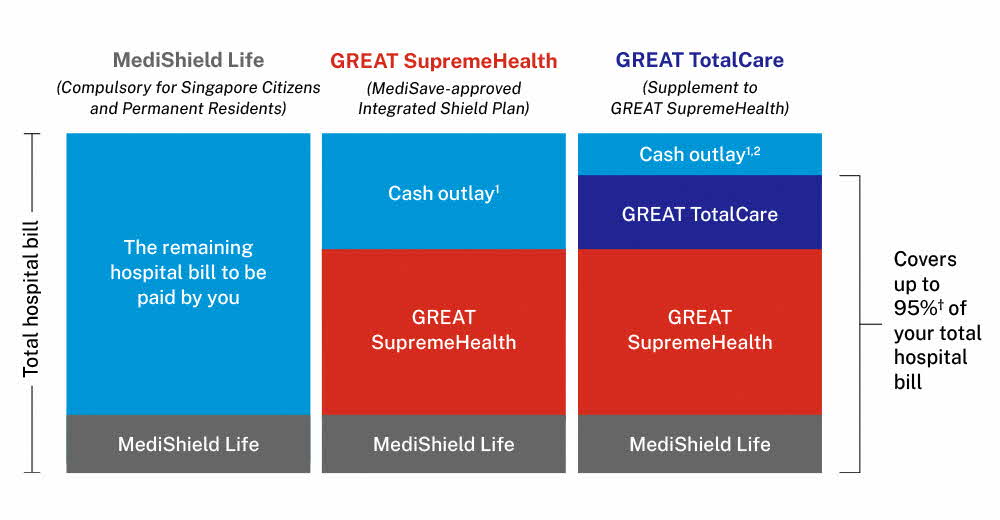

How GREAT SupremeHealth + GREAT TotalCare optimises your healthcare coverage

GREAT SupremeHealth, our MediSave-approved Integrated Shield plan, when supplemented with GREAT TotalCare, provides coverage of up to 95%† of your total hospitalisation bill, keeping your out-of-pocket expenses low.

GREAT SupremeHealth P Prime + GREAT TotalCare P Prime Our best-value plan for private healthcare access

Ensure sufficient coverage against large private medical bills

Ensure sufficient coverage against large private medical bills

Benefit from one of the highest annual benefit limits available among Private Integrated Shield plans, with coverage of up to S$2.9 million‡ per period of insurance, ensuring the protection you need will always be within reach.

Access premium healthcare with greater choice

Access premium healthcare with greater choice

Access premium healthcare through our wide network of Private Panel Specialists at accredited day surgery centres and at Private Hospitals we partner with, including Mount Alvernia Hospital, Farrer Park Hospital, Raffles Hospital and Thomson Medical Centre. You also have the flexibility to seek treatment at any Private or Restructured Hospital.

Enjoy lifetime assistance with cancer, post-stroke outpatient and rehabilitation care benefits

Enjoy lifetime assistance with cancer, post-stroke outpatient and rehabilitation care benefits

Our coverage goes beyond immediate treatment to support your recovery:

- Cancer care: High coverage for outpatient drug treatments3 and services. With GREAT TotalCare, you will also receive up to S$200,000 per period of insurance for Outpatient Cancer Drug Treatment not on the Cancer Drug List4, plus up to S$10,000 per period of insurance for Additional Outpatient Cancer Support to help with follow-up treatments when your cancer is in remission

- Post-stroke outpatient care: Up to S$2,000 per period of insurance for follow-up therapy and medical support

- Rehabilitation care: As-charged coverage for post-hospitalisation treatments provided within 365 days of hospitalisation discharge5, including physical, occupational and speech therapy. With GREAT TotalCare, you will also have added coverage for Traditional Chinese Medicine6 treatments and expenses incurred for the rental or purchase of medical aids7 such as braces or wheelchairs

Get help with choosing and booking your specialists with the Great Medical Care Concierge

Get help with choosing and booking your specialists with the Great Medical Care Concierge

Enjoy 24/7 dedicated support through our in-house concierge service, giving you seamless guidance and coordination throughout your healthcare journey:

- Access to over 600 Panel Specialists at Partnering Medical Institutions across all available specialties in Singapore

- Priority appointment booking at both Private and Restructured Hospitals for timely and coordinated care

- Guidance on policy coverage and treatment options to manage your out-of-pocket expenses

- Pre-authorisation of medical bills so you know what is covered before treatment commences

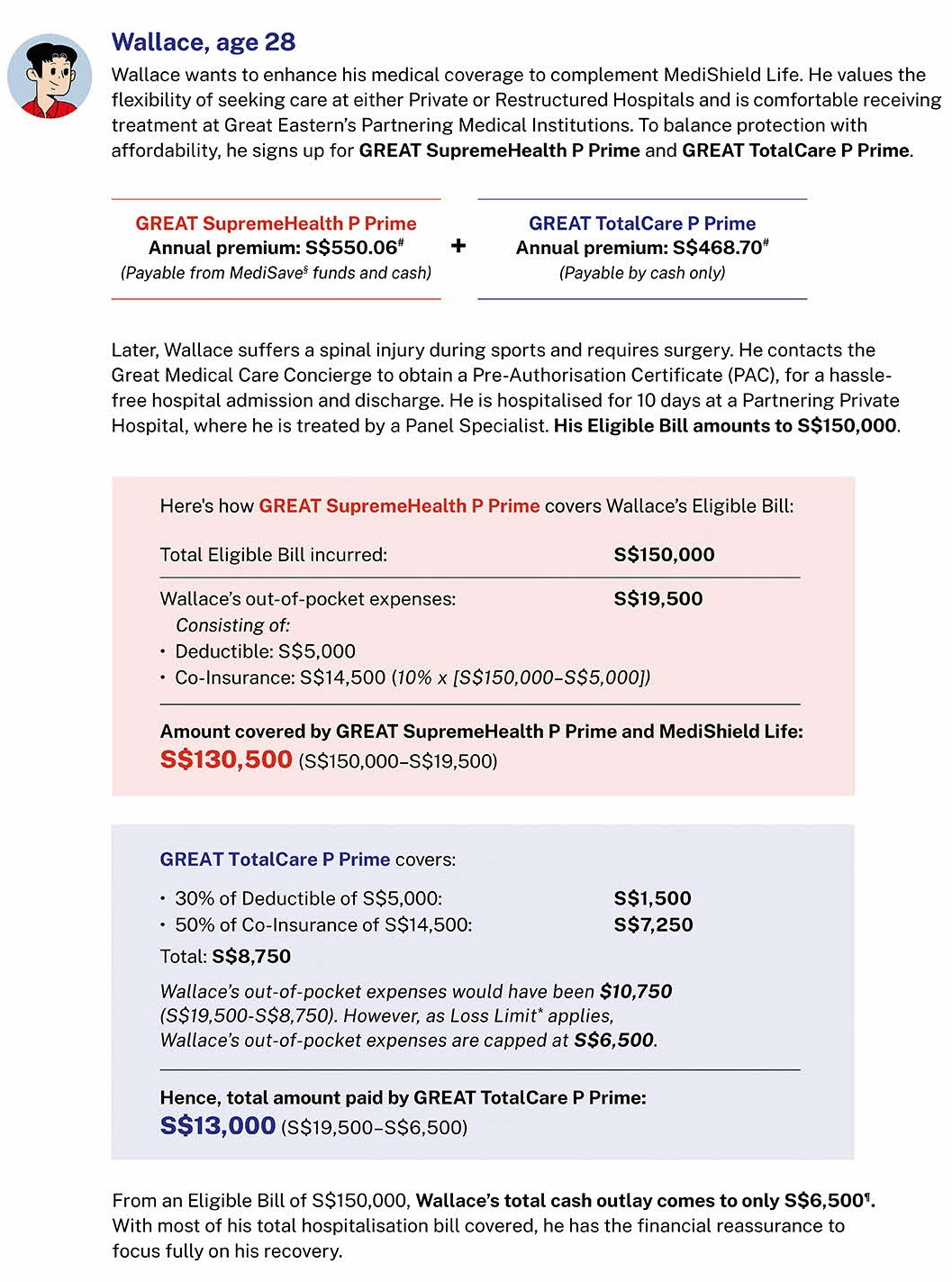

Here’s how GREAT SupremeHealth P Prime + GREAT TotalCare P Prime supports your Private Hospital bill

For parents with young children

In the fragile early years of childhood, even a short hospital stay can be overwhelming — both emotionally and financially. Securing coverage early ensures your child has access to the quality healthcare they need during this critical period.

- Give your child a head start with coverage that begins from just 15 days after birth8, providing reassurance against hospitalisation during the most vulnerable years

- Receive as-charged coverage for congenital abnormalities diagnosed after policy inception. For mothers already insured with us, your child’s congenital abnormalities9 are covered right from birth

- With GREAT SupremeHealth P Prime, enjoy quality maternity care10 and personalised support for Pregnancy and Childbirth Complications at our Partnering Private Hospitals such as Mount Alvernia Hospital and Thomson Medical Centre

For foreigners who work and reside in Singapore

Navigating healthcare in a country other than your own can be challenging. Reliable and comprehensive coverage ensures you and your family have access to world-class medical care, along with attentive guidance. With this assurance, you can focus on living and working in Singapore with ease.

- Add the GREAT TotalCare Plus rider to your GREAT TotalCare supplementary plan11 for comprehensive worldwide coverage, including Emergency Medical Evacuation and Repatriation services, giving you complete peace of mind wherever you are

- Enjoy peace of mind with upfront authorisation of your treatment, procedure and estimated costs before admission — with no upfront cash deposit required. This ensures a smooth, cashless admission at both Private Hospitals and Restructured Hospitals

Access to the Great Medical Care Concierge

Enjoy 24/7 dedicated support through our in-house concierge service, giving you seamless guidance and coordination throughout your healthcare journey.

Understand the details before buying

1 Cash outlay includes deductibles, co-insurance and any amounts in excess of applicable Benefit Limits. Deductible is the amount which must be borne by the policyholder before any benefit becomes payable under GREAT SupremeHealth. Co-insurance is the proportion of the expenses that needs to be borne by the policyholder after the deduction of the deductible (where applicable).

2 Up to 95% of the deductible is covered under selected GREAT TotalCare plan types. Please refer to the Benefit Table in the policy contract for more information on coverage of the deductible under the different GREAT TotalCare plans.

3 GREAT SupremeHealth (P Plus, P Prime, A Plus and B Plus) when supplemented with GREAT TotalCare covers Outpatient Cancer Drug Treatment on Cancer Drug List of up to a total of 20 times MediShield Life's limit for one primary cancer. For the latest MediShield Life’s limit, refer to the Cancer Drug List on the Ministry of Health of Singapore’s website under “MediShield Life Claim Limit per month” (go.gov.sg/moh-cancerdruglist).

4 GREAT TotalCare does not cover Class F of Outpatient Cancer Drug Treatments that are not on the Cancer Drug List. For the classification of non-CDL cancer drug treatments, please refer to the Non-CDL Classification Framework by the Life Insurance Association: https://www.lia.org.sg/media/3553/non-cdl-classification-framework.pdf.

5 Expenses incurred for post-hospitalisation treatment will be covered for up to 365 days from the date of hospital discharge if the treatment is provided in a Restructured Hospital, or if it is prescribed by the admitting and/or main treating Specialist Doctor who ordered the hospitalisation of the Life Assured. The Specialist Doctor must be a Panel Provider, and the post-hospitalisation treatment must also be provided by a Panel Provider.

6 For post-hospitalisation follow-up Traditional Chinese Medicine (TCM) treatment provided by a registered TCM practitioner at an approved TCM clinic outside of a Singapore Hospital or Community Hospital, the expenses incurred will be subject to a limit of S$60 per visit, up to one visit per day. Such treatment must be administered within 180 days from the date of hospital discharge.

7 Such medical aids must be prescribed by a Medical Doctor and must be purchased or rented: (a) within 120 days before Hospitalisation; (b) during the period of Hospitalisation; or (c) within 180 days from the date of discharge from the Hospital, and subject to Co-Payment to be borne by the policyholder.

8 Coverage may begin 15 days after birth or discharge from hospital, whichever is later.

9 Applicable to treatment provided to the Life Assured’s biological child during hospitalisation of the child for treatment related to congenital abnormalities. Such expenses must be incurred within (and including) 730 Days from Date of Birth of the Child. Such condition(s) must be first diagnosed after 300 days from the Last Policy Effective Date, and any expenses incurred in connection with condition(s) which are first diagnosed within 300 days after the Last Policy Effective Date are not payable. Please refer to the policy contract for the respective benefit limits under the various applicable plans under GREAT SupremeHealth.

10 Expenses arising from pregnancy and childbirth (including caesarean section, vacuum extraction or forceps delivery and the consequences thereof) is not payable under GREAT SupremeHealth and GREAT TotalCare, except when such expenses are due to covered Pregnancy and Childbirth Complications. Waiting period applies for Pregnancy and Childbirth Complications. Refer to policy contract for more details.

11 Only applicable to GREAT TotalCare P Signature.

† Applicable when the GREAT SupremeHealth is attached with either: a) GREAT TotalCare A or GREAT TotalCare B and for bills incurred at Restructured Hospitals of the respective ward class entitlement; b) GREAT TotalCare P Signature and for bills incurred at Panel Providers and/or at Restructured Hospitals; or c) GREAT TotalCare P Prime and for bills incurred at Restructured Hospitals.

‡ Comprising an Annual Benefit Limit of up to S$2.5 million under GREAT SupremeHealth P Prime, and S$400,000 under GREAT TotalCare P Prime. For GREAT SupremeHealth P Prime, the additional Annual Benefit Limit of S$1,000,000 per Period of Insurance, in excess of the base Annual Benefit Limit of S$1,500,000, applies only to expenses incurred at a Restructured Hospital, polyclinic, government-funded Community Hospital, government-funded Inpatient Palliative Care Institution, general practitioner clinic or a Partnering Medical Institution where the Life Assured is treated by a Panel Provider.

# Premium illustrated for GREAT SupremeHealth P Prime plan includes MediShield Life’s premium and prevailing rate of GST. Premium illustrated for GREAT TotalCare P Prime plan includes prevailing rate of GST. The prevailing rate of GST is subject to change

§ MediShield Life’s premium is fully payable by MediSave and there are no withdrawal limits. The premium of the additional private insurance component of GREAT SupremeHealth is payable by MediSave up to the Additional Withdrawal Limit, beyond which cash is required.

* Loss Limit for GREAT TotalCare P Prime is S$3,000 per period of insurance for the Eligible Bills incurred at a Restructured Hospital, and S$6,500 per period of insurance for the Eligible Bills incurred at a Partnering Medical Institution and treated by Panel Provider.

¶ The illustrations are based on the assumption that the applicable Benefit Limits have not been exceeded.

Terms and conditions apply.

The maximum entry age for GREAT SupremeHealth P Plus, P Prime, A Plus and B Plus, GREAT TotalCare and GREAT TotalCare Plus rider is age 75 years next birthday.

GREAT TotalCare and GREAT TotalCare Plus are not MediSave-approved Integrated Shield plans and premiums are not payable using MediSave. GREAT TotalCare is designed to complement the benefits offered under GREAT SupremeHealth. GREAT TotalCare Plus is a rider that can only be attached to GREAT TotalCare to extend medical coverage worldwide.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contracts.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and the Chinese versions, the English version shall prevail.

Information correct as at 1 November 2025.

Let our Financial

Representative serve you

We are happy to help you.