Key benefits

-

Growth potential with index-linked returns2

This plan offers growth potential and participation in market opportunities while safeguarding against adverse conditions. It leverages the performance of the S&P 500 Engle 6% VT TCA Index3, which incorporates advanced volatility controls to manage risk effectively.

-

100% capital guarantee4 for peace of mind

Rest assured knowing that your single premium contribution is guaranteed at maturity. Regardless of market fluctuations, your capital remains secured, providing a reliable foundation for long-term financial confidence.

-

Flexible income options to suit different needs

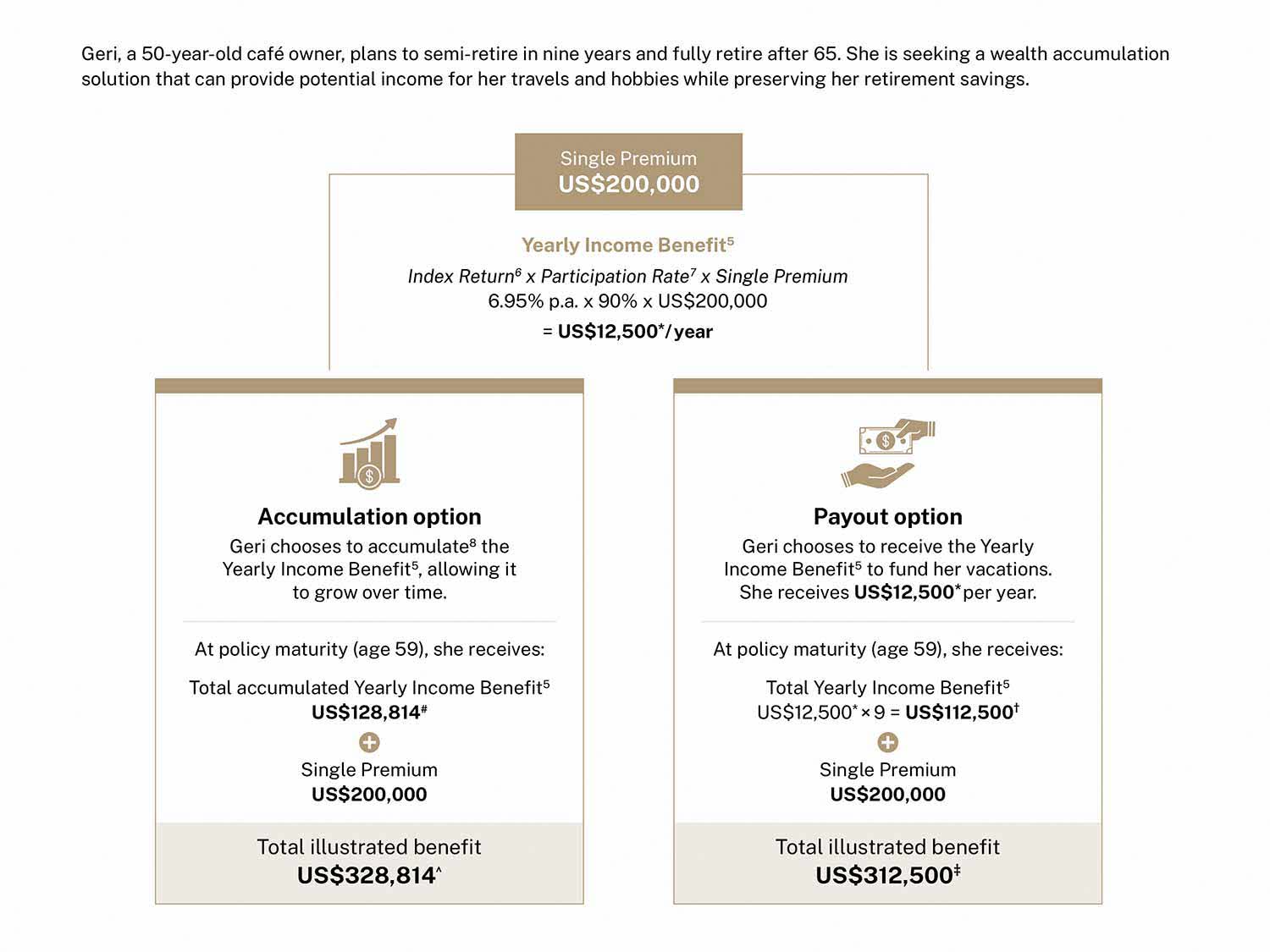

Choose to withdraw your Yearly Income Benefit5 to support your financial goals or allow it to accumulate for potentially higher future growth.

-

Life protection at no additional cost

Ensure financial security for your loved ones with a lump sum benefit of 101% of the single premium paid in the event of death, increasing to 105% for accidental death—all without the need for a medical assessment.

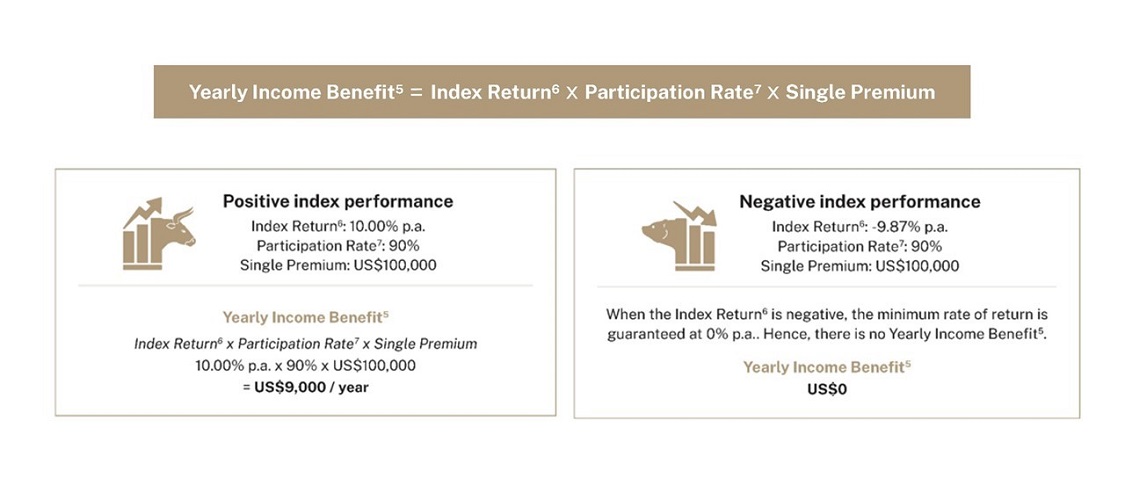

How to calculate the Yearly Income Benefit5

Your questions answered

Prestige Index Income is a single premium, non-participating endowment insurance plan denominated in US dollars that provides index-linked returns based on the performance of the underlying index - S&P500 Engle 6% VT TCA Index, providing a dynamic, responsive and risk-managed way to capitalise on market opportunities. When the index returns are positive, you can choose to receive payouts on a yearly basis or let them accumulate for enhanced growth. At the same time, it guarantees 100% of your capital at maturity.

Prestige Index Income provides you with financial protection against death and accidental death. If the life assured dies during the policy term, we will pay 101% of the single premium. If the life assured dies from an accident during the policy term, we will pay 105% of the single premium. We will deduct any debts under the policy before paying the remaining sum and the policy will end after we make this payment. There are certain situations when we will not pay the benefits under this policy. Please refer to the Product Summary and Policy Contract for more details.

If the life assured is still surviving when the policy matures, we will pay the single premium with the last Yearly Income Benefit (if any) within 14 business days from the last segment maturity date. Any debt under the policy will be deducted before the remaining balance is paid in one lump sum.

The policyholder will receive an annual update after a segment has matured. The update will include information on the Yearly Income Benefit and Participation Rates for the segment (current and past).

We have included fees and charges when working out the premium and you will not be separately charged for these. However, we will not bear any costs associated with the telegraphic transfer, including any bank fees or charges incurred that may arise for any payment under this policy.

If you surrender your policy after the 14-day free-look period, you may lose part or all of the premiums paid. This is because the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

As Prestige Index Income is denominated in US Dollars, you should be aware that if the US Dollars is not your home currency, you will be exposed to foreign exchange volatility risks between the time you purchase the policy to the time the policy benefits are payable. You must therefore recognise and accept this foreign exchange exposure.

For more details on Prestige Index Income, please refer to the product summary of the relevant plan. Alternatively, you may also speak to your financial representative or call us at 1800 248 2888 (9am to 5.30pm (Mon- Fri)).

The acceptable payment methods are via telegraphic transfer or USD cheque.

A guaranteed minimum rate of return of 0% p.a. safeguards your policy against market downturns. If the rate of return is determined to be at the minimum, no Yearly Income Benefit will be payable. Your capital is guaranteed upon maturity of the policy provided there are no policy alterations such as partial surrenders made during the policy term.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 Please be aware that if the US Dollar is not your home currency, you will be exposed to foreign exchange volatility risk.

2 Subject to the prevailing Participation Rate used to calculate the Yearly Income Benefit for the segment. A segment is always initiated on the 16th day of the month (i.e. the segment initiation date) and it will mature 12 months later, on the 15th day of the same month in the following year (i.e. segment maturity date).

3 The S&P 500 Engle 6% VT TCA Index is a rule-based index that leverages a unique volatility control methodology that dynamically adjusts its exposure to the S&P 500 index futures. By dynamically adjusting its exposure to the S&P 500 index futures, its returns can vary significantly from the S&P 500 index itself. Please note that past performance may not be indicative of future performance.

4 Capital is guaranteed upon maturity provided that no policy alterations such as partial surrenders are made during the policy term of 9 years.

5 The "Yearly Income Benefit" is non-guaranteed and subject to the performance of the underlying index and the segment Participation Rate. Please note that past performance may not be indicative of future performance. Derivatives will also be used to provide the Yearly Income Benefit.

6 The "Index Return" is the percentage change in the value of the index from the start to the end of the segment. The Index Return for the segment is uncapped and the minimum rate of return is guaranteed at 0% p.a. to safeguard your policy against market downturns. If the rate of return is determined to be at the minimum, no Yearly Income Benefit will be payable.

7 The "Participation Rate" is a rate used to calculate the Yearly Income Benefit. It is non-guaranteed and can vary for each segment, but it will not go below the guaranteed minimum Participation Rate of 60%.

8 At an Illustrated Investment Rate of Return (IIRR) of 6.25% p.a., the prevailing interest rate is 3.35% p.a.. At an IIRR of 4.00% p.a., the prevailing interest rate is 1.85% p.a.. This rate is not guaranteed and can be changed from time to time.

All figures in the above illustrations are based on an Illustrated Investment Rate of Return (IIRR) of 6.25% p.a. with an average Participation Rate of 90% and an accumulation interest rate of 3.35% p.a. and are subject to rounding.

Based on an IIRR of 4.00% p.a., guaranteed minimum Participation Rate of 60% and an accumulation interest rate of 1.85% p.a.:

* The Yearly Income Benefit is US$8,000.

# The total accumulated Yearly Income Benefit at age 59 is US$77,564

^ The total illustrated benefit at age 59 is US$277,564.

† The total Yearly Income Benefit at age 59 is US$72,000.

‡ The total illustrated benefit at age 59 is US$272,000.

The two IIRRs used (6.25% p.a. and 4.00% p.a.) are purely illustrative and do not represent lower and upper limits on the index performance. The actual benefits payable will depend on the actual performance of the index and the Participation Rates.

All ages specified refer to age next birthday.

All figures used are for illustrative purposes only and are subject to rounding.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and the Chinese versions, the English version shall prevail.

Information correct as at 22 April 2025.

Index Disclaimer

The “S&P 500 Engle 6% VT TCA Index" is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and incorporates methodology licensed from UBS AG (“UBS”), and has been sublicensed for use by The Great Eastern Life Assurance Company Limited (“Great Eastern”). S&P®, S&P 500®, US 500™, and The 500™ are trademarks of S&P Global, Inc. or its affiliates (“S&P”), EngleTM is a trademark of Engle Volatility Consulting LLC (“Engle Consulting”), the research principal of which is Robert F. Engle (“Engle”), and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Great Eastern. Great Eastern’s Index Income based on the S&P 500 Engle 6% VT TCA Index is not issued or sold by SPDJI, S&P, Dow Jones Trademark Holdings LLC, their respective affiliates, Engle Consulting, Engle or UBS and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Engle 6% VT TCA Index. For more information on the index, please refer to https://www.spglobal.com/spdji/en/indices/multi-asset/sp-500-engle-6-vt-tca-index.