Eligible insurance plans

20 winners for each draw. The winners of the draw will each receive 30,000 GREAT Dollars (worth S$300).

| Eligible products | Draws | Life Insurance - New Business Submission Period / General Insurance - Transaction Date Timeframe |

| Life Insurance: General Insurance: | Draw 1 | 1 April 2025 to 30 April 2025 |

| Draw 2 | 1 May 2025 to 31 May 2025 | |

| Draw 3 | 1 June 2025 to 30 June 2025 | |

Draw date and start time: 31 July 2025 at 3pm View draw results here |

||

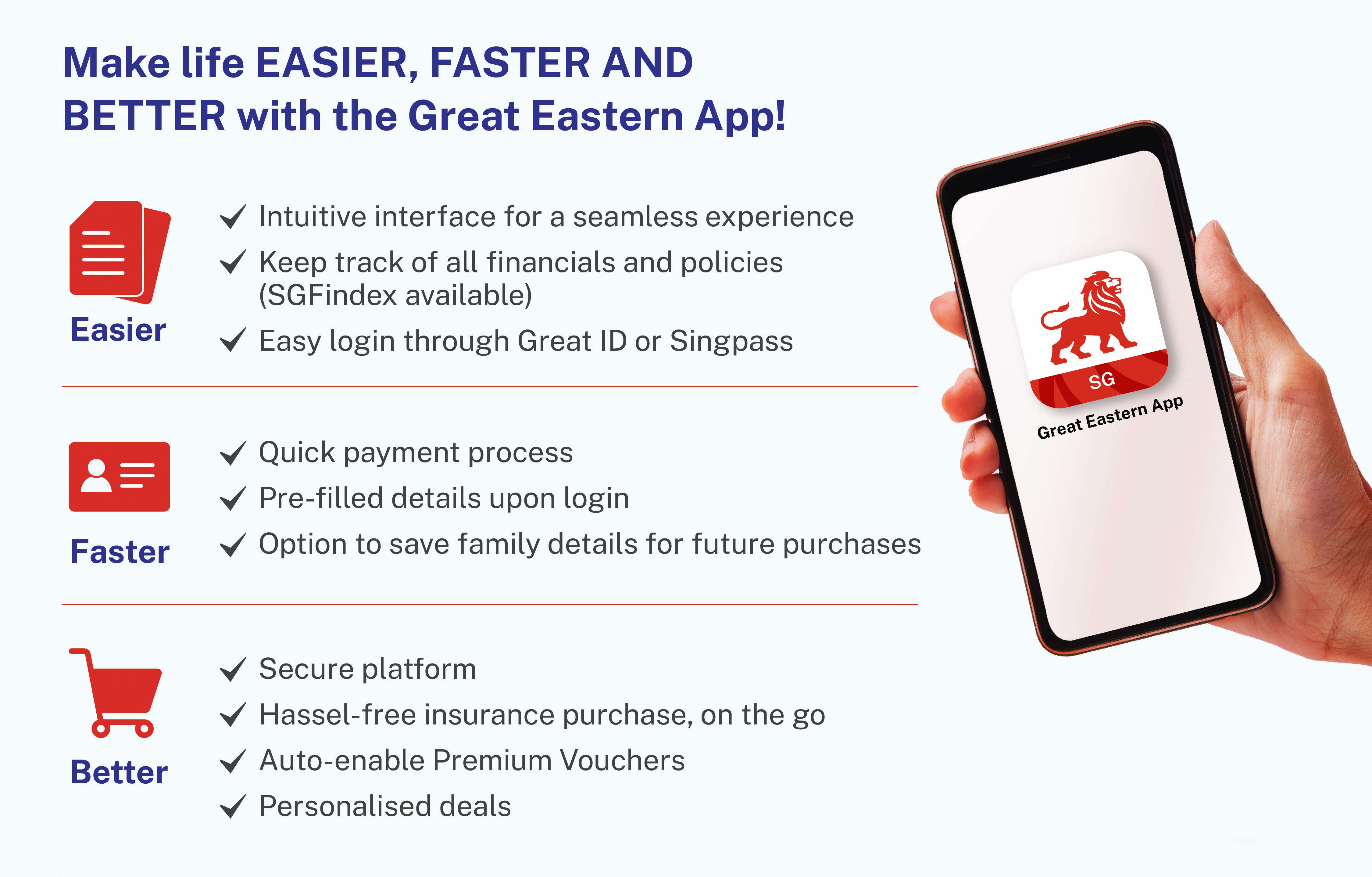

Why use the Great Eastern App?