Key benefits

-

Your legacy is limitless with unlimited generational transfers3 for up to 300 years

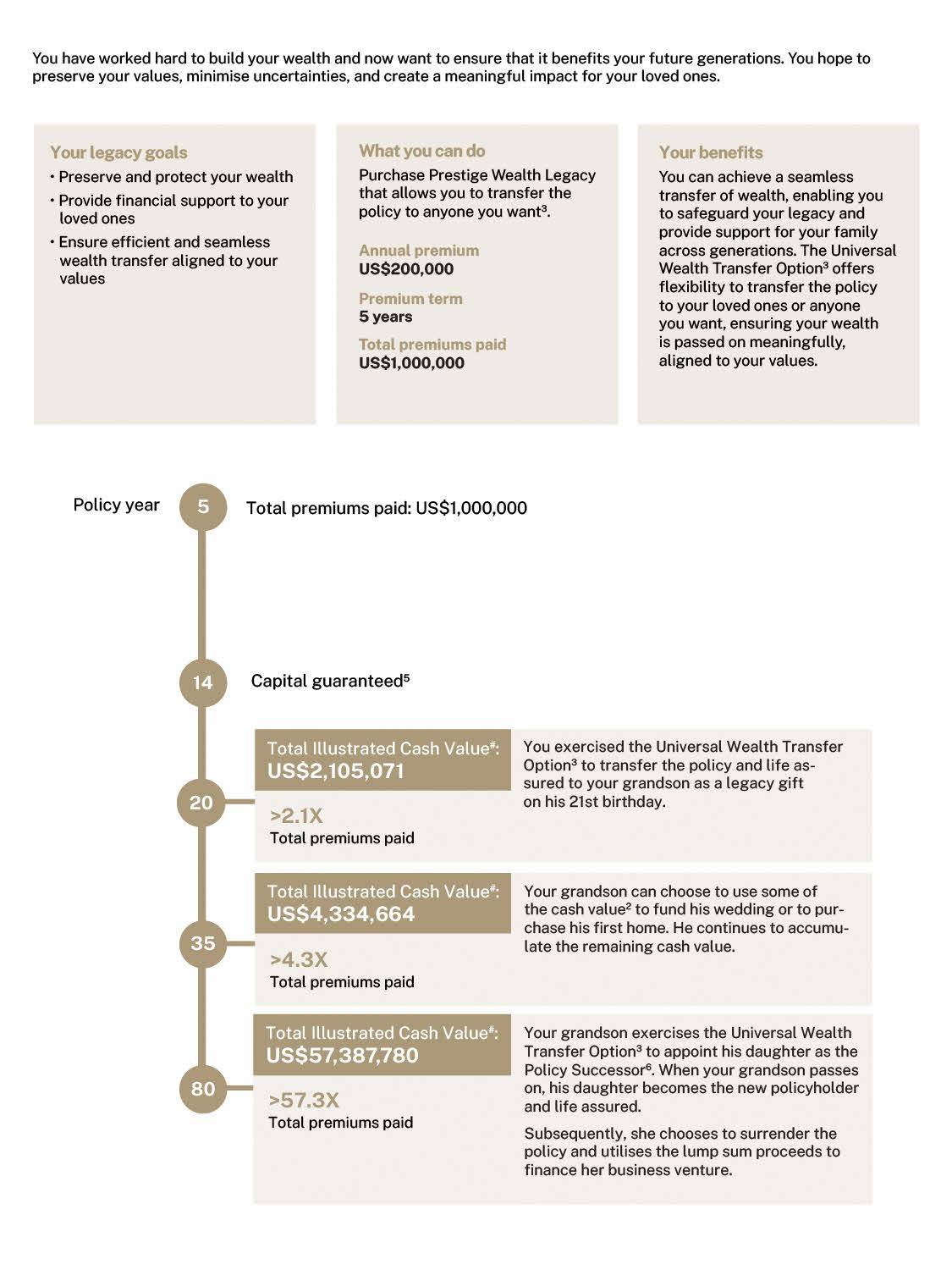

The Universal Wealth Transfer Option3 allows you to pass on your policy to anyone, allowing unlimited generational transfers for up to 300 years, while the policy is active. Prestige Wealth Legacy provides an ever-growing financial foundation for those you love. This gesture of generosity ensures that your policy continues to provide security and opportunities for generations to come.

-

Confidence from guaranteed cash value and freedom to access your funds2

Grow your wealth with certainty, supported by guaranteed cash value that builds steadily over time and a 100% capital guarantee5 as early as the end of the 7th policy year. With the added freedom to access your funds2 if needed, your financial goals can be pursued without compromise.

-

First-in-market^ promise of care with up to 150% boosted death benefit4

Life may be unpredictable, but your protection need not be. Prestige Wealth Legacy offers a death benefit4 boosted by up to 150%, ensuring financial security and immediate liquidity for your family, so they can embrace life's uncertainties with reassurance and ease.

-

A legacy that begins with ease, without any medical underwriting

Start your legacy without medical underwriting, up to age 80 – making it effortless to secure continuity on your terms.

Your questions answered

Prestige Wealth Legacy is a US dollar denominated participating whole life plan with premium terms of either a single premium or 5 years. It is a long-term wealth accumulation plan, maturing 300 years from the original policy commencement date. The plan provides financial protection against death throughout the policy term and pays a maturity benefit upon policy maturity.

Additionally, the plan allows you to take part in the performance of the participating fund in the form of bonuses that are not guaranteed and it supports policy continuity across generations via the Universal Wealth Transfer Options.

The Universal Wealth Transfer Option lets you pass your policy to anyone, allowing unlimited generational transfer for up to 300 years while the policy is active, provided that all the premiums have been fully paid. From the 2nd policy year onwards, the current policyholder‡ may request in writing to either:

(A) Effect a change in policyholder and life assured while the current policyholder‡ is still alive; or

(B) Appoint a Policy Successor¶, where the change in policyholder and life assured shall be effected upon the death of the current life assured‡.

Please refer to the product summary of the relevant plan for the terms & conditions.

‡ Current policyholder, who is also the current life assured, refers to the person who is the policyholder and life assured of the policy as at that point in time.

¶ Refers to a person appointed by the current policyholder to be the new policyholder and life assured for the policy in exercise of the Universal Wealth Transfer Option. This allows for the continuity of the policy upon the death of the current policyholder and life assured, provided that the appointment has not been revoked or invalidated on or prior to the death of the current policyholder and life assured.

Prestige Wealth Legacy provides both guaranteed and non-guaranteed benefits. The guaranteed benefits, including bonus(es) which have been declared, will be paid regardless of how the participating fund performs. Non-guaranteed benefits are in the form of future bonuses.

The future bonuses which have yet to be declared are not guaranteed and are dependent on the performance of the participating fund. There are two main types of bonuses for this plan - Reversionary Bonus and Terminal Bonus.

While we usually review the reversionary and terminal bonuses yearly, they may be adjusted at any time and more frequently should economic conditions or other related factors change. There is no set limit by which the bonus rates may change from previously declared bonuses.

Please note that the terminal bonus forms a significant component of the non-guaranteed benefits of this policy, where any adjustment to the terminal bonus may significantly affect the benefits payout.

You will receive an annual bonus update that will include the following:

- The performance of the participating fund and its future outlook, which you should receive around the second quarter of each year after the bonus is declared for your policy; and

- An annual statement regarding bonuses for your policy, which you should receive around the second quarter of each year after the bonus is declared for your policy.

When there is a change in the rate of bonuses declared, you can ask us for an update of the illustrated values.

If you partially or fully surrender your policy after the 14-day free-look period, you may lose part or all of the premiums paid. This is because the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

As Prestige Wealth Legacy is denominated in US dollars, you should be aware that if the US dollar is not your home currency, you will be exposed to foreign exchange volatility risks between the time you purchase the policy to the time the policy benefits are payable. You must therefore recognize and accept this foreign exchange exposure.

Please refer to the product summary of the relevant plan for more details. Alternatively, you may also speak to your financial representative or call us at 1800 248 2888 (Monday to Friday, 9am to 5.30pm).

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

¹ Please be aware that if the US Dollar is not your home currency, you will be exposed to foreign exchange volatility risk.

2 Partial cash withdrawal is via partial surrender of the policy only after it has acquired cash value. Partial surrenders will reduce the long-term value of the plan.

3 From the 2nd policy year onwards, after all the standard premium(s) have been fully paid and while the policy is still in force, you may write in to change the policyholder and life assured with immediate effect or appoint a Policy Successor to take over the policy upon your death. The policy will mature 300 years from the original policy’s commencement date. Terms and conditions apply. Please refer to the product summary for more details.

4 If the life assured’s age next birthday is 65 and below as of the policy issue date, the following death benefit will be paid in one lump sum, less any debt:

I. Policy Year 1 to 10:

(a) (i) 100% of total standard premium(s) paid; plus

(ii) an additional 5% of total standard premium(s), subject to a cap; or

(b) The guaranteed surrender value plus any bonuses added to the policy that have not been surrendered,

whichever is higher.

II. Policy Year 11 onwards:

(a) (i) 100% of total standard premium(s) paid; plus

(ii) an additional 50% of total standard premium(s) paid, subject to a cap; or

(b) The guaranteed surrender value plus any bonuses added to the policy that have not been surrendered,

whichever is higher.

III. If the life assured’s age next birthday is 66 and above as of the policy issue date, the following death benefit will be paid in one lump sum, less any debt.

(a) (i) 100% of total standard premium(s) paid; plus

(ii) an additional 5% of total standard premium(s) paid, subject to a cap; or

(b) The guaranteed surrender value plus any bonuses added to the policy that have not been surrendered,

whichever is higher.

The following will apply regardless of the life assured’s age next birthday as of the policy issue date:

IV. After the first successfully effected conversion under the Universal Wealth Transfer Option, if any current life assured dies while the policy is in force, we will pay the following in one lump sum less any debt:

(a) (i) 100% of total standard premium(s) paid; plus

(ii) an additional 5% of total standard premium(s) paid, subject to a cap; or

(b) The guaranteed surrender value plus any bonuses added to the policy that have not been surrendered,

whichever is higher.

No death benefit is payable if a policy successor has been appointed and the change in the policyholder and life assured is successfully effected.

Please refer to the product summary for more details.

5 Capital guarantee is on the condition that no policy alterations are made. Capital is guaranteed from the end of the 7th policy year for a single premium policy, from the end of the 14th policy year for a 5-pay policy.

6 Refers to a person appointed by the current policyholder to be the new policyholder and life assured for the policy in exercise of the Universal Wealth Transfer Option. This allows for the continuity of the policy upon the death of the current policyholder and current life assured, provided that the appointment is not revoked or invalidated on or prior to the death of the current policyholder and current life assured. Please refer to the product summary for more details.

^ Up to 150% boosted death benefit is the first-in-market as of 10 October 2025, compared with endowment insurance products provided by Singapore major insurance companies.

# All figures in the above illustration are based on a 55-year-old male. The figure comprises guaranteed and non-guaranteed benefits. The non-guaranteed benefits are illustrated based on an Illustrated Investment Rate of Return (IIRR) of the participating fund at 6.00% p.a.. Based on an IIRR of 4.25% p.a., the total illustrated cash values at the end of policy year 20, 35 and 80 are US$1,353,809 (>1.3X of total premiums paid), US$2,041,656 (>2.0X of total premiums paid) and US$12,792,478 (>12.7X of total premiums paid) respectively.

All ages specified refer to age next birthday.

All policy years specified refer to the end of the policy year.

All figures used are for illustrative purposes only and are subject to rounding.

The actual benefits payable may vary according to the future performance of the participating fund.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance or a recommendation to buy an insurance product or service. This document does not take into account the specific investment and protection aims, financial situation or particular needs of any particular person. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

The precise terms and conditions of this insurance plan are specified in the policy contract. If you are interested in the insurance product, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

In case of discrepancy between the English and the Chinese versions, the English version shall prevail.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information correct as at 10 October 2025.