to build stronger portfolios.

Start Investing in GreatLink Dynamic Portfolios

The GreatLink Dynamic Portfolios are available through our selected investment-linked plans:

• If you are looking to grow and accumulate your wealth for your life goals, you may consider GREAT Wealth Advantage 4 or GREAT Invest Advantage.

• If you prefer to have higher life protection coverage and build your wealth potential at the same time, GREAT Life Advantage 4 or Prestige Legacy Advantage supports that and more.

These investment-linked plans offer a combination of insurance and investment in professionally managed sub-funds, providing a practical way to benefit from professional management while also meeting your insurance needs.

Build Your Future With Confidence

Real wealth is built on discipline, expertise and strategy. With professional fund management, you gain access to expertise, insights and discipline that can help your money grow steadily over time.

Explore our investment-linked plans and see how our latest GreatLink Dynamic Portfolios can give you and your family the assurance to build wealth on the shoulders of giants. Contact your Great Eastern representative today to find out how you can start building your future with confidence!

Disclaimer

Terms and conditions apply.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

GreatLink Dynamic Portfolio is an investment-linked policy (ILP) fund offered by The Great Eastern Life Assurance Company Limited ("Great Eastern") and is only available under Great Eastern investment-linked policies.The information presented is for informational use only. Investment in GreatLink Dynamic Balanced Portfolio and GreatLink Dynamic Growth Portfolio involve a high degree of risk and is only appropriate for a person able and willing to take such a risk.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of the insurance plans mentioned are specified in their respective policy contracts.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

Investments in the investment-linked plans are subject to investment risks including the possible loss of the principal amount invested. Please refer to Fund Details and Product Highlights Sheet for the specific risks of the fund(s). Past performance is not necessarily indicative of future performance.

A Product Summary and a Product Highlights Sheet in relation to the fund(s) may be obtained through Great Eastern or its financial representatives. Potential investors should read the Product Summary and the Product Highlights Sheet before deciding whether to invest in the fund(s). Returns on the units of the fund(s) are not guaranteed. The value of the units in the fund(s) and the income accruing to the units, if any, may fall or rise.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information is correct as at 12 January 2026.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.